- The recovery of Solana is under the pressure of large -scale sales and weak feelings.

- Beyond the technique, Solana found herself involved in controversy.

Solana (soil) plunged 36% this month, ranking as the best asset as performing. A 2% increase in the negotiation volume, associated with an RSI occurring and a MacD Haussier crossover, reports a potential drop by buying around $ 120.

However, with the always low risk appetite, can it resolve that bulls can take advantage of technicians alone to stage a recovery?

Beyond the graphics: key factors in play

Pumpfun continues to combine sales pressure on Solana, recently transferring 196,370 soil worth 25.3 million dollars in Kraken.

In total, he deposited 2,629,656 soil worth $ 511 million at $ 194 and discharged 264,373 soil for $ 41.64 million USDC at $ 158, contributing to the continuous recession.

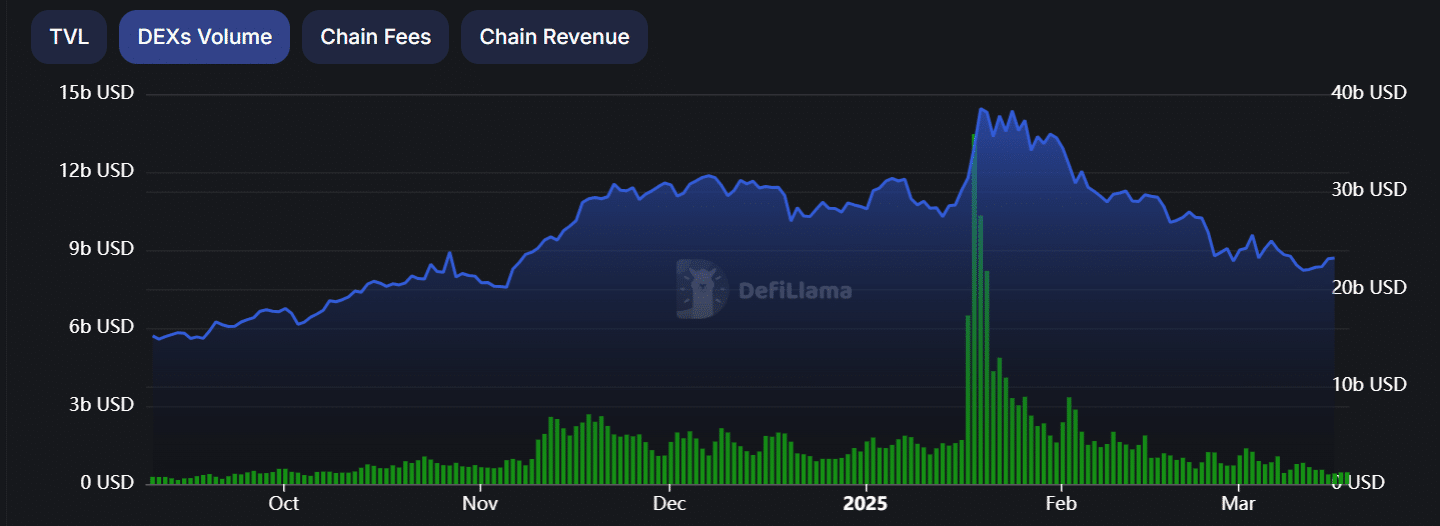

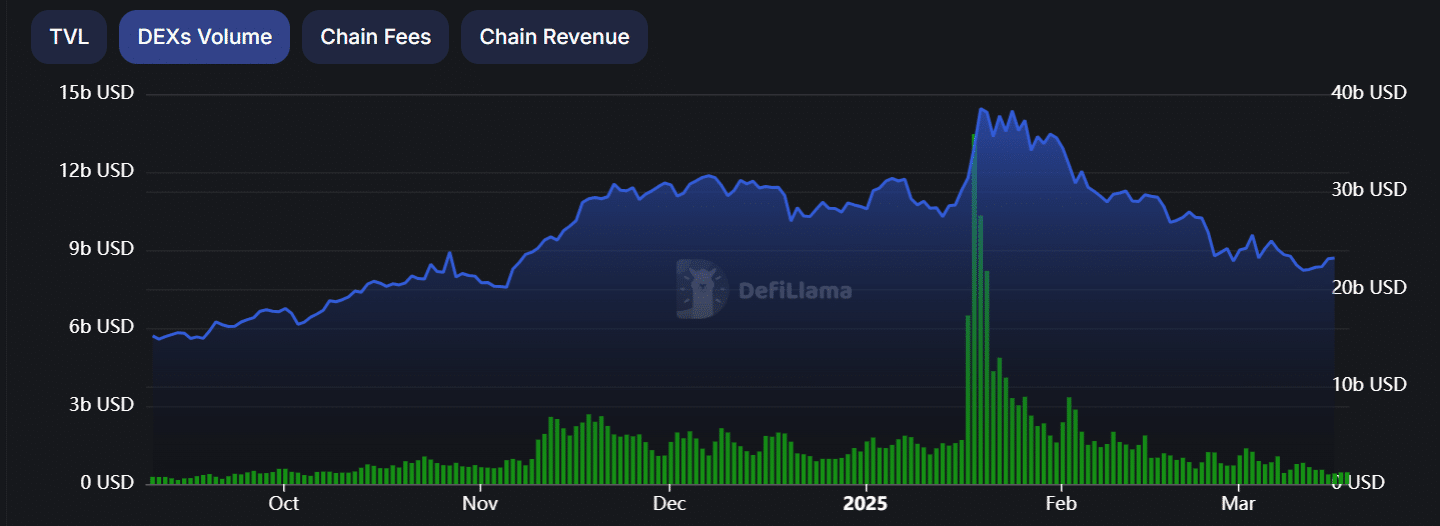

With the increase in sales liquidity in a risk market, a rebound seems uncertain. Meanwhile, Solana and TVL’s volume of Solana and TVL have raised the pre-electoral levels, weakening the activity of the network.

Historically, Solana’s recovery phases were marked by two -digit growth in the TVL and DEX volume, often signaling a background of the market.

However, on March 15, its volume DEX fell below $ 1 billion, which raised concerns about a potential trend reversal.

Source: Defillama

Unless merchants intervene with a strong purchasing momentum, a new decline remains likely. Adding to uncertainty, Solana now faces a reaction on controversial advertisement on X (formerly Twitter).

The announcement, which raised 1.2 million views, encountered overwhelming negativity, forcing Solana to remove it. However, damage has been caused, which has an impact on the feeling of the market.

Composing the lowered signals, the weighted feeling has overturned negative, strengthening the lack of bullish confirmation and suggesting that investors remain cautious about a potential rebound.

Evaluate the next Solana movement

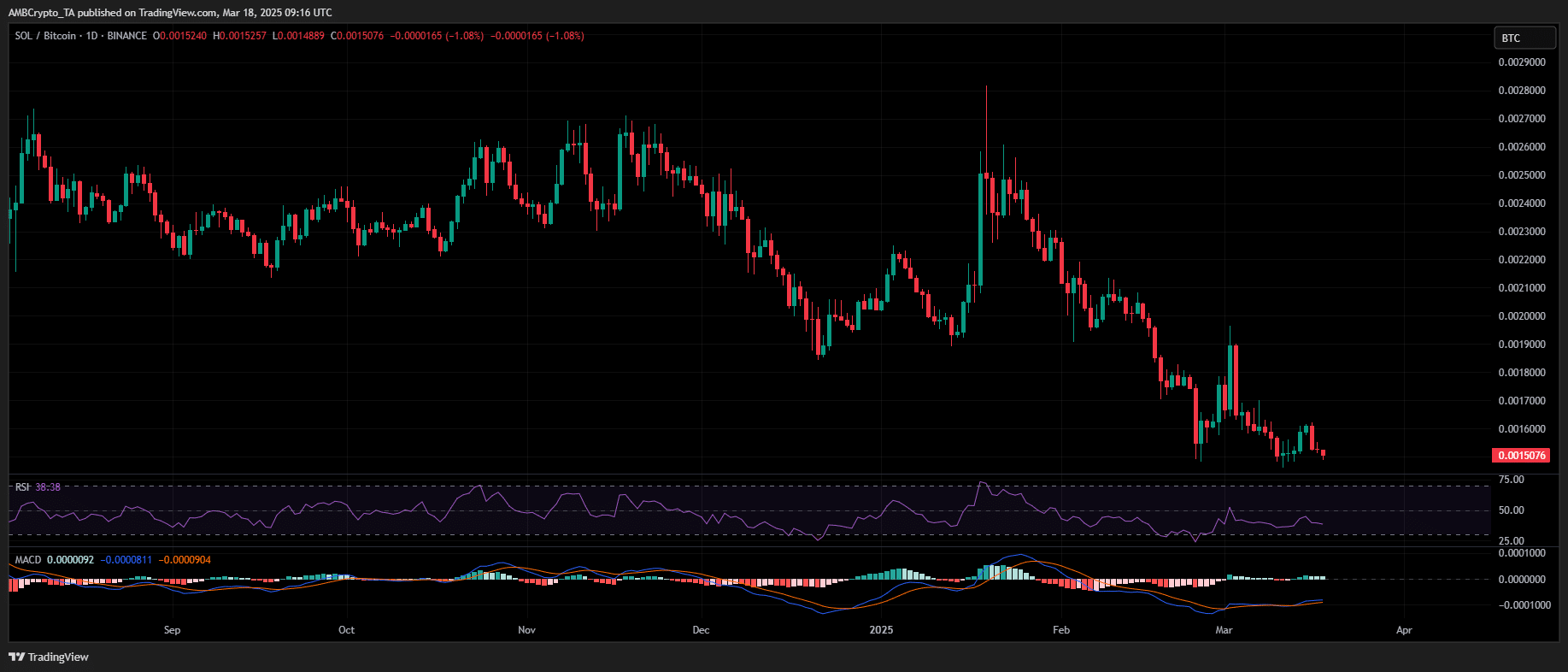

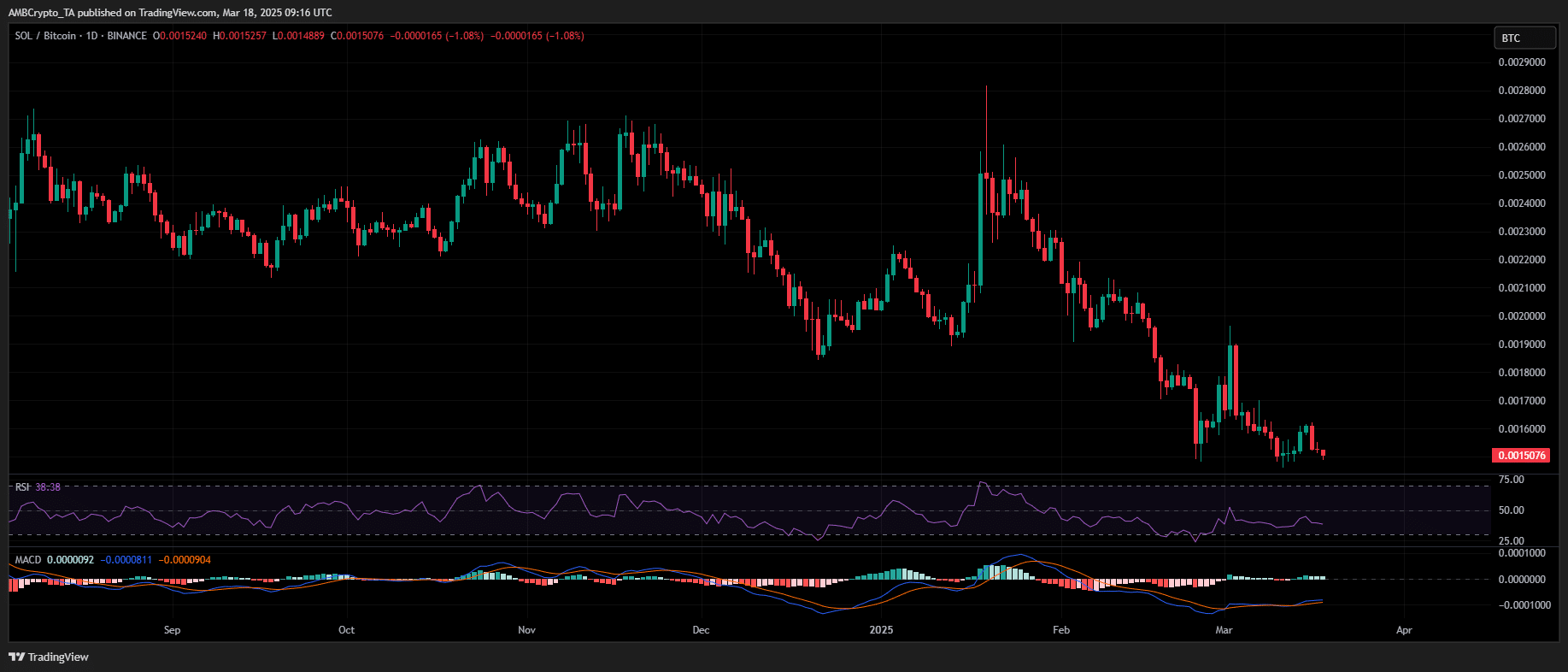

The action of Solana prices highlights a persistent imbalance in the offer of the offer. While Bitcoin is consolidated, Solana has not yet seen a strong entrances in strategic investor capital.

Despite a monthly decrease of 30%, reduced prices did not trigger a strong accumulation. The floor / BTC pair continues to print lower stockings, recently immersed in a two -year lower, weakening the relative force.

Source: TradingView (Sol / BTC)

With large -scale sales and a dominant lowering feeling, the lack of conviction of traders managed by the risk weakens the chances of soil to recover the levels of resistance of the keys.

Given the current market dynamics, another decline in $ 120 or less seems more and more likely.