Join our Telegram channel to stay up to date with the latest news

Solana’s price jumped 4.8% in the past 24 hours to trade at $204.72 as of 6:10 a.m. EST on trading volume that plunged 9% to $11.6 billion.

This comes as VanEck filed its fifth amendment for its Solana Spot ETF (VSOL) with the US Securities and Exchange Commission, introducing a 0.30% management fee and a regulated staking feature that is the first of its kind for a US digital asset fund.

🚨JUST: @vaneck_us filed an updated S-1 for its spot @Solana ETF, setting management fees at 0.30%.

The filing adds details on staking, noting plans to potentially delegate SOL to multiple third-party staking providers, with allocations based on performance, availability,… pic.twitter.com/lR02YtK40U

– SolanaFloor (@SolanaFloor) October 14, 2025

The Company is expected to use one or more third-party staking providers, including SOL Strategies, to manage Solana delegation and yield generation.

During this time, Gemini Trust Company and Coinbase Custodian will be the custodians of the ETF and will store the fund’s Solana holdings in an insured and regulated manner. VanEck’s staking model includes a 5% liquidity cushion to manage redemption risks during market volatility.

In other developments, Fantasy Sports crypto platform Sorare prepares to migrate from Ethereum to Solana after 6 years.

✨We are moving to @solana 🚀

Our goal is to accelerate our vision of an open, on-chain sports platform for Sorare, where speed, liquidity and utility are at the heart of a new digital sports economy.

This is not a replacement, it’s an upgrade

A thread 🧵 pic.twitter.com/VVhRik7gU5

– Sorare (@Sorare) October 8, 2025

According to Niclas Julia, CEO of Sorare, he remains confident in Ethereum even as the company prepares to migrate to Solana, which he calls an “upgrade.”

Solana has just climbed back above the $200 level, as it maintains its recovery following Friday’s flash crash that sent prices tumbling below $170.

Even though the price is rising, Solana’s on-chain metrics reveal a continued lack of bullish momentum. For example, decentralized applications (dApps) on Solana generated $35.9 million in weekly revenue, while network fees totaled $6.5 million, a 35% drop from the previous month, according to ChallengeLlama data.

Solana Price regains her balance after canal outage

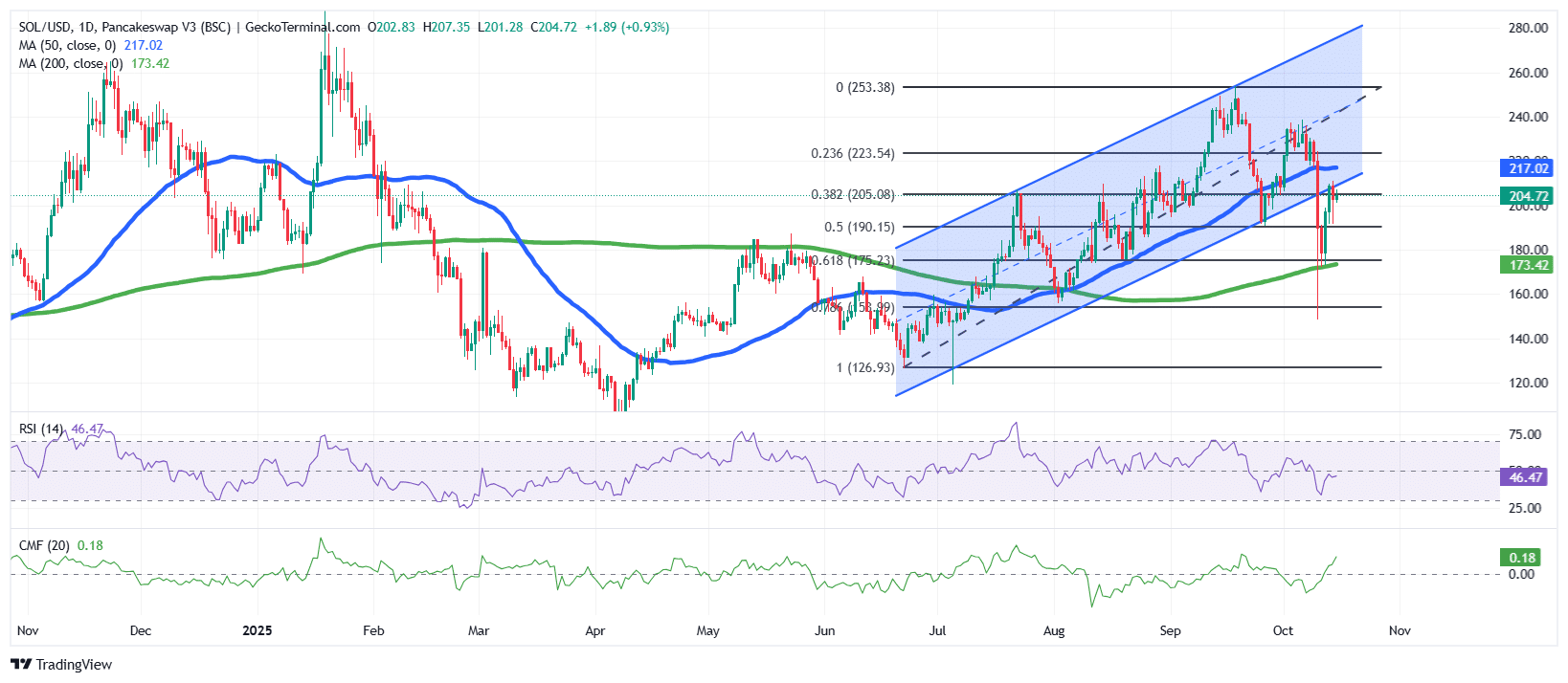

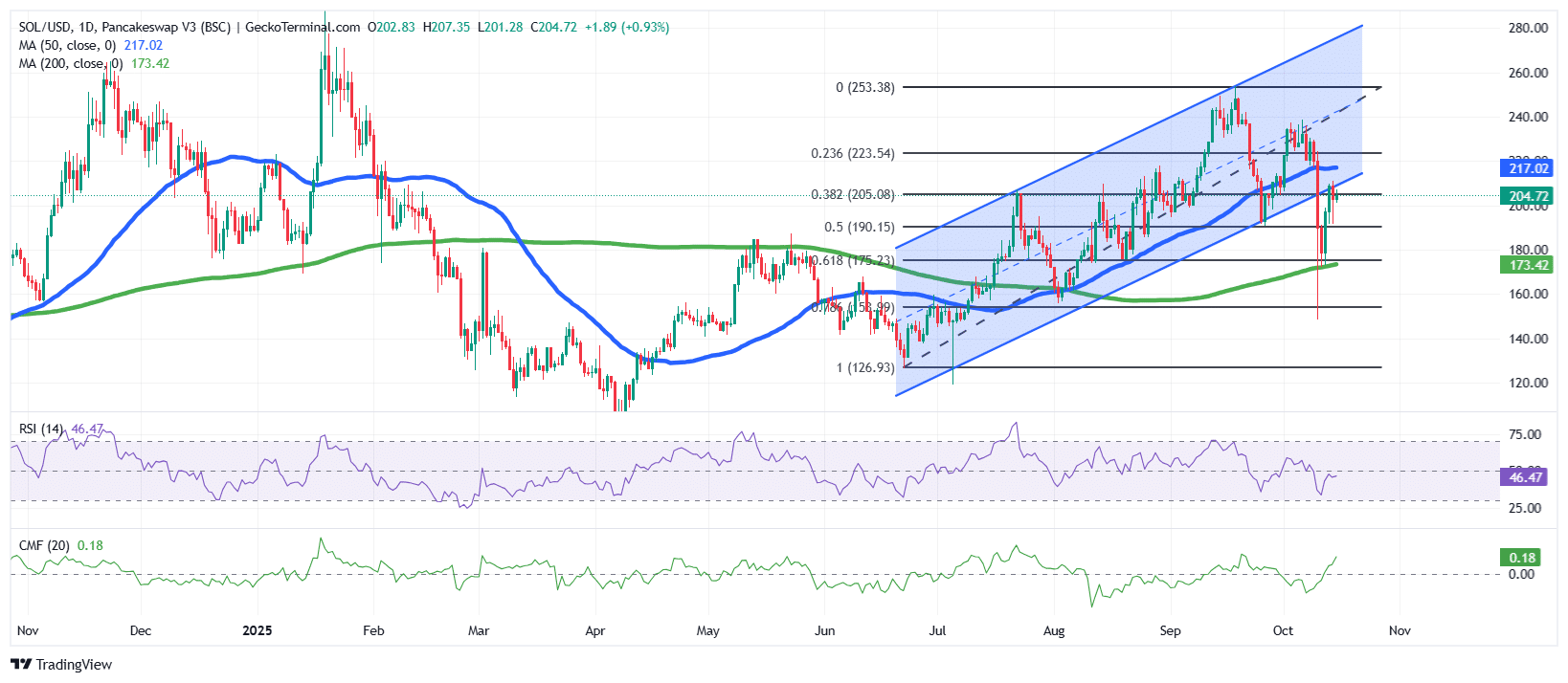

THE SOL Price has attempted to recover after a recent breakout of its ascending channel pattern.

Beginning in June, Solana price traded within this ascending channel, marking a steady uptrend that began around mid-June 2025. SOL price respected both the upper and lower boundaries of the channel, forming a consistent sequence of higher highs and higher lows.

However, recent selling pressure, following the flash crash, pushed Solana price briefly below the lower trendline, testing the strength of the bulls around the $175-$180 range.

Currently, Solana is trading near $204.72, showing resilience as it rebounds from the 200-day simple moving average (SMA) ($173), a critical long-term support. This rebound is also accompanied by an attempt to reclaim the 50-day moving average at $217, a level that now acts as short-term resistance.

The Fibonacci retracement places SOL around the 0.382 retracement level ($205), suggesting a potential inflection point where a decisive move could set the tone for the next trend.

SOL technical indicators suggest consolidation ahead of next wave

The relative strength index (RSI) is hovering around 46.47, a neutral zone indicating that neither buyers nor sellers are in complete control. If the RSI were to rise above 50, it would reinforce bullish momentum, while a decline towards 40 could signal a return to downward pressure.

Meanwhile, the Chaikin Money Flow (CMF) indicator is slightly positive at +0.18, suggesting a slight inflow of capital into Solana. This indicates that buying interest remains present even after the recent correction.

Given the bullish signs, the near-term outlook for Solana price leans towards cautious optimism. If SOL price holds above the $190 level and manages to break through the resistance at $217, it could advance towards $223 and possibly retest $253.

Conversely, failure to sustain above $190 could result in a further decline towards $175, or even the 0.618 Fibonacci level at $175.23.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news