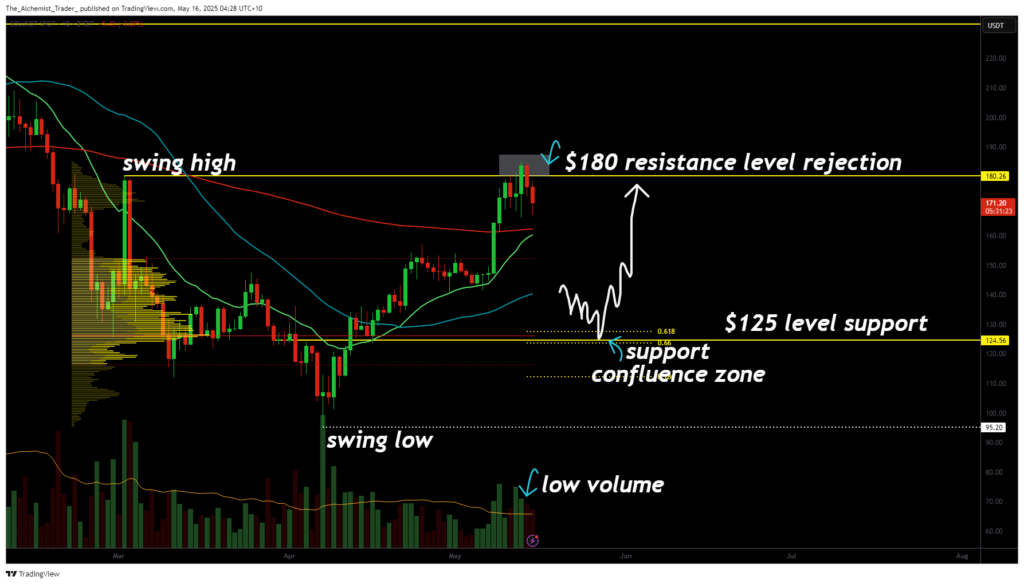

Solana showed a potential gap in terms of key resistance of $ 180, the price closing briefly above before falling quickly below. This indicates a probable rotation towards a major support nearly $ 125 if the level fails to be recovered.

Solana (Sol) is at a critical time after having encountered strong resistance at $ 180. The recent price action reveals a deviation model where the price was temporarily closed above $ 180 but was unable to maintain this decision and quickly found itself below. This type of behavior suggests that sellers aggressively defend the level, which increases the probability of a retracement to lower support areas.

Key technical points

- Deviation of resistance: The price action has shown a counter candle above $ 180, followed by a fence below, confirming a rejection to this resistance.

- Support area: $ 125 represents a major macro-macro support level which acts as a high or low technical trend on the longer term trend.

- Mobile average watch: The 200 -day mobile average is a critical level; Losing it would increase the probability of a new momentum.

The recent price share close to $ 180 is an example of a manual of a deviation, where a first closure increased above the resistance is immediately reversed by selling pressure. This indicates that the bulls have trouble drilling and $ 180 remain a firm ceiling. If this level is not decisively recovered, the probability of a deeper withdrawal increases.

The next large area to watch is the $ 125 support area. This level has a significant technical weight because it coincides with the support of anterior macro on the daily time. Merchants often consider such areas of strong entry points, anticipating a rebound or reversal following a healthy correction in a global bullish structure. This reflects the concept of “bullish sale”, where withdrawals in support are considered to be a sustained rise trend.

In addition, the 200 -day mobile average acts as a dynamic support. Ventilation below this level would cause a dynamic change and probably accelerate the downward pressure around $ 125.

What to expect in the action of upcoming prices

For the moment, Solana remains under pressure at the resistance of $ 180 and has not yet recovered the level. If $ 180 continue to hold while the resistance and Solana breaks below the 200-day mobile average, expect a rotation to the $ 125 support area.

This potential decrease can offer a long, highly probability opportunity, setting up an exchange of $ 125 to $ 231. On the other hand, a strong recovery of $ 180, especially in high volume, would invalidate the downward scenario and restore the bullish momentum. Merchants should closely monitor volume trends and medium mobile levels for confirmation.