- Solana falls slightly on Thursday, trading at $152.26.

- Builder interest in the Solana blockchain doubled in 2024, according to an a16z report.

- The number of active addresses in the Solana network has also increased significantly.

Solana (SOL) is hovering around the $150 level on Thursday. The native blockchain token Solana’s recent gains are likely catalyzed by growing interest from investors and developers.

A16z’s State of Crypto report released on Wednesday, October 16 shows an increase in addresses and interest from Web3 builders in Solana.

Solana could extend its gains by attracting the interest of traders and builders

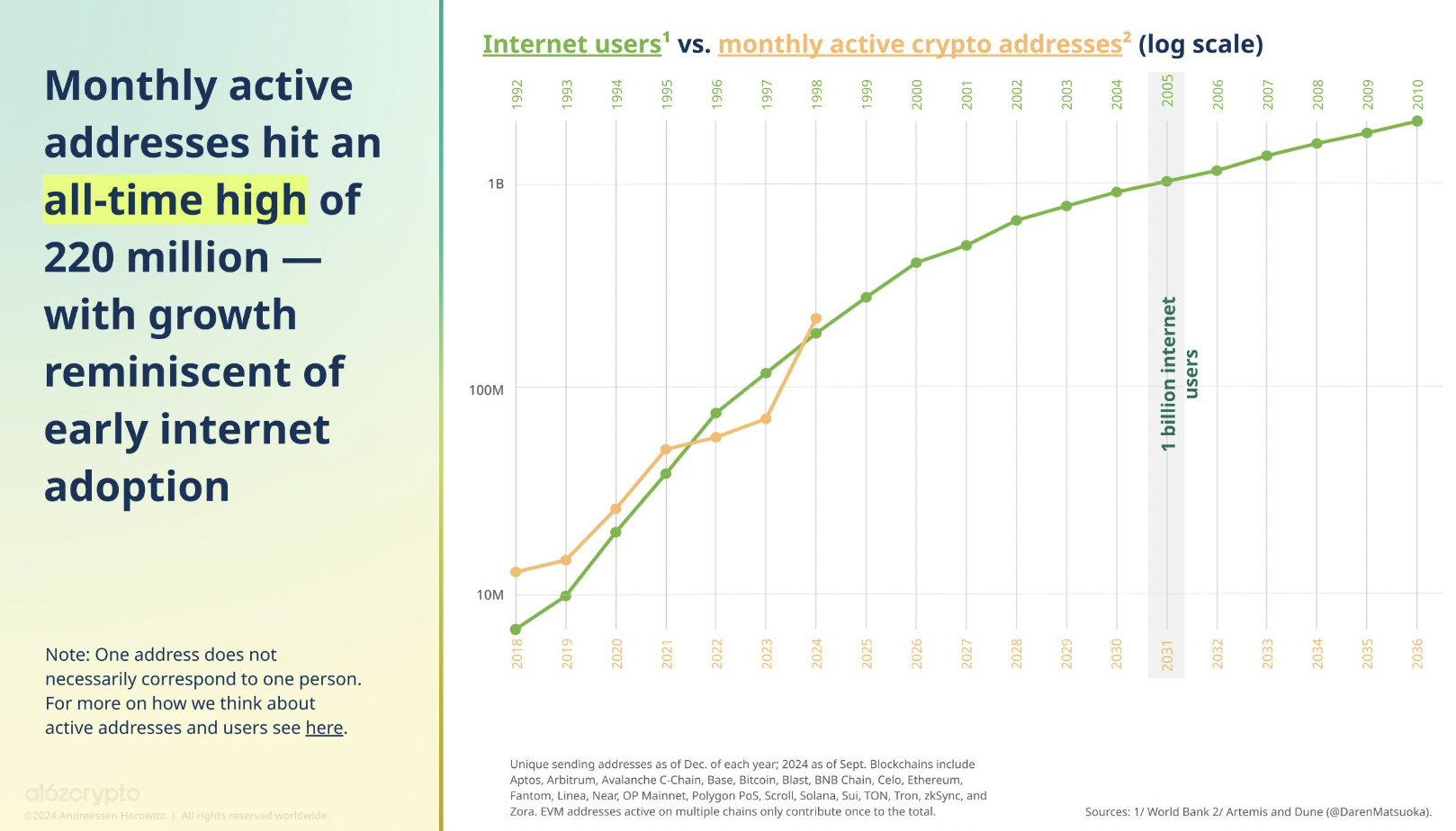

Crypto’s monthly active addresses reached an all-time high of 220 million in September 2024. Of this number, Solana and the growing activity on its blockchain accounted for approximately 100 million active addresses.

Active crypto addresses as shown in the a16zcrypto report

The Builder Energy dashboard that lists developer interest in building applications on different blockchains in the crypto ecosystem tracks how lucrative Solana is for Web3 builders. The report shows that SOL blockchain saw the biggest change in total builder interest share, up to 11.2% in 2024 from 5.1% in 2023.

Solana witnessed several meme coin launches in 2024, which contributed to the “meme coin” cycle this year. In Q1 2024, the best performing crypto token category was meme coins. This sector continues to attract users to blockchain and the SOL ecosystem.

Solana Price Prediction: SOL Could Rebound 12%, Test Key Resistance

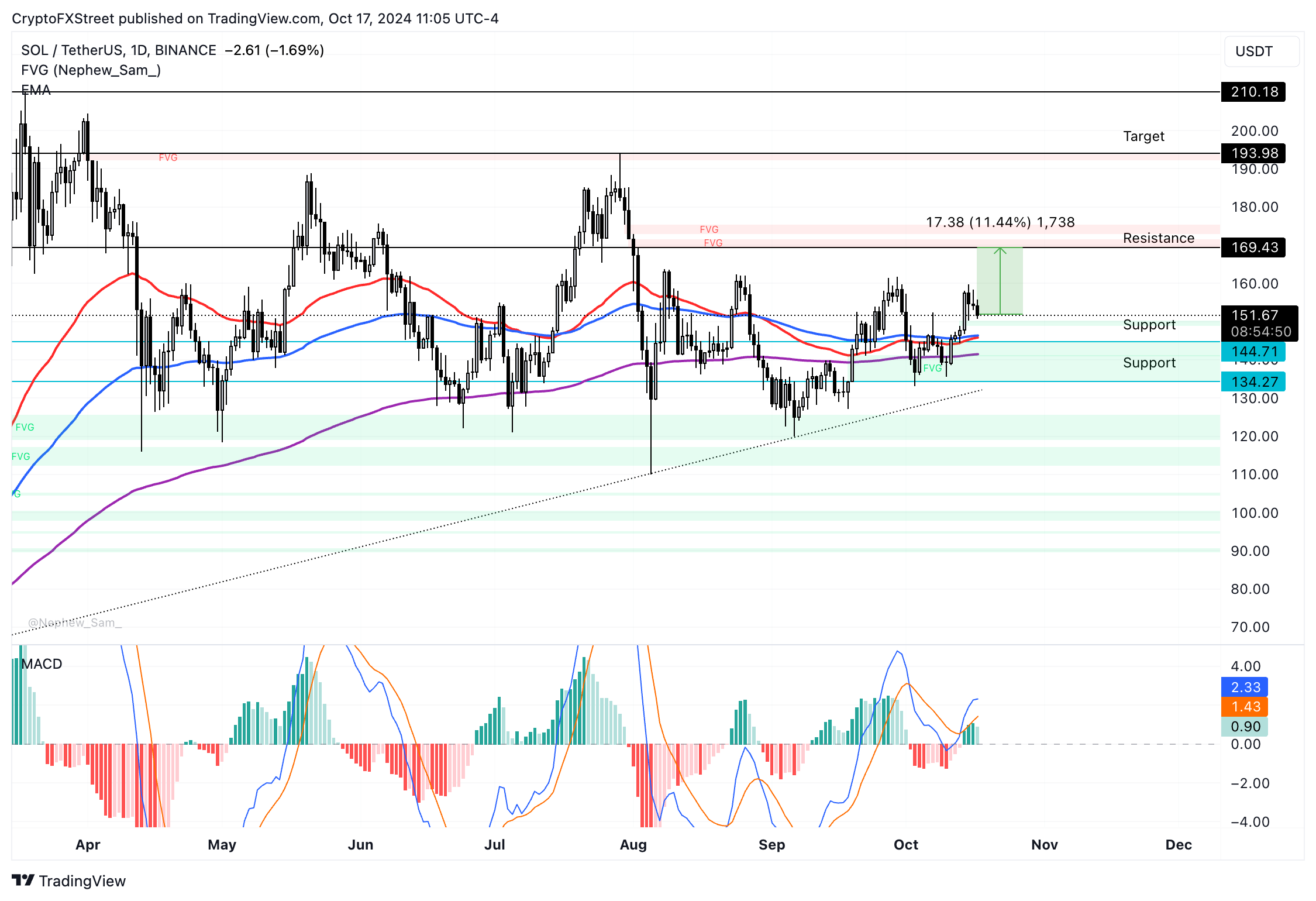

Solana is in an uptrend, as seen in the SOL/USDT daily chart. Bullish catalysts could push SOL higher to test resistance at the lower fair value gap (FVG) boundary between $169.43 and $171.61. SOL could gain 11.44% during its rally towards resistance at $169.43. This level has not been tested since August 2, 2024.

Moving Average Convergence Divergence (MACD), a momentum indicator, shows green histogram bars above the neutral line, meaning there is underlying positive momentum in SOL price.

SOL/USDT daily chart

A daily candlestick closing below the 50-day exponential moving average (EMA) at $146.35 could invalidate the bullish thesis. SOL could sweep support at $134.27, the September 19 low for SOL. Traders should closely monitor the MACD indicator. If consecutive histogram bars continue to shorten, SOL is likely to see a reversal in its trend.