PayPay, Japan’s largest mobile payment platform, has acquired a 40% stake in Binance Japan to jointly develop integrated digital asset services and improve access to Web3 finance nationwide.

Summary

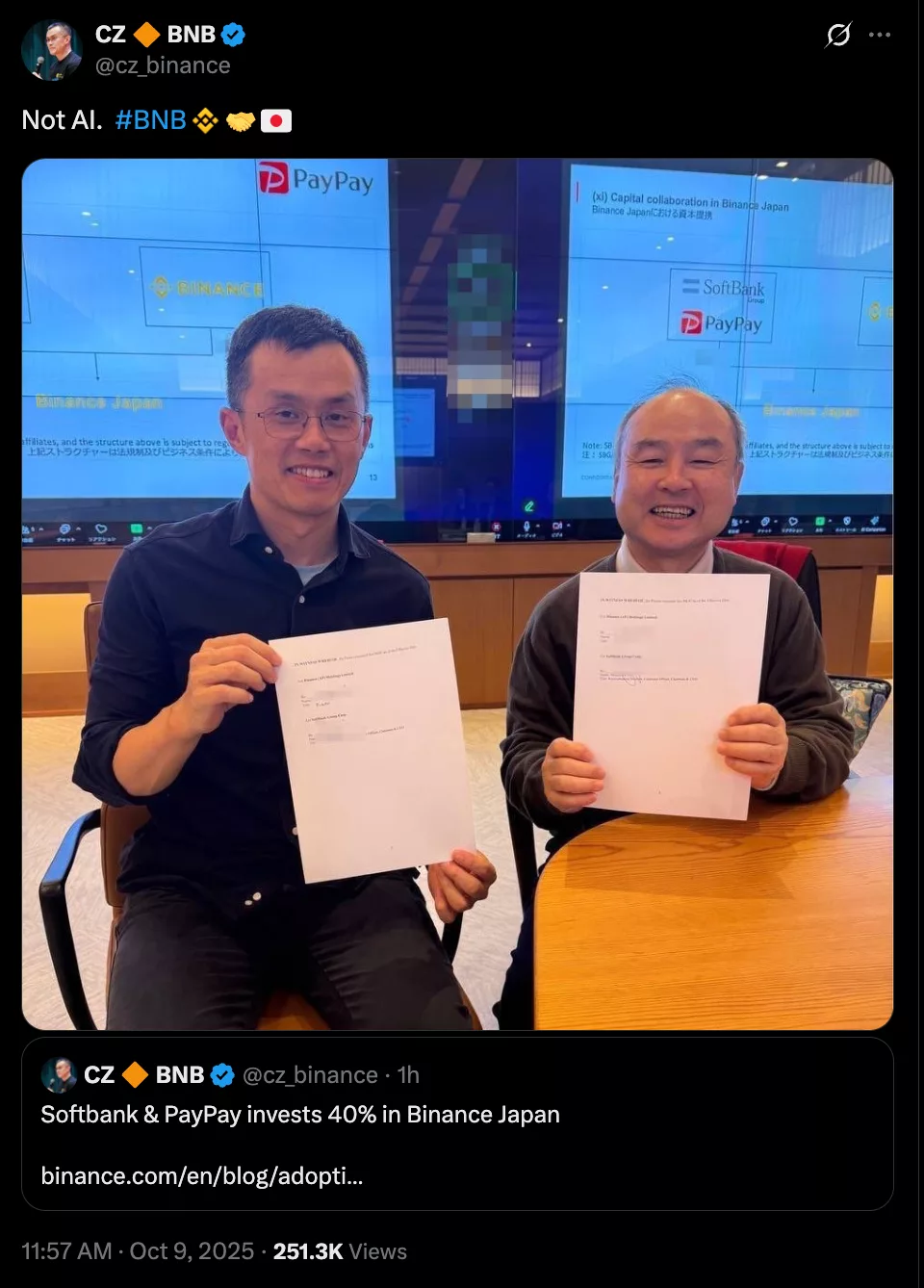

- SoftBank-owned PayPay has taken a 40% stake in Binance Japan as part of a capital and business alliance.

- The partnership allows Binance Japan users to purchase and withdraw cryptocurrencies directly through PayPay Money’s digital wallet.

PayPay, which is a SoftBank Corp. group company. with over 70 million users, has entered into a financial and business alliance that hopes to leverage PayPay’s vast user base and expertise, as well as Binance’s blockchain technology to advance the integration of cashless payments with digital assets, Binance said in an October 9 announcement.

As part of the deal, PayPay acquired a 40% stake in Binance Japan and will allow the exchange’s customers to purchase cryptocurrencies and withdraw sale proceeds directly through PayPay Money, the company’s digital wallet service used for cashless payments and peer-to-peer transfers.

“By investing in Binance Japan, the Japanese subsidiary of Binance, the world’s largest digital asset exchange by trading volume, we will provide Binance users with solutions that combine the convenience and security of PayPay,” said Masayoshi Yanase, chief executive officer of PayPay Corporation, in an accompanying statement.

Ultimately, the two companies plan to develop other “innovative products and services,” the announcement said, without disclosing further details.

Last month, local media suggested that PayPay was considering expanding its services beyond Japan, starting with South Korea, with plans to expand to other regions like Taiwan, Hawaii and China. Last August, PayPay announced plans to debut on the US stock market.

The latest partnership has resonated well within the BNB community, with many participants hoping that this major development will be the catalyst that could push the token back into price discovery, especially after former Binance CEO and co-founder Changpeng Zhao directly referenced BNB while sharing the news on X.

BNB rebounded more than 4% from intraday lows after the news was announced. At the time of writing, it was trading less than 2% below its all-time high price of $1,330.51 reached on October 8, thanks to significant growth in its memecoin ecosystem and other project-specific developments and partnerships.

SoftBank Crypto Connection

For the SoftBank Group, this is not the first foray into the field of digital assets. SoftBank owns a minority stake in new Bitcoin investment firm Twenty One Capital alongside stablecoin issuer Tether, crypto exchange Bitfinex, financial services firm Cantor Fitzgerald and Strike CEO Jack Mallers.

Last month, Bloomberg reported that SoftBank Group had begun negotiations to join Tether Holdings’ next funding round, which could potentially value the stablecoin issuer at up to $500 billion.