Join our Telegram channel to stay up to date with the latest news

Solana price climbed 2% in the last 24 hours to trade at $125 as WisdomTree expands its tokenized fund offerings on the Solana blockchain.

The US-based asset manager said the move was part of its multi-chain rollout strategy, allowing institutional and retail investors to create, trade and hold its full suite of tokenized funds directly on Solana. All of WisdomTree’s tokenized products, including money market funds, equities, fixed income, alternatives and asset allocations, are now available on the Layer 1 broadband network.

BREAKING: WisdomTree expands access to tokenized funds in Solana

Allow individual and institutional users to transfer and store @WisdomTreePrimethe full range of regulated tokenized funds on Solana pic.twitter.com/HXxtSbKjns

– Solana (@solana) January 28, 2026

Prior to this expansion, the company already offered tokenized funds on Ethereum, Arbitrum, Avalanche, Base and Optimism. Meredith Hannon, WisdomTree’s head of business development for digital assets, said the move demonstrates the company’s focus on real-world regulated assets (RWA) within the on-chain ecosystem.

“Solana’s infrastructure allows us to meet the growing demand for crypto-natives while maintaining the regulatory standards expected by institutions,” she added, highlighting the network’s high transaction speeds as a key factor.

Solana strengthens its position on RWA

Solana currently ranks as the fourth largest blockchain for distributed tokenized assets, with an on-chain RWA value of approximately $1.3 billion, representing 5.6% of the total distributed assets market, according to RWA.xyz. Ethereum continues to dominate the industry with over 60% market share. Distributed assets leverage blockchains as a distribution layer, allowing investors to subscribe, hold and manage tokenized products directly through self-custody wallets or regulated custodians.

Nick Ducoff, head of institutional growth at the Solana Foundation, said WisdomTree’s move highlights the growing demand for broader access to tokenized RWAs and reflects Solana’s ability to support such offerings at scale.

Investors can access WisdomTree funds through WisdomTree Connect and WisdomTree Prime, with the added ability to integrate Solana USDC directly into the platforms, streamlining participation in on-chain investment products.

Solana Price Signals Potential Reversal After Recent Pullback

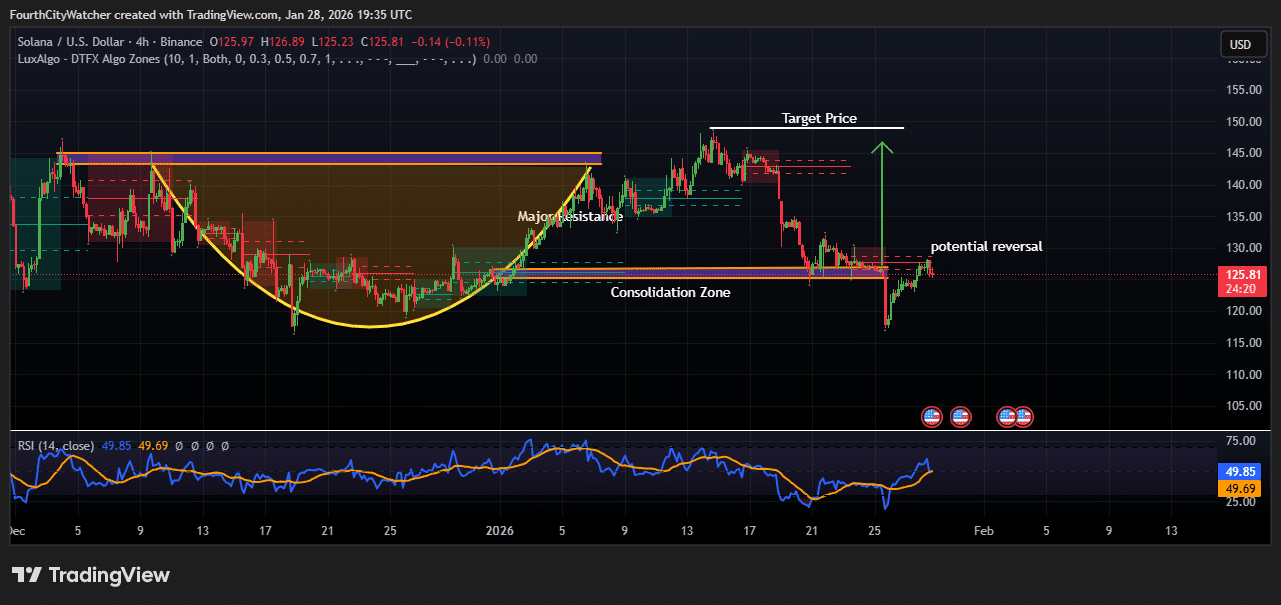

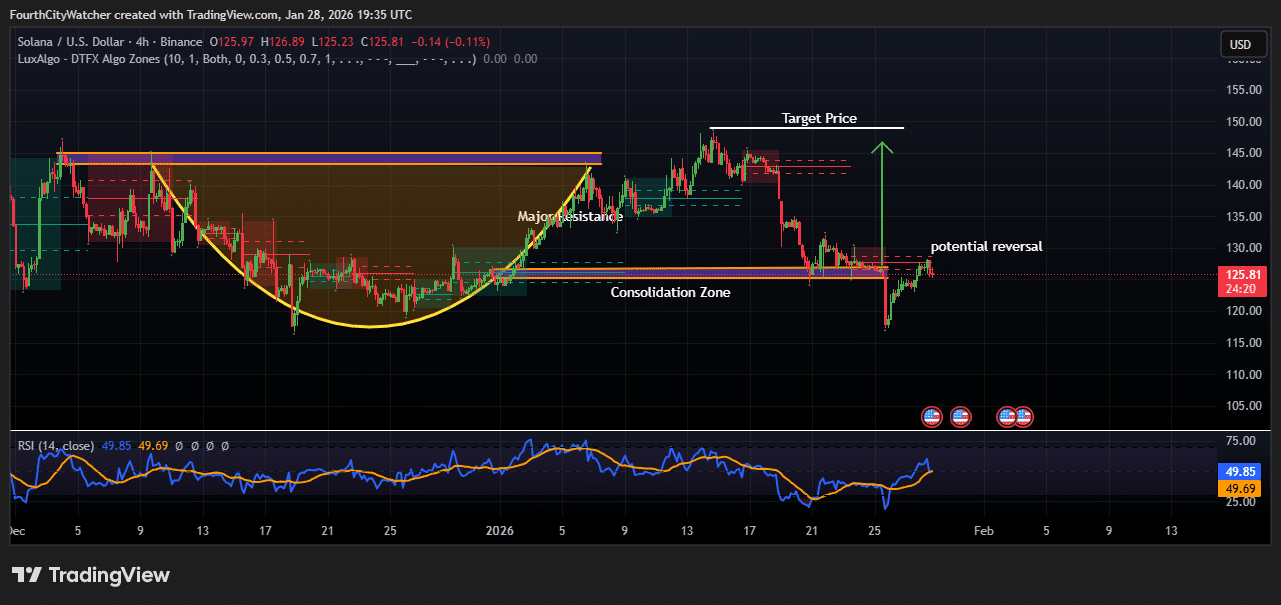

Solana price is trading at $125.94 after a slight decline of 0.01% over the last session, signaling a potential reversal after recent consolidation. The 4-hour chart highlights a critical support area near $122-$123, which served as a floor after the sharp decline from the $145 resistance level.

The pair previously formed a rounded bottom pattern, a classic technical pattern that often precedes bullish reversals. This formation appeared after a prolonged consolidation phase, suggesting accumulation by buyers around the $122-$123 level. Price action has since attempted to retake the $125-$126 range, indicating renewed buying interest.

SOLUSDT chart analysis. Source: Tradingview

A major resistance zone remains around $145, marking a key level that SOL must cross for sustained upward movement. Analysts note that the consolidation zone between $122 and $130 has been crucial in defining near-term market structure, with repeated testing reinforcing its importance.

The Relative Strength Index (RSI) is hovering around 50.37, indicating neutral momentum and room for bullish or bearish movement. A rise in the RSI from this midpoint could support further upward movement, potentially targeting previous highs near $145-$150 if buying pressure continues.

Solana appears to be at a pivotal moment, with technical signals suggesting near-term recovery potential. According to chart indicators, traders closely monitor the current price to confirm a reversal. If SOL manages to hold above the $125-$126 zone and gain momentum, a push towards the target price zone is likely.

Conversely, a break below $122 could trigger further downward pressure, signaling that consolidation could expand. Investors and traders are advised to carefully monitor key support and resistance levels while evaluating market sentiment and volume trends to confirm the next directional move.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news