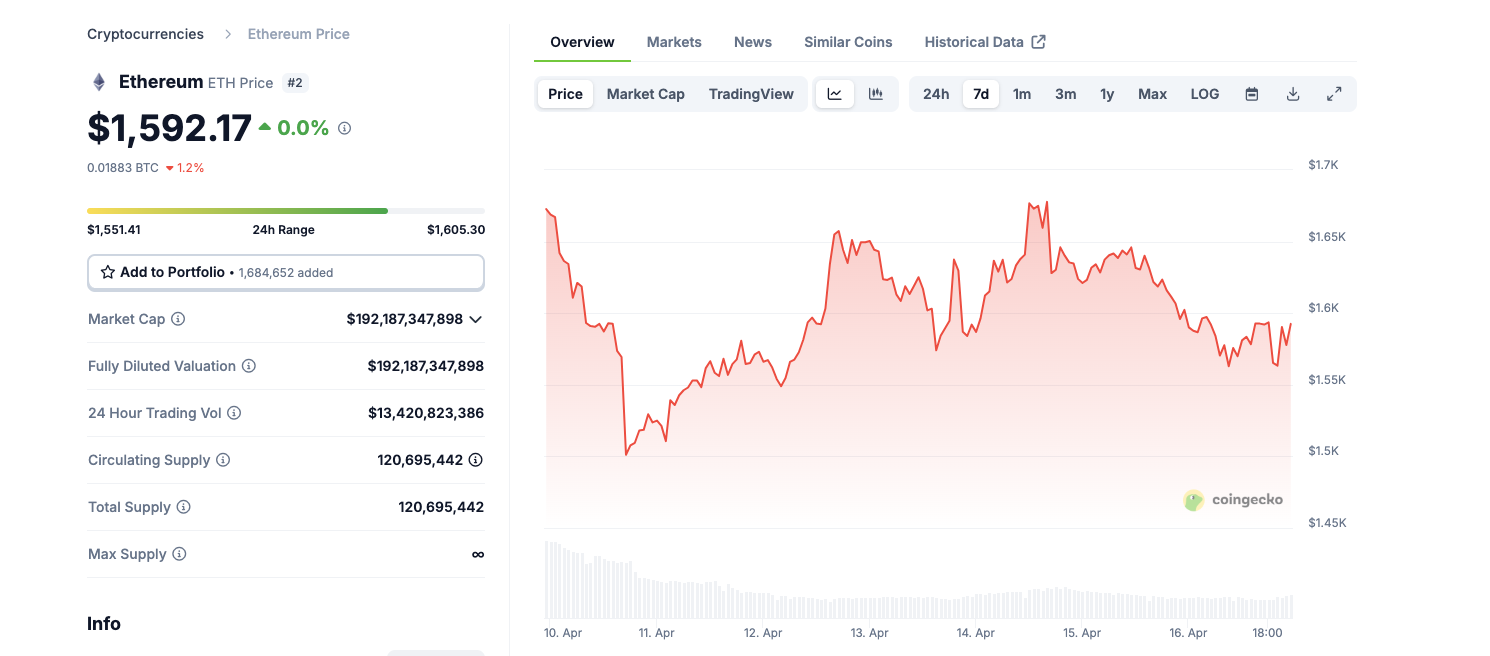

- The Ethereum price decreases below $ 1,600, in the BTC train and the publication of the second lowest gains on Wednesday.

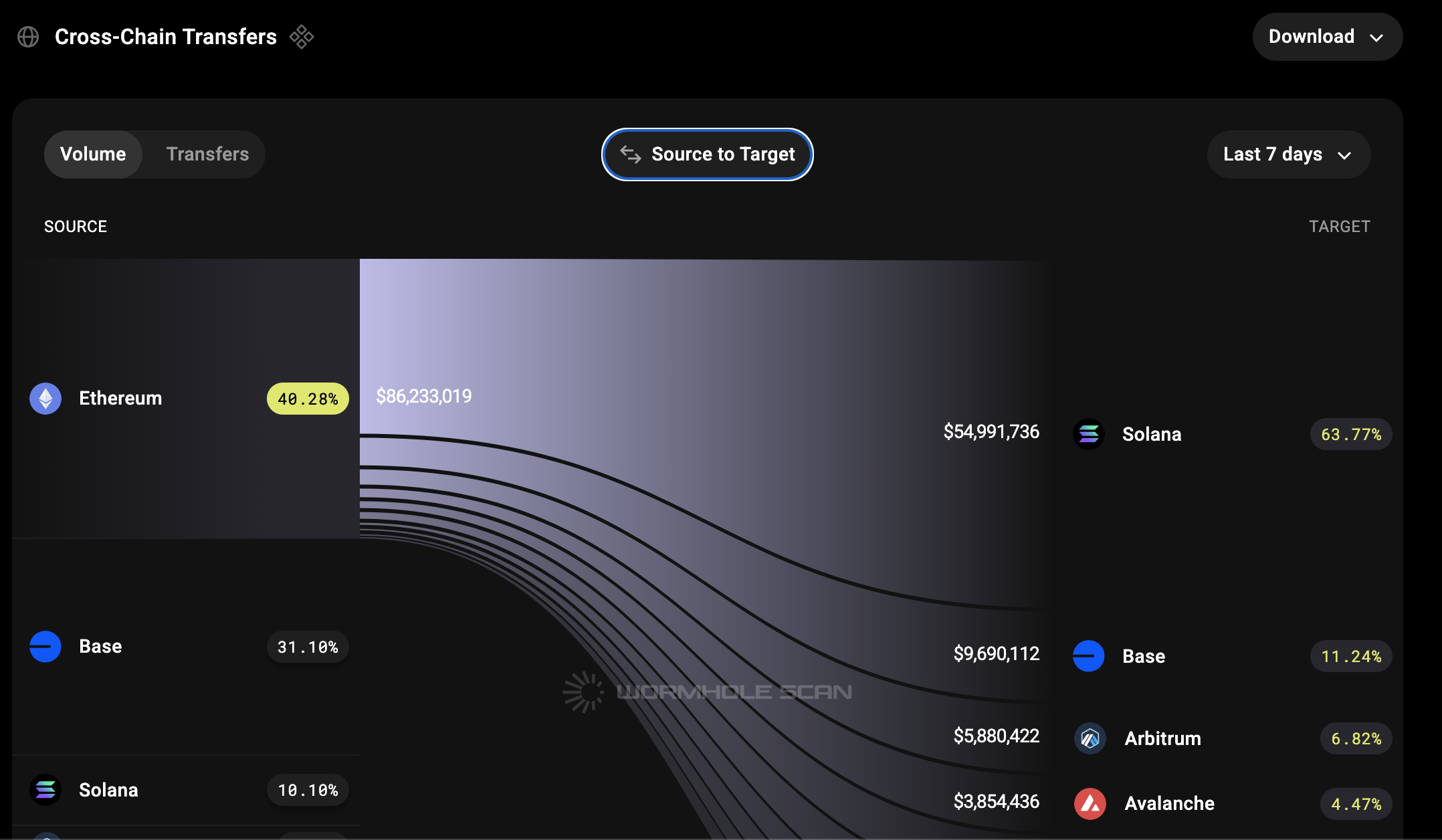

- Investors withdrew more than $ 86 million in Ethereum assets in Solana, Base, Arbitrum and Avalanche in the week following Trump’s Defi Law law.

- On April 10, Trump’s executive order reversed a Biden era policy forcing KYC compliance for DEFI protocols.

- Solana captured more than 60% of Ethereum outings in last week, raising questions on the long -term market share of Ethereum.

Ethereum Price tumbles less than $ 1,600, a week after Trump repealed the Defi KYC mandate, while investors react by redirecting capital to Solana and other networks of DEFI rivals.

Ethereum performance is lagging behind while the markets react to the repeal of Trump’s law

The domination of Ethereum in decentralized finance (DEFI) is under intense pressure this week, triggering lowering tensions in the ETH points markets. Wednesday, Ethereum Price a Langui below the level of $ 1,600, while BTC switched to $ 85,000.

As a sudden NVIDIA sale, investors prompted investors to run American stock market funds to cryptographic assets, the best altcoins like Bitcoin Cash and Litecoin have also experienced light gains.

Ethereum price performance

However, data on the chain show that the persistent underperformance of Ethereum could be linked to the fluctuations in capital flows with the world sector DEFI.

On April 10, Trump signed an executive decree announcing a Biden era policy which required DEFI protocols to comply with the Caund Your Client (KYC) and anti-flange (AML) regulations.

The overthrow was praised as a victory for crypto-native platforms and the financial infrastructure opened, but for Ethereum, the consequences were decisive.

Only a week after former American president Donald Trump repealed the law, investors have constantly moved the assets of Ethereum in other rival networks.

Solana captures 60% of outings while investors withdraw $ 86 million from Ethereum

According to Wormhole data, the largest transverse bridge in Ethereum, Solana absorbed the share of the outings, attracting more than $ 54 million, or 62% of the total. Base, Arbitrum and Avalanche followed $ 9.6 million, $ 5.8 million and $ 3.9 million at entries respectively.

Ethereum transverse chain transaction flow | Source: Green hole bridge

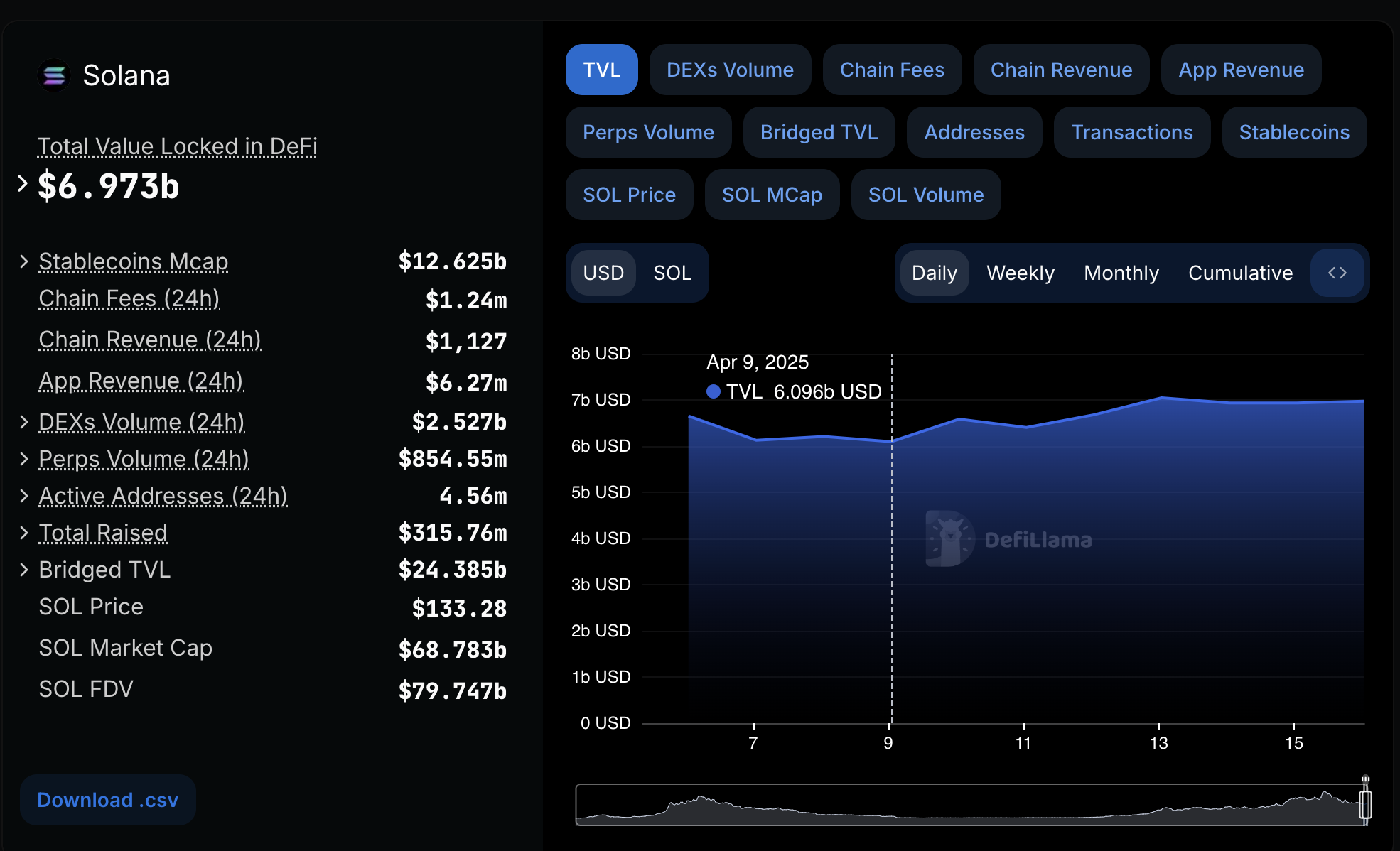

Most of the assets linked to Solana have been channeled in high -speed deffi protocols like Jupiter, Kamino and Marginfi, who have increased in the middle of the improved Solana scalability and lower costs.

Total value Solara Defi Located, April 16, 2025 | Source: Defillama

This decision sparked a strong market response. The total value of locked Solana (TVL) jumped 12% in last week, going from $ 6.1 billion on April 9 to $ 6.9 billion on April 16, according to Defillama.

More than $ 800 million in fresh capital were deployed in all Solana -based protocols during this period.

The Solana Native Token Solla soil also joined, winning 21% in last week to negotiate $ 135. In comparison, the price of Ethereum has increased only by 8%, underperforming nine of the 10 best cryptocurrencies by market capitalization.

Ethereum’s long -term market share at risk

The strong rotation of the capital suggests that the longtime lead of Ethereum in DEFI could erode while developers and users are looking for faster and low -cost environments.

While Ethereum still leads to the total locked value – with more than $ 80 billion – it is increasingly disputed on performance metrics and user experience.

The tendency of Migration DEFI seems to be part of a wider change. Institutional investors pursuing the tokenization of real assets and the issue of ONCHAIN titles are increasingly exploring alternatives such as Avalanche and Hedera, which offer native and low costs.

Meanwhile, Solana and Cardano continue to dominate the retail trade and the same space because of their scalability and their community traction.

Solana price forecasts: Bulls Eye $ 139 while RSI Momentum is built above the midline

After the initial fears of FTX payments at the beginning of the month, Solana Price Action found an upward momentum, recovering $ 132 with a gain of 5.01% on Wednesday.

A more in -depth examination of vital technical indicators suggests more increase towards resistance to $ 139 marked by the upper band of the Keltner canal.

The 12 -hour graph shows a clear rejection of the median support at $ 124.62, with an expanding bullish volume, the soil of 3.64 m indicates a renewal of the buyer’s interest.

Solana price forecasts

The Solana price forecasts also signals optimization, as the relative force index (RSI) currently prints 57.86, comfortably above its signal line at 54.84.

This crossover confirms the positive Momentum building while remaining below the surachat levels, suggesting space in pursuit.

Although the downward risk at $ 124.62 remains possible in a withdrawal scenario, as long as Solana is above the midline, the path of the slightest resistance is up. An escape greater than $ 139.57 would open the door to a potential rally around $ 145.