Key notes

- The co-founder of Bitmex, Arthur Hayes, joins the UPEXI consultative committee as the first member to guide strategic expansion.

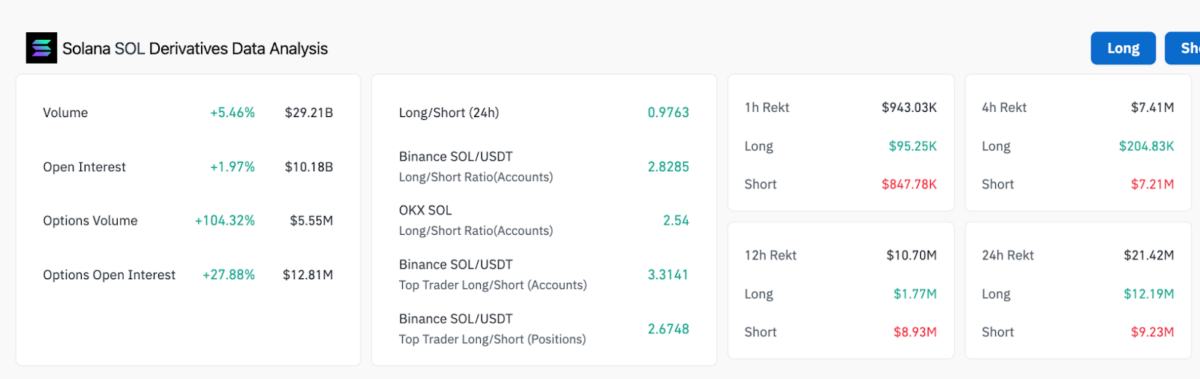

- The solara open interests increased by 1.97% to $ 10.18 billion while the volume of derivatives increased by 5.46% in the midst of new capital entries.

- Technical analysis shows the resistance of $ 189 to soil with a potential escape to $ 200 representing an upward gain of 7.18%.

After a disappointing performance on Monday, Solana

BTC

$ 119 667

24h volatility:

0.7%

COURTIC CAPESSION:

$ 2.38 T

Flight. 24 hours:

$ 46.88 B

Price increased by 7% on Tuesday August 12 to reach $ 185, its highest day gain since July 12. Solana’s renewed bullish traction was supported by a major announcement from the Upexi, a first investor of the Solana Treasury.

On August 12, the Upexi announced the appointment of the co-founder of Bitmex and the leader of opinion Arthur Hayes to its advisory committee on crypto strategy. Hayes joined as the first member of the UPEXI consultative group. The Upexi, which currently contains 1.9 million soil chips, indicates that this decision will help consolidate its leadership in the management of Solana Treasury.

“The advisory committee will be a catalyst for the next Upexi growth stage – stimulate performance, amplify our brand and unlock transformative opportunities. It will expand our imprint in the Solana ecosystem thanks to strategic partnerships and targeted investments and will help us to Solana champion among institutions and businesses “Allan Marshall, CEO of the Upexi, said.

The co-founder of Bitmex, Arthur Hayes, should provide strategic advice and industry ties to the company’s expansion plans. The Committee will strive to develop the presence of Upexi in the Solana ecosystem thanks to targeted investments and partnerships.

The market response was immediate. The solara open interests increased by 1.97% to 10.18 billion intrajournage dollars, crossing the $ 10 billion mark for the first time this month, a clear indicator of fresh capital entries while the soil price bounted local lower at $ 175 on Tuesday.

Analysis of the Solana derivative market | Source: Coringlass

In addition, the volume of Solana’s derivatives also climbed from 5.46% to 29.2 billion dollars, while the open options increased by 27.88% to 12.81 million dollars.

The big jump in the volume of options, associated with the increase in open interest, indicates that traders constitute positions for potential breakdown movements.

Floor price forecasts: can bulls return a resistance of $ 189 to resume $ 200?

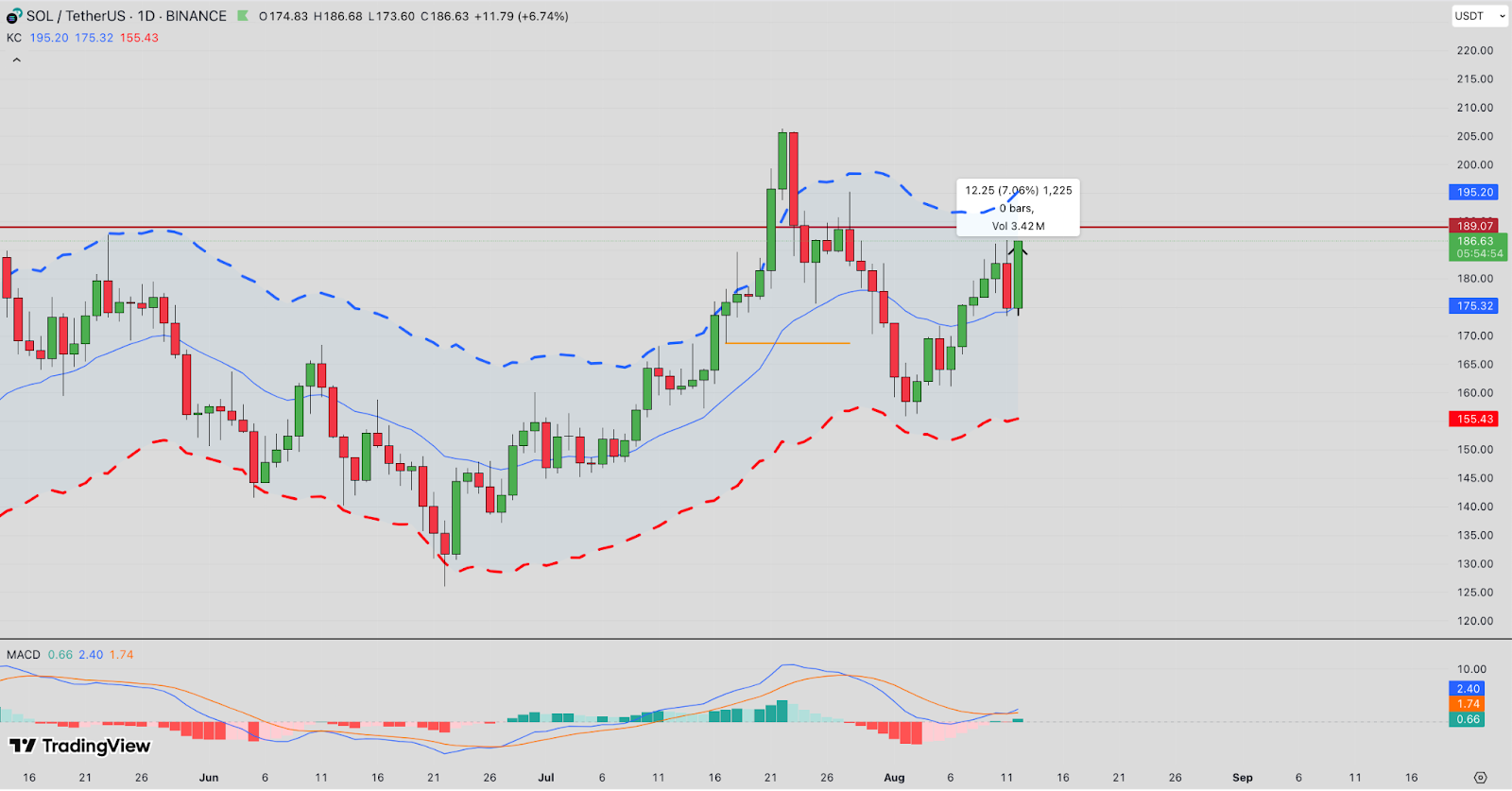

Solana Price is testing a critical resistance level at $ 189 after recovering its short -term mobile average close to $ 175. The daily graphic watch Sol Trading just below the Upper Keltner Channel band at $ 195.20, with moving indicators improving. The MacD histogram overturned to green, signaling an early bullish impulse, while the action of the prices has shown higher stockings since the overthrow of August 5.

Solana price forecasts

Current levels close to $ 186.60, a decision at $ 200 represents a gain of 7.18%. A daily fence greater than $ 189 up the volume and a sustained open interest would confirm an escape. Cleaning the upper canal nearly $ 195 would add technical confirmation and would likely trigger start -up -out purchases to July peaks nearly $ 210.

Conversely, non-compliance with $ 189 followed by a drop below the mobile average of 20 days to $ 175.32 would invalidate the upward forecasts of Solana prices. Another rupture of less than $ 170 would expose support from the lower canal nearly $ 155.43, which represents a potential drop of 16.7% of current prices.

BTC Hyper Presale is gaining ground as growth in the eye layer of pump 2 merchants

While Solana’s ecosystem takes up the momentum with the positive news of treasury investors, the Bitcoin layer 2 sector also arouses significant interest.

The Hyper Presale BTC has already raised $ 5.46 million, promising instant Bitcoin transactions and at low cost for payments and up to 1,052% in rewards.

BTC Hyper Prévennte

For merchants who look at Solana’s momentum and the search for diversification in the growth of layer 2 of Bitcoin, BTC Hyper presents a high reward speculative option in the current environment. With the next level of price level to approach, participants at an early stage can visit the official BTC Hyper website to arrive early on the presale.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn