- Friday, Solana, Dogecoin and Cardano are negotiated in the red.

- The liquidations of the cryptography market increase to $ 635 million, mainly driven by long liquidations.

- Setting bets have increased derivatives on the market as the feeling of the market decreases at neutral levels.

The cryptocurrency market is down Friday, supported by the decision of the American federal reserve to maintain stable interest rates at 4.25% to 4.50% for the fifth consecutive time. Investors are on board, because short -term volatility sparks are delays during the Altcoin season, while bulls are bleeding more than $ 600 million and the rise of lower bets.

Solana, Cardano and Dogecoin lead the decline

Solana (Sol), Dogecoin (Doge) and Cardano (ADA) are declining among the 10 best crypto projects while a sudden sales wave has hit the cryptography market. The drop of 24 hours in soil, Doge and Ada reaches approximately 7% while maintaining the profits within 30 days, reflecting the short -term nature of current volatility.

Cryptography market data. Source: CoinmarketCap

The drop in the cryptography market is mainly motivated by a for -lucrative wave in Bitcoin (BTC) by new investors, resulting in more than $ 6 billion profits and the delay in interest rate drops due to the waiting decision of the American federal reserve in the midst of tariff negotiations.

Derivative market takeing

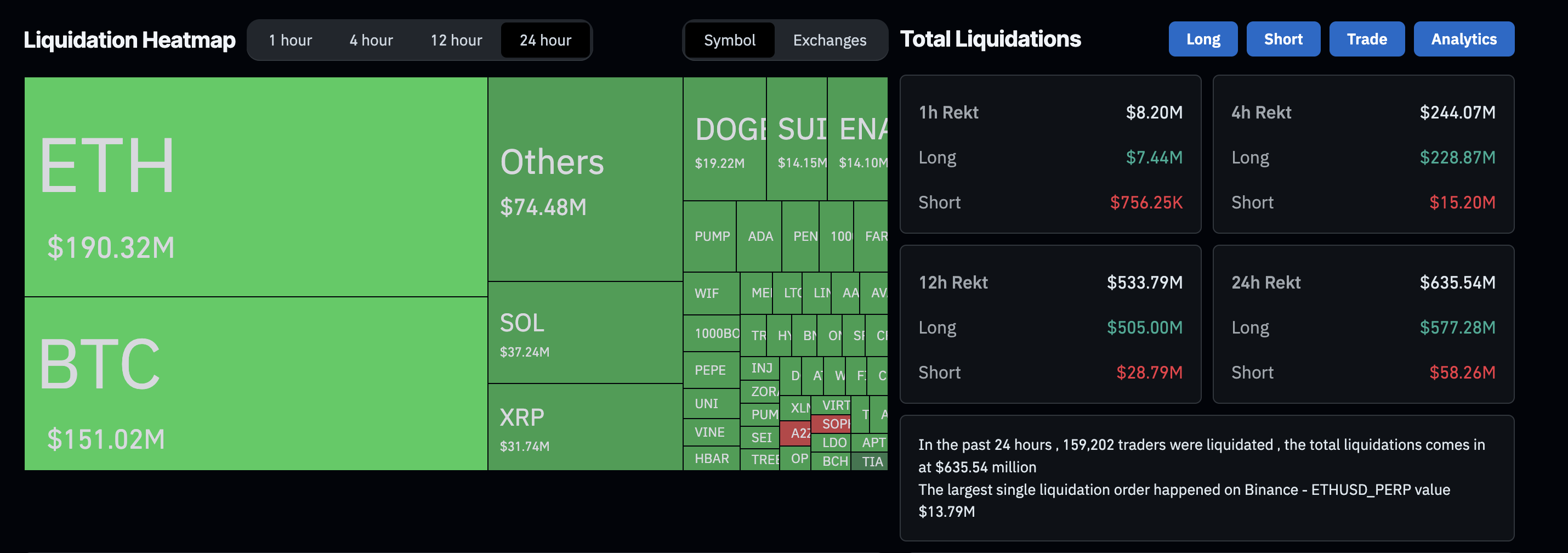

In the middle of the broader collapse of the market, the bullish feeling takes a blow with the massive erasure of long positions. Coinglass data shows $ 635 million in positions liquidated in the last 24 hours. Of the total liquidations, long positions represented $ 577 million, compared to 58 million dollars in shorts, indicating an exodus of bulls on the cryptography market.

Liquidation data. Source: Coringlass

Long liquidations in Solana, Cardano and Dogecoin reach $ 34.86 million, $ 5.74 million and $ 18.37 million, compared to $ 22 million, $ 286,800 and $ 847,710 in short liquidation. This creates an imbalance in the domination of the sale, evident by a wave of lowering positions.

Total liquidation data. Source: Coringlass

Based on short VS positions, the short positions of Solana represent 51.96% out of 48.04% of long term contracts in the last 24 hours. Similarly, the short positions of Cardano and Dogecoin increased to 52.48% and 51.88%, respectively.

Futures long vs shorts. Source: Coringlass

The feeling of investors takes a hit

Investors remain on board, traders increase the downward exposure in short -term volatility, resulting in a drop in feeling. Coinmarketcap Crypto Fear and Greed index, at 57, against 62 Thursday, indicates a sudden change in the feeling of investors. However, the feeling gauge remains close to a neutral level, which suggests that the appetite of investors is firm.

Crypto fear and greed index. Source: CoinmarketCap