Key notes

- Solana joined 17% in a week, exceeding $ 180 for the first time in August 2025.

- 8m soil worth $ 1.4 billion withdrawn from jalitude in 5 days, adding to the short -term market offer.

- The Solusd technical indicators show that the next resistance of the general costs is now at the mark of $ 202, the optimistic momentum maintains above the 20-day MA. .

The Solana prize finally exceeded $ 180 on Saturday August 9, 2025, after several unsuccessful attempts since the beginning of the month.

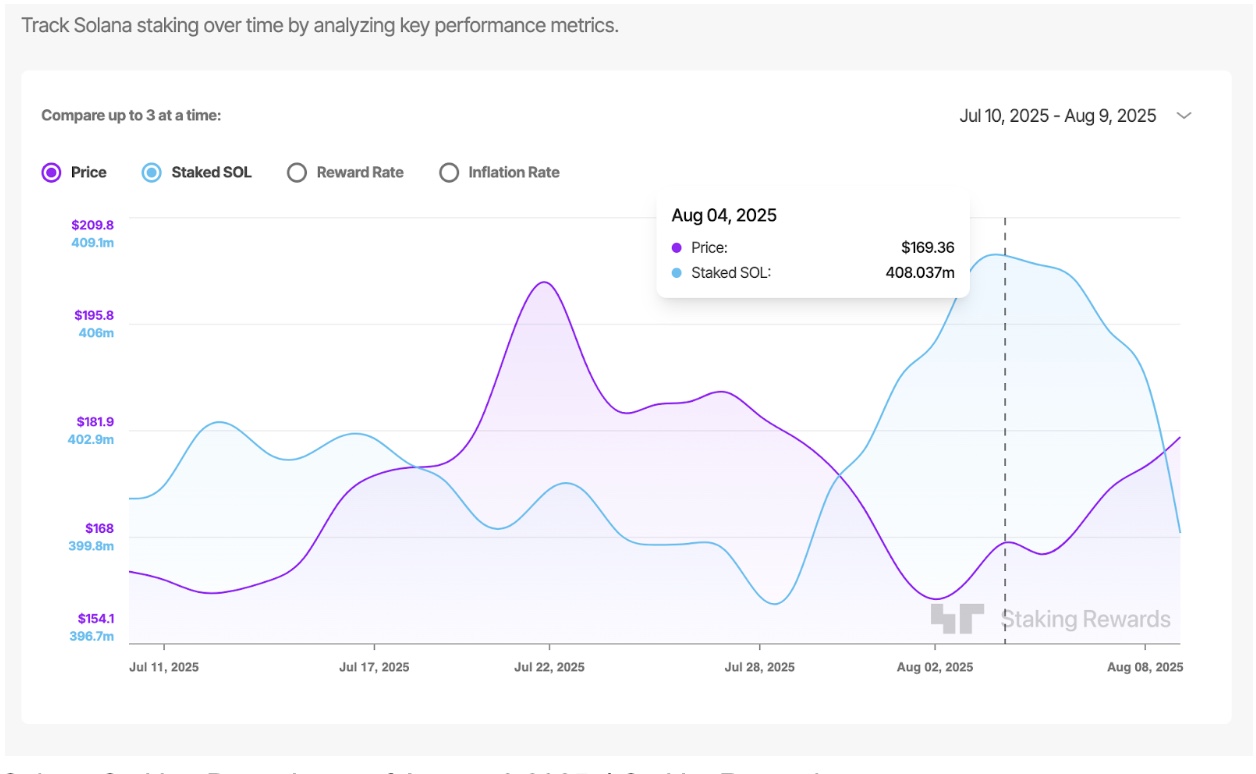

The 17% rally in last week coincided with 8 million withdrawal from Brade Sol, which suggests that investors move to short -term speculative transactions in the medium of increased market optimism. According to the Blockchain Stokingrewards.com blockchain analysis platform, the cleansing deposits went from 408.04 million soil on August 4 to 399.93 million soil at the time of the press.

Solana stale deposits on August 9, 2025 | SAOKETREWARDS.COM

At the current price of $ 180, the soil withdrawn represents more than $ 1.4 billion reintroduced in the active market offer. Although this increase in liquidity has probably helped to push soil over $ 180, it also causes potential short-term risks, an excess offer that could accelerate a lively withdrawal if the current haus feeling is weakening.

Can Solana price forecasts: Can bulls push around $ 202?

In the past three days, Solana Price has increased by 14%, adding another intraday by 2% on August 9 to earn $ 182, its highest level in August 2025.

The technical indicators show the daily closure above the 20-day mobile average, a configuration that often signals the potential start of a new rally leg. If the bullish momentum holds and the appetite for short -term games, fueled by the implementation withdrawals of $ 1.4 billion, remains high, Sol Price could target the next resistance to general costs at $ 202, marked by the Bollinger upper band.

Solana price forecasts | Tradingview

In order for this increased forecast to be validated, Sol must display several consecutive daily closures above the 20-day MA.

Lowering, if the feeling of the market is weakening, the recent excess offer could trigger rapid sales. In such a scenario, Sol can quickly meet for levels of support around $ 165 at $ 170 before trying another escape.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn