- Solana’s bullish pennant pattern hints that SOL may reach the $299 level after the breakout.

- Traders were overleveraged at $251.2 at the bottom and $264.1 at the top.

Solana (SOL), the world’s fourth-largest cryptocurrency by market capitalization, is poised for a notable rise as it forms a pattern of bullish price action.

In recent days, alongside major cryptocurrencies, SOL reached its all-time high (ATH). However, its price now appears to be consolidating near this level.

This price consolidation near its ATH suggests a potential preparation for a further rise.

At press time, SOL was enjoying support from its bullish price action, current market sentiment, and increased trader and investor participation.

Solana Price Action and Key Level

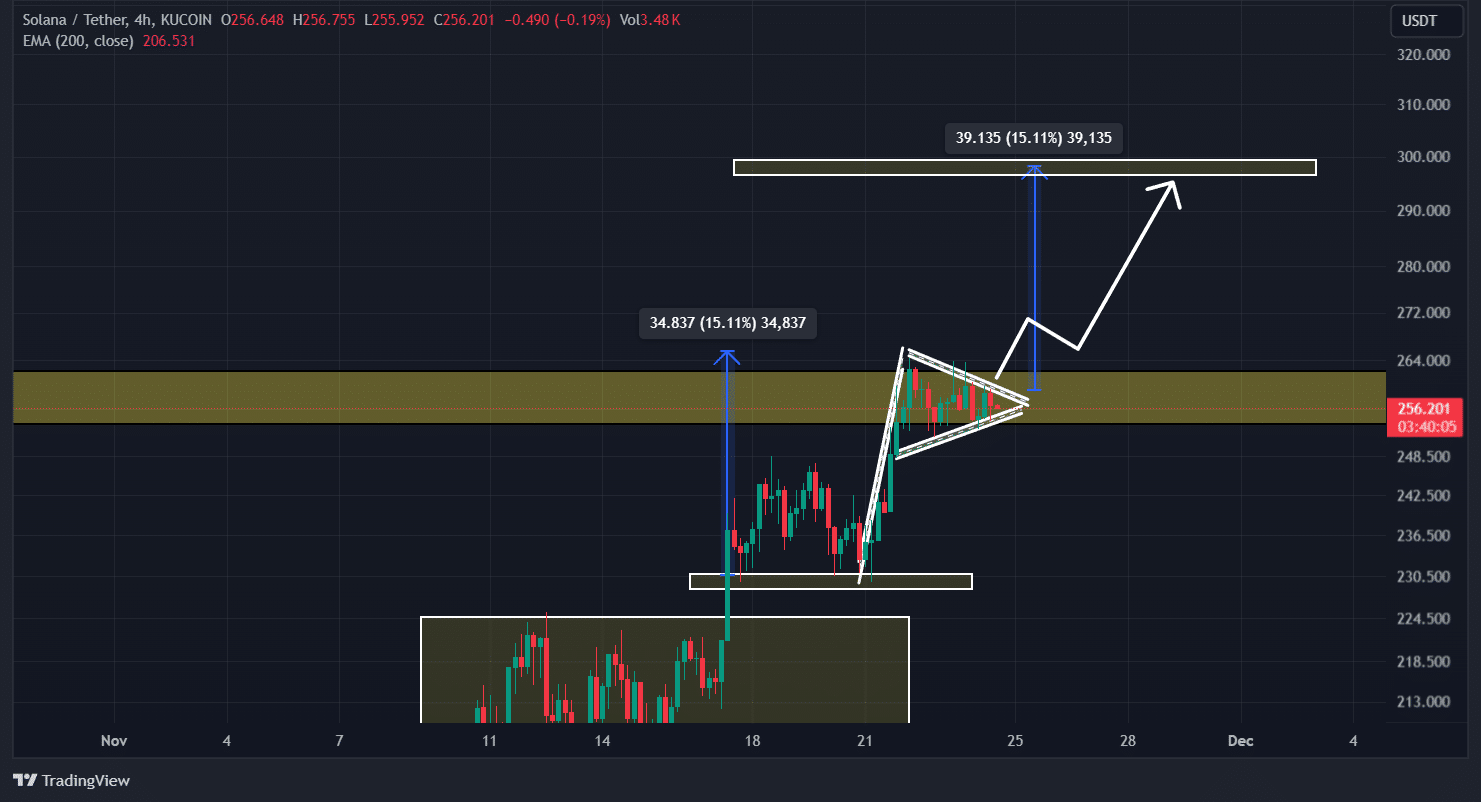

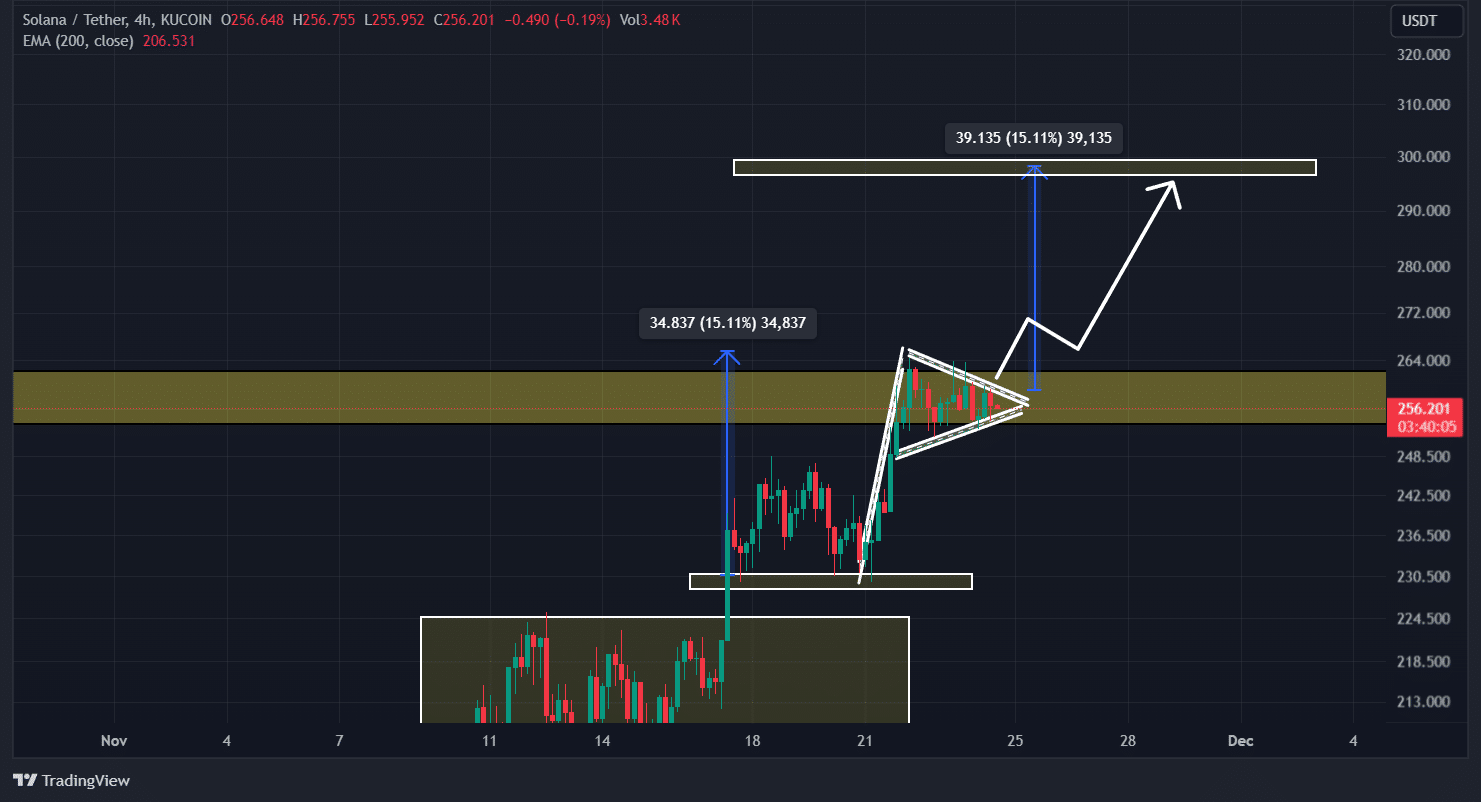

According to technical analysis from AMBCrypto, SOL formed a bullish pennant pattern over a four-hour time frame and is currently on the verge of a breakout.

Based on recent price action and historical price momentum, this uptrend appeared near a strong resistance level of $260.

Source: TradingView

If SOL breaks out of this bullish pennant pattern, breaks above the resistance, and closes a four-hour candle above the $260 level, there is a good chance that it will rebound 15% to reach $299 in the coming days .

Currently, the asset is trading above the exponential moving average (EMA) of 200, indicating an upward trend. Traders and investors often rely on this indicator before creating positions.

Additionally, its relative strength index (RSI) was at 57.10, suggesting that SOL still has room to rally in the coming days.

Mixed sentiment about on-chain metrics

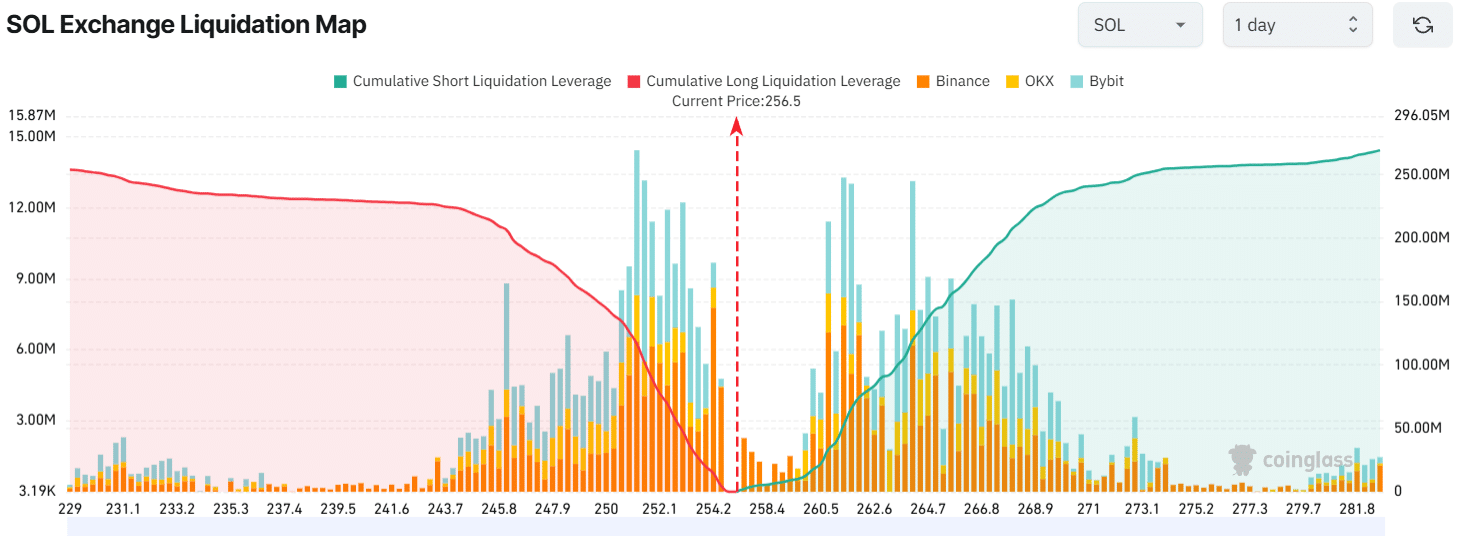

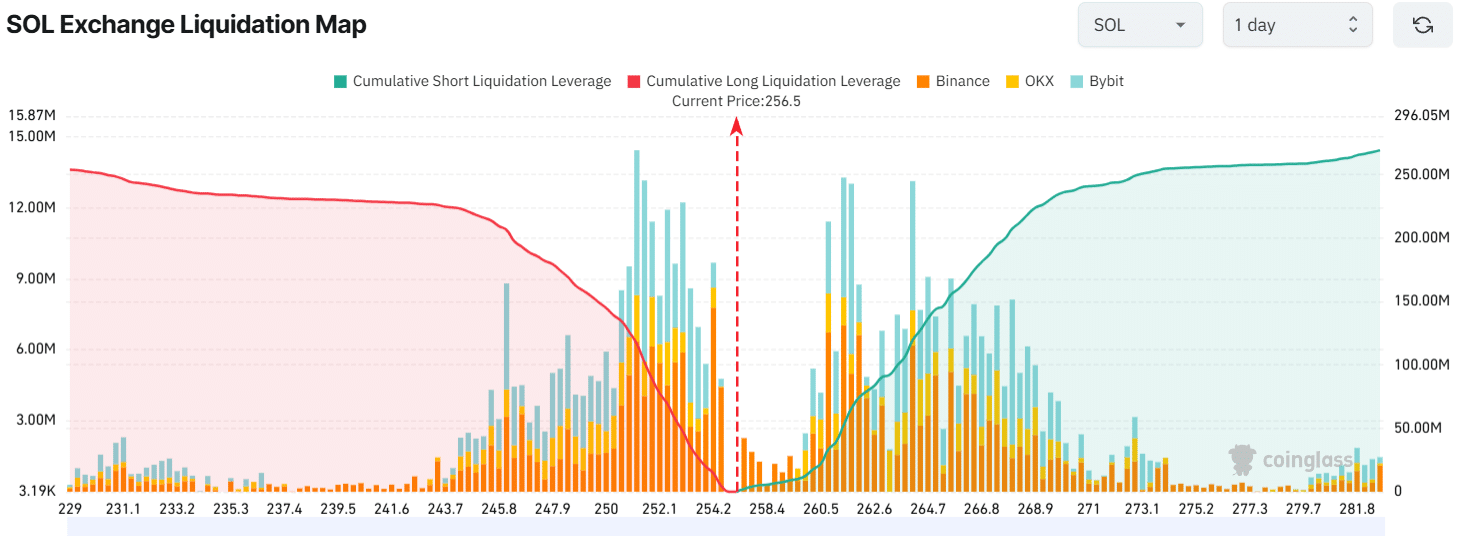

In addition to technical analysis, on-chain metrics suggest mixed feelings among traders.

According to on-chain analytics firm Coinglass, SOL’s open interest decreased by 3.5%, indicating that traders either exited their positions or faced liquidations during the price correction.

However, a break from the current pattern of price action could attract both investors and traders.

Is your wallet green? Check out the SOL Profit Calculator

Right now, the main liquidation levels are at $251.2 low and $264.1 high, according to Coinglass’ exchange liquidation map.

This data indicates that traders are highly leveraged at these levels. A breakout or breakout from these levels could provide a safer entry point for traders.

Source: Coinglass