Key notes

- Solana Price holds above $ 200 despite the weakened volume, supported by wrapped bitcoin entries and ETF speculation.

- The WBTC on Solana offer exceeds $ 1 billion, marking five consecutive months of growth.

- Cyber Hornet deposits an ETF that mixes Solana Futures with S&P 500 stocks, signaling the progressive integration of Wall Street of Crypto.

The price of Solana (soil) managed to avoid a fence below $ 200 despite a significant drop in the negotiation volume. An influx of $ 1 billion in the wrapped bitcoin struck on Solana and another vital ETF deposited by the American company Cyber Hornet, was among the key events that stimulated the resilient projection of Solana during the weekend.

On Friday, Solanfloor’s Solana News aggregator, alerted the Bitcoin wrapped community (WBTC) to Solana crossing the milestone of a billion dollars. According to the Dune Chart shared in the Post, the WBTC offer of Solana has recorded five growth thrusts per consecutive month since May 2025.

🚨New: Bitcoin supply wrapped on @Solana reached a summit of 9,270 $ BTCExchange the market capitalization of $ 1.03 billion for the first time. pic.twitter.com/nkjxehtt7d

– Solanafloor (@Solanafloor) September 26, 2025

This indicates that the recent innovative network upgrades have seen Solana emerge as a higher destination for investors looking for passive income in their BTC holdings as the market is consolidated. If this positive impact of active inputs of the trend of BTC holders was essential at the price of Solana, it avoided the main decreases less than $ 200.

The filling of Cyber Hornet ETF could trigger a delayed soil price reaction

Solana’s inclusion in the Cyber Hornet ETF deposit is another key event that may not have been fully assessed before the market closes the official markets on Friday. Cyber Hornet Trust revealed that the launching plans of three ETFs integrate S&P 500 actions at the exposure to the Crypto in the long term.

Cyber Hornet File Form N-1A launch three ETFs combining S&P 500 Stocks with ether, Solana and Futures XRP | Source: dry.gov

According to the deposit of the SEC dated September 26, a proposed vehicle will allocate 75% of the assets to American shares with large capitalization while devoting 25% to term contracts on Solana. The fund provides exposure to indirect cryptography via listed contracts to the CME and regulated exchanges.

If it is approved, the ETF will be negotiated on the Nasdaq, giving traditional investors another diverse and regulated exhibition at the Solana ecosystem.

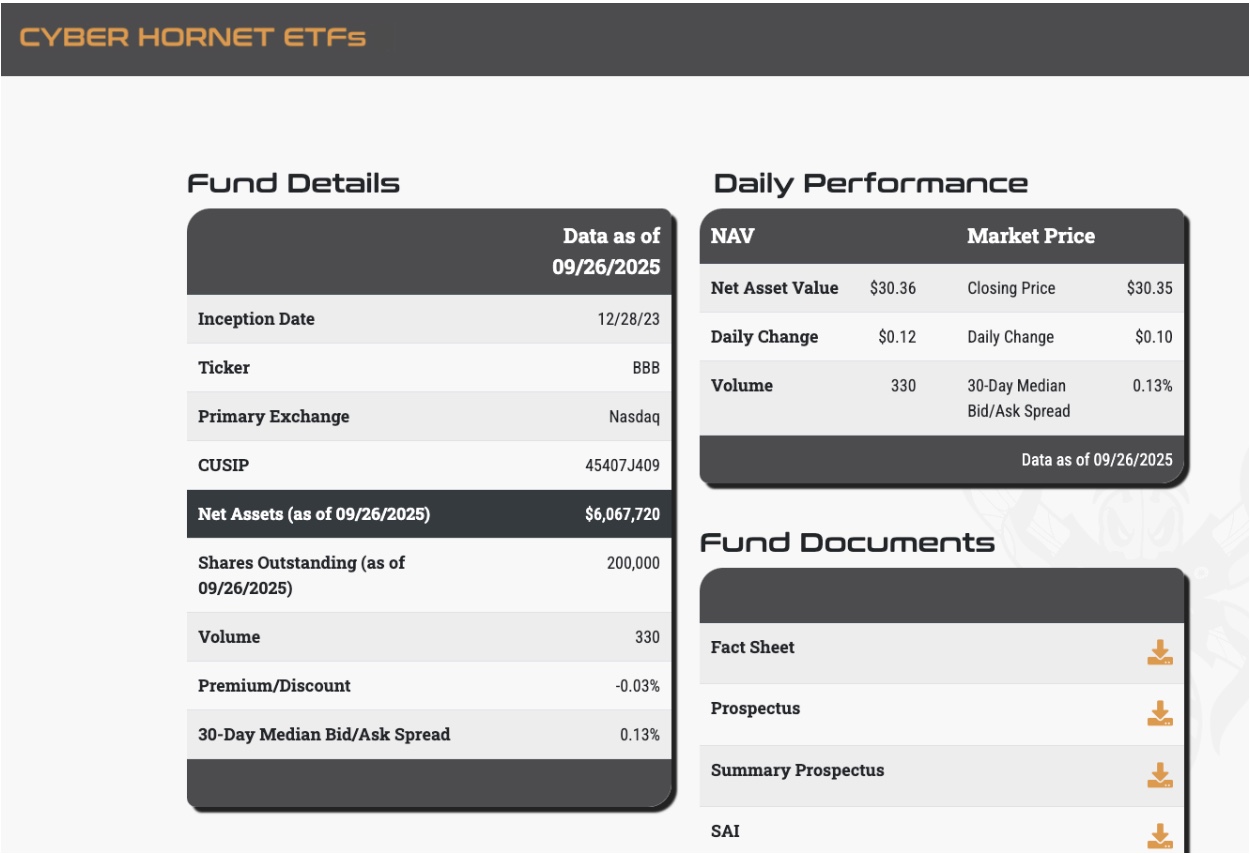

Cyber Hornet Trust S&P 500 and Bitcoin 75/25 Strategy ETF (BBB) Performance on September 28, 2025 | Source: Cyberhornetfs.com

In particular, Cyber Hornet Trust currently manages a similar ETF product, the S&P 500 and Bitcoin 75/25 Strategy ETF (BBB), which on September 26, attracted net assets worth $ 6 million.

The last deposit completes Bitcoin 75/25 ETF existing by Cyber Hornet, reporting an intention to extend the coverage in the main altcoins. S

Subject to approval, Solana’s inclusion in the last Cyber Hornet deposit further highlights its preference among business investors, in particular those looking for additional return income.

Solana Forecast Price: Is a rebound of $ 250 for the game for the coming week?

Solana Price consolidated nearly $ 203 at the time of the press after defending $ 200. However, technical indicators on the Solusd daily price graph reveal mixed signals.

The Keltner canal places immediate resistance nearly $ 216.98, aligning on the midline. An escape above this level could trigger momentum towards the canal greater than $ 239.24. Conversely, the canal less than $ 194.72 remains the key marker downwards, the fact of potentially exposing additional drops.

Solana technical price forecasts (floor) | Source: tradingView

The volatility stop indicator (VSTOP) is nearly $ 215.24, which suggests that the bulls must recover this level to neutralize the current lower momentum. The relative resistance index (RSI) to 42.28 indicates that the soil remains in lowering territory but tends to the rise, suggesting a possible rescue gathering if the purchase persists.

The supported defense of $ 200 support, combined with a thrust greater than $ 217, could unlock a rebound around $ 239. If the bulls remain dominant, an escape beyond the ban on the upper Kelter canal would validate a target of $ 250, especially if WBTC entries and the ETF enthusiasm will maintain institutional interests.

Upon decrease, non-compliance with $ 215 could see Solana Price enter an extended correction phase around $ 194.

The best president (best) presale reaches $ 16.1 million while Solana Rebound arouses interest

In the midst of the recent Solana price consolidation over $ 200, the best portfolio (BEST) has also become a remarkable project at an early stage. Designed as a multi-chain storage solution, it emphasizes institutional quality safety features to treat vulnerabilities in current non-guardian wallets.

Best portfolio (best) presale Best portfolio presale

Industry estimates suggest that the non -guardian portfolio market could be worth more than $ 11 billion in the coming years, providing significant increase potential for the first investors of the best portfolio.

At the time of the press, Best Wallet’s presale crossed $ 16.1 million, with only hours before the next price update. Interested participants can always acquire the best tokens at $ 0.0257 via the official website.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn