Key notes

- The company plans to put its assets on the ground to generate an native yield of 7%, unlike Bitcoin positions not rendered.

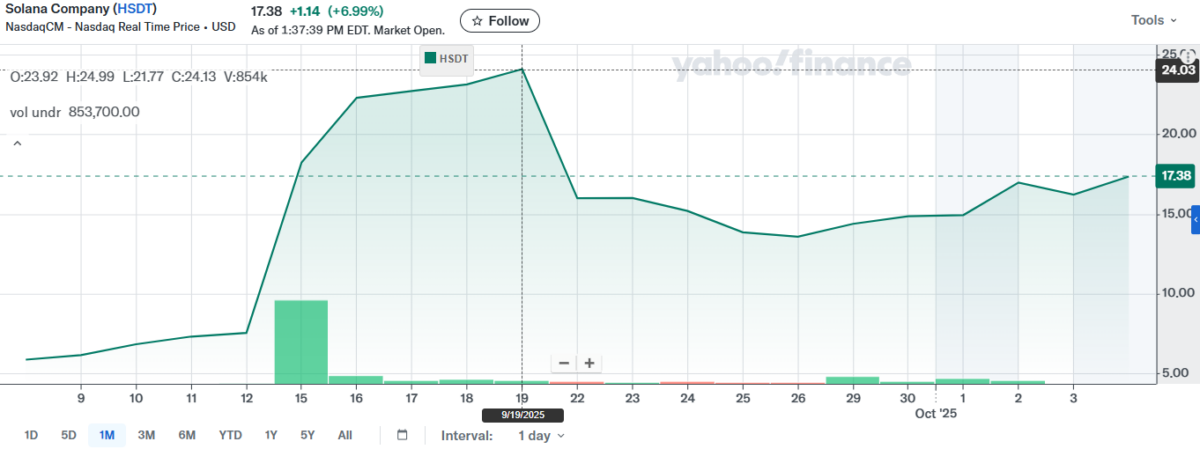

- HSDT shares jumped almost 190% after the announcement of the Solana Treasury, shares that merging around $ 17.38.

- More than nine public companies in three countries now have more than 13 million soils collectively in their treasury bills.

Solana Company (Nasdaq: HSDT), formerly Helius Medical Technologies, said that she continues to acquire Solana

GROUND

$ 235.4

24h volatility:

3.5%

COURTIC CAPESSION:

$ 128.75 B

Flight. 24 hours:

$ 7.47 B

As part of an Asset Treasury digital program (DAT) and now has more than 2.2 million soil, as well as more than $ 15 million in cash to extend the strategy, according to a press release on October 6.

At a reference price of $ 232.50 per soil at 12:00 p.m. on October 6, the company said that the combined soil and cash value exceeds $ 525 million, exceeding the gross product of its private placement which closed on September 18.

Solana Company seeks to play the ground and follow the treasure treasure

The company has highlighted data from the Solana network to justify accumulation, citing processing capacity greater than 3,500 transactions per second, around 3.7 million daily active portfolios and more than 23 billion annual transactions to date, with soil offering a native yield estimated at 7% design, unlike non -compatible assets, according to the announcement.

“Following the traces of Michael Saylor at MSTR and Tom Lee at the BMNR, the company HSDT Solana focuses on maximizing the value of shareholders by effectively accumulating Solana. As proof of this concentration on an effective accumulation, the Solana and the HSDT species hatching now exceeds the initial amount of capital in less than three weeks, “said Cosmo Jiang, general partner of Pantera Capital and Board Obesiver.

After examining the market activity, HSDT is actively negotiated on the NASDAQ, with recent sessions marked by net oscillations while the company pivots a cash profile focused on Solana and the brand change on the “Solana Company” page under HSDT.

Société performance of Solana | Source: Yahoo! Finance

According to Yahoo! Finance, reflecting a volatile band at the beginning of October, aligning with the increase in the company’s capital in September and the disclosure of the subsequent treasury, today, its stock prices are close to $ 17.38 with gains of 7%, and since the announcement of Solana Treasury, there has been an increase in its share by almost 190%.

Solana treasure bills grow elsewhere

Solana’s treasury bills were expanded among the players in the public market in 2025, with trackers and coverage indicating cumulative assets of several billion dollars between companies and funds, with a soil forecast at $ 300 thanks to this trend.

Recent reports highlight the Pantera Capital position size of around 1.1 billion dollars in soil, accompanied by an increase in business activity. This includes the launch by Fatetel of an Australian treasure with a first 10 million dollars and up to $ 100 million in financing capacity, alongside American companies, building considerable soil reserves.

According to Coingecko data, currently, more than nine public companies with a Solana treasure exist, from three different countries. They have more than 13 million soil together, and compared to other digital assets treasury bills, they have only 2.46% of DAT domination.

Larger pipeline for soil accumulation

As Coanspeaker, Galaxy Digital, Multicoin Capital and Jump Crypto reported reported to lift about $ 1 billion to acquire a public company and establish a treasure focused on Solana. This offer would exceed existing vehicles if it was finished.

Additional reports cite companies such as Forward Industries and others pursuing major programs to finance and extend Sol Holdings, reflecting wider cash rotation beyond the BTC to Solana’s compatible profile and network activity measures.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

José Rafael Peña Gholam is a cryptocurrency journalist and publisher with 9 years of experience in the industry. He wrote in the best outlets like Criponotias, Beincrypto and Coindesk. Specializing in bitcoin, blockchain and web3, he creates news, analyzes and educational content for the world public in Spanish and English.

José Rafael Peña Gholam on Linkedin