Este Artículo También is respondable in Español.

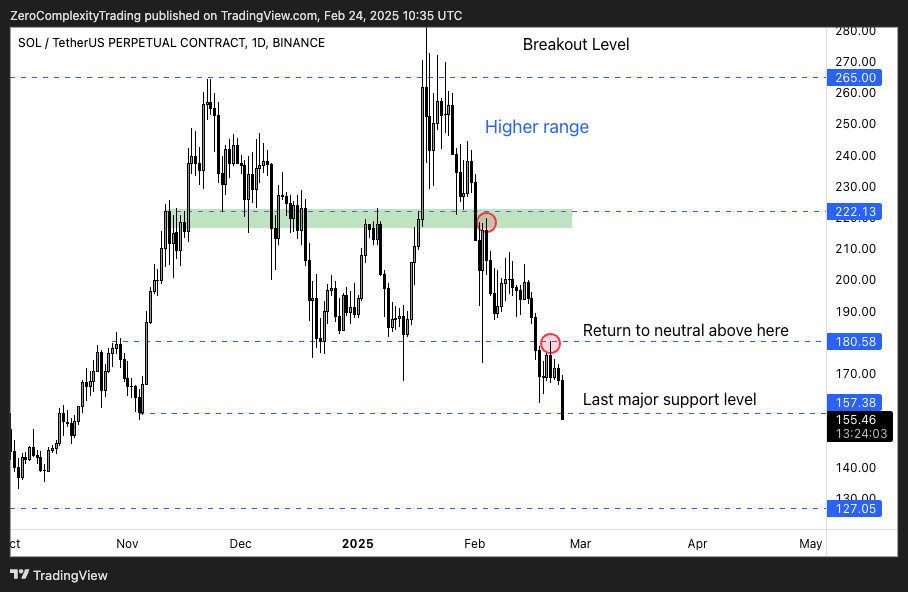

In a technical graph shared today, Crypto Kororesh Khaneghah, founder of Zero Complexity Trading, underlines the continuous decrease trend of Solana, highlighting pivot support levels and resistance on the daily floor / USDT Perpetual (Binance). According to the graph, Solana has lost several key areas and currently hovers near the $ 157 area – which Khaneghah describes the “last level of major support”.

The lowering argument for Solana

“The downward trend continues when Sol is rejected by another S / R Flip and crashes at $ 150. Feeling in a hollow of all time. Suppose the continuation until proven the opposite, ”writes Khaneghah via X.

An important characteristic of the analysis is a support / resistance reversal (S / R) around $ 180.58. Earlier in February, Solana tried to recover this level but was faced with high sales pressure. Not guaranteeing a daily fence greater than $ 180.58, now as resistance, renewed renewed momentum.

After the drop, Solana settled just above $ 157, marked on the graph as the “last level of major support”. The prices have briefly dropped below this area, suggesting fragility in the current market position. A failure to contain $ 157 on daily fences increases the possibility of further decline towards the next significant horizontal line around $ 127.05 – visible at the lower end of the graph.

Related reading

Korehh’s annotations also indicate that crossing over $ 180.58 would pass through the “neutral” Bearish market. Until this happens, the analyst warns that the sellers seem to control, with a negative feeling around the pieces even strengthening the downward trend.

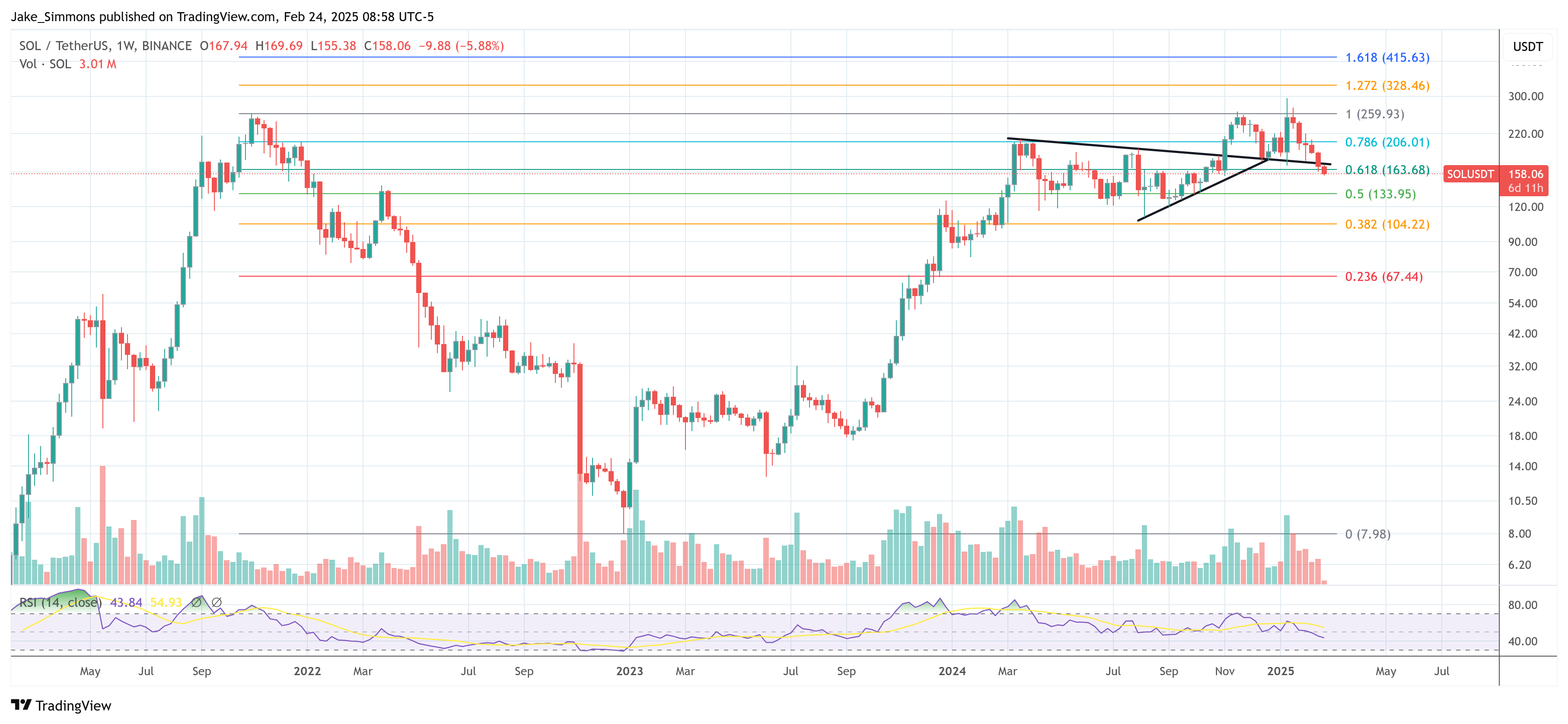

The Haussier argument for ground

Meanwhile, Crypto Analyst Runnerxbt (@RunnerxBT) shared an order analysis of the graphic graph Solana (soil) (duration of 2 hours on Binance) today. The graph underlines notable prices, liquidations and changes in positioning before unlocking of March 1 – when 11.2 million soils (valued at around $ 1.77 billion) are planned to be published.

In the annotated graph, the price culminated in mid-January, reaching $ 295, before starting a regular descent which recently saw the soil of the fork of $ 150. The graph shows that from the start to the end of January, there was a significant drop in open interest (OO) alongside a slide in the price, with cumulative Delta volume (CVD) suggesting that it was mainly driven by closing long positions. Runnerxbt notes attribute this to Lowerness Sol moving largely in tandem (1: 1) with Bitcoin.

At the end of January, after a more pronounced drop movement, the price and the OI were both installed at lower levels. Only bouncing in early February, although the graph indicates that the initial long positioning was quickly followed by short coverage while the traders pivoted for profit or losing short positions. Despite this activity, the soil price could not set up a sustained rise trend, strengthening a wider feeling of hesitation among traders.

Related reading

Around mid-February (February 16 to 18) and again on February 24, the graph highlights the phases of “aggressive short-circuit and sale of points”, which contributed to a persistent drop pressure on the price. Although there were short coverage cases (especially around February 21, where MCVs checked slightly), the overall momentum remained moderate, with few signs of new long accumulation.

On the right side of the graphic, Runnerxbt placed a vertical red line marking on March 1 as the date of what he calls the “greatest unlocked soil known to humanity”. Many market players seem to be “in mind” the event by selling in anticipation of a flood of new tokens that strike the market. This has the potential to drive increased volatility.

However, in his article, Runnerxbt warns against the ground brokerage at the current levels, explaining that he initially started to monitor this situation when the token exchanged just under $ 200 and is now looking for a scalp long after release . He stresses that attempts to catch up every 5 to 10% of daily fall are dangerous and that traders who thus risk frequent stops or liquidations.

“I don’t think it’s a short” new “soil” short. I started to publish on the juice situation of less than $ 200 per soil. I am looking for a scalp long after unlocking, people “originally” that he is arrested or liquidated. You are not a hero catching the knives falling per day from -5% at -10%. (…) TLDR: looking for long (not 5 days before unlocking). Not shorts. If people cannot read, I cannot help you, ”he wrote via X.

At the time of the press, Sol exchanged $ 158.

Shutterstock star image, tradingView.com graphic