SOL continues to outperform ETH year-to-date as the cryptocurrency kicks off 2025 with an 8% jump, with investors continuing to eye a potential Solana ETF.

As of January 2, 2025, Solana (SOL) was trading at $205.64, an increase of 8.48% in the last 24 hours. This increase follows a brief consolidation phase, reflecting renewed investor confidence and optimism.

SOL hit an intraday high of $205.64 and a low of $187.82, signaling a strong rebound driven by rising demand and favorable market sentiment regarding the proposed Solana exchange-traded fund.

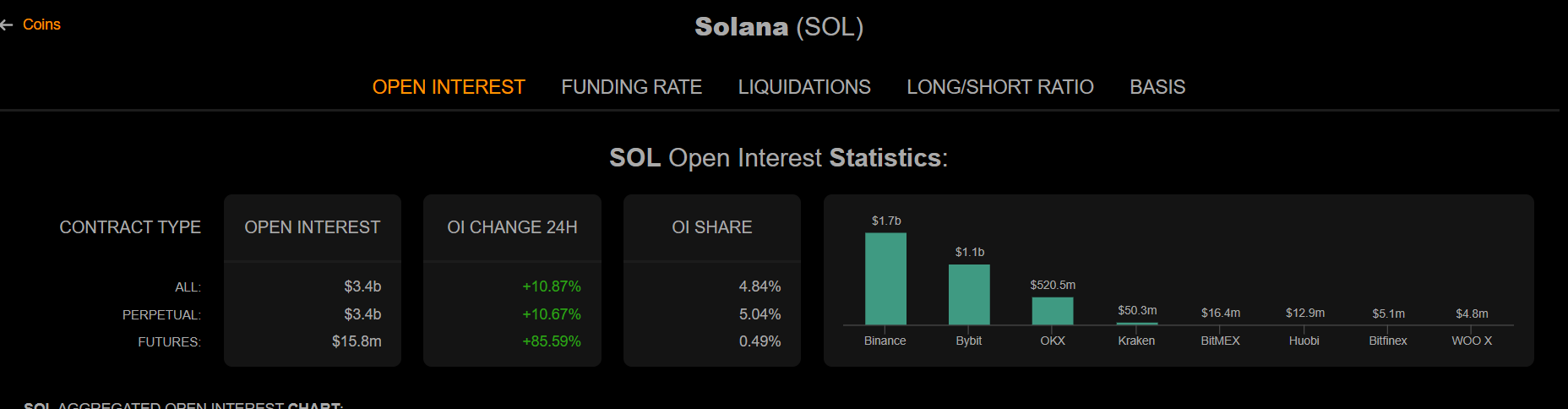

Open interest in SOL futures surged to $3.42 billion, fueled by increased investor engagement.

Perpetual contracts dominate the landscape with $3.4 billion in open interest, while futures account for $15.8 million.

Over the past 24 hours, perpetual contracts increased by 10.67% and futures saw a significant increase of 85.59%, contributing to an overall increase of 10.87% in total open interest. Among crypto exchanges, Binance leads with $1.7 billion in open interest, followed by Bybit with $1.1 billion and OKX with $520.5 million.

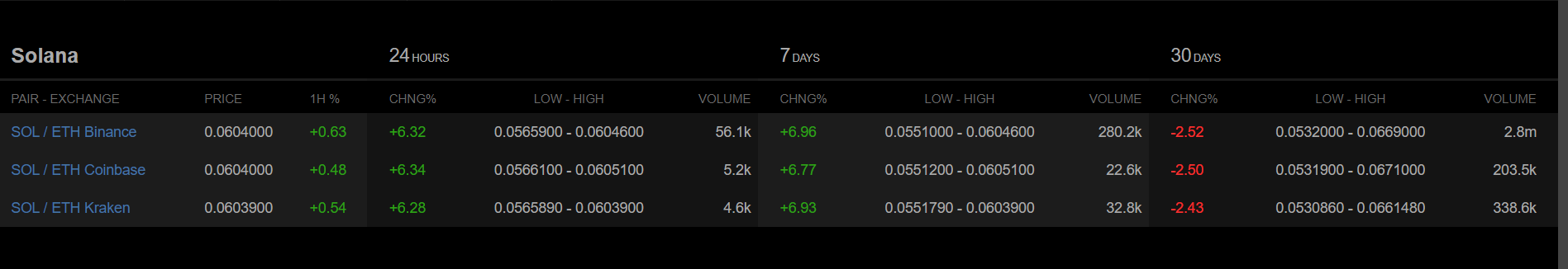

On Binance, SOL price increased by 6.32% in the last 24 hours and registered a gain of 6.96% in the last seven days. Coinbase and Kraken reported similar 24-hour increases of 6.34% and 6.28%, respectively. Binance also leads in terms of trading volume, with 56.1k SOL/ETH pairs traded in the last day, while Coinbase and Kraken follow with 5.2k and 4.6k respectively.

The sharp increase in SOL price and open interest highlights growing investor optimism.

The 85.59% rise in open interest for SOL futures suggests that a growing number of traders are betting on SOL’s price movements. Open interest is often linked to high market activity and sentiment, indicating that the market is expecting further upside for SOL. The dominance of perpetual contracts reflects the fact that traders are actively capitalizing on SOL’s price volatility through short-term strategies.

This trend highlights the interplay between increased speculative activity and fundamental interest, both of which are behind SOL’s strong performance.

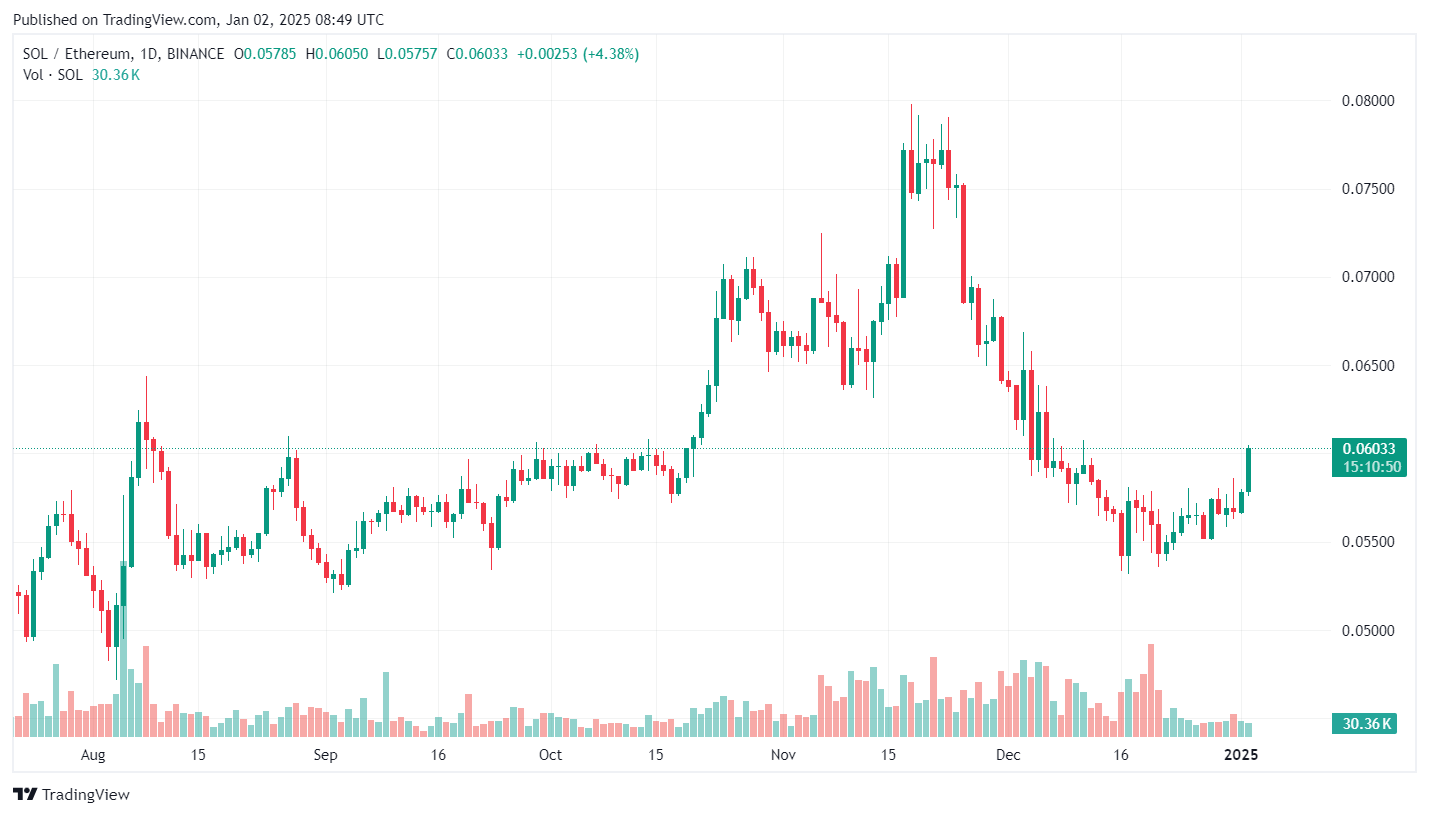

Awawat, a trader and angel investor at APG Capital, tweeted a compelling visual representation of the current SOL market movements.

SOL’s recent performance reflects growing investor confidence, with strong support around $0.002156 in the SOL/BTC pair and a steady consolidation phase signaling stability against BTC.

The breakout of the SOL/ETH pair indicates the resurgence of Solana as an attractive investment amid slowing ETH momentum, demonstrating its competitiveness in the ecosystem.

SOL and ETH differ in their technical designs, with SOL using unique proof of history combined with proof of stake for faster transactions, while Ethereum operates on proof of stake for scalability. SOL’s transaction fees are consistently low, around $0.00025, compared to ETH’s fluctuating gas fees.

ETH has a larger, well-established community and ecosystem, while SOL, although newer, is growing rapidly due to its speed and low costs, attracting DeFi, NFT, and gaming developers. These differences influence the user experience and use cases of each blockchain.

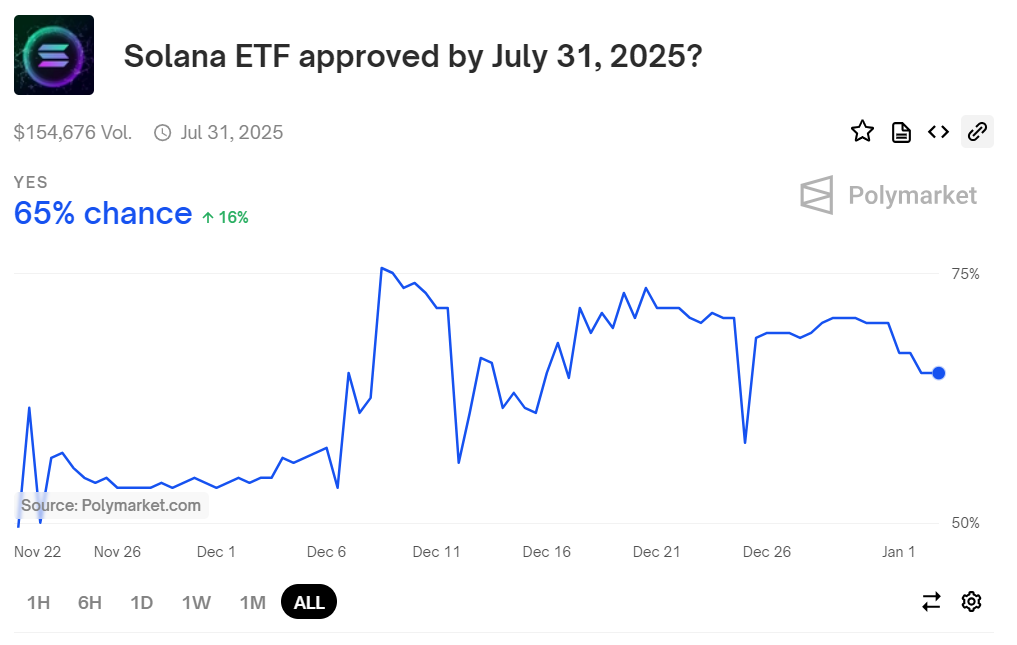

Moreover, speculations about the approval of the SOL ETF by July 31, 2025 are gaining ground. Platforms like Polymarket have seen the odds of getting such approval increase, with odds currently around 65%, up from 50% earlier this month.

The combined effects of whale accumulation, growing adoption, and increased open interest positions in SOL have collectively contributed to this rise. However, potential risks remain, such as network stability issues and regulatory oversight, which could impact market confidence.