- Solana’s social dominance reached record levels during its whale distribution phase

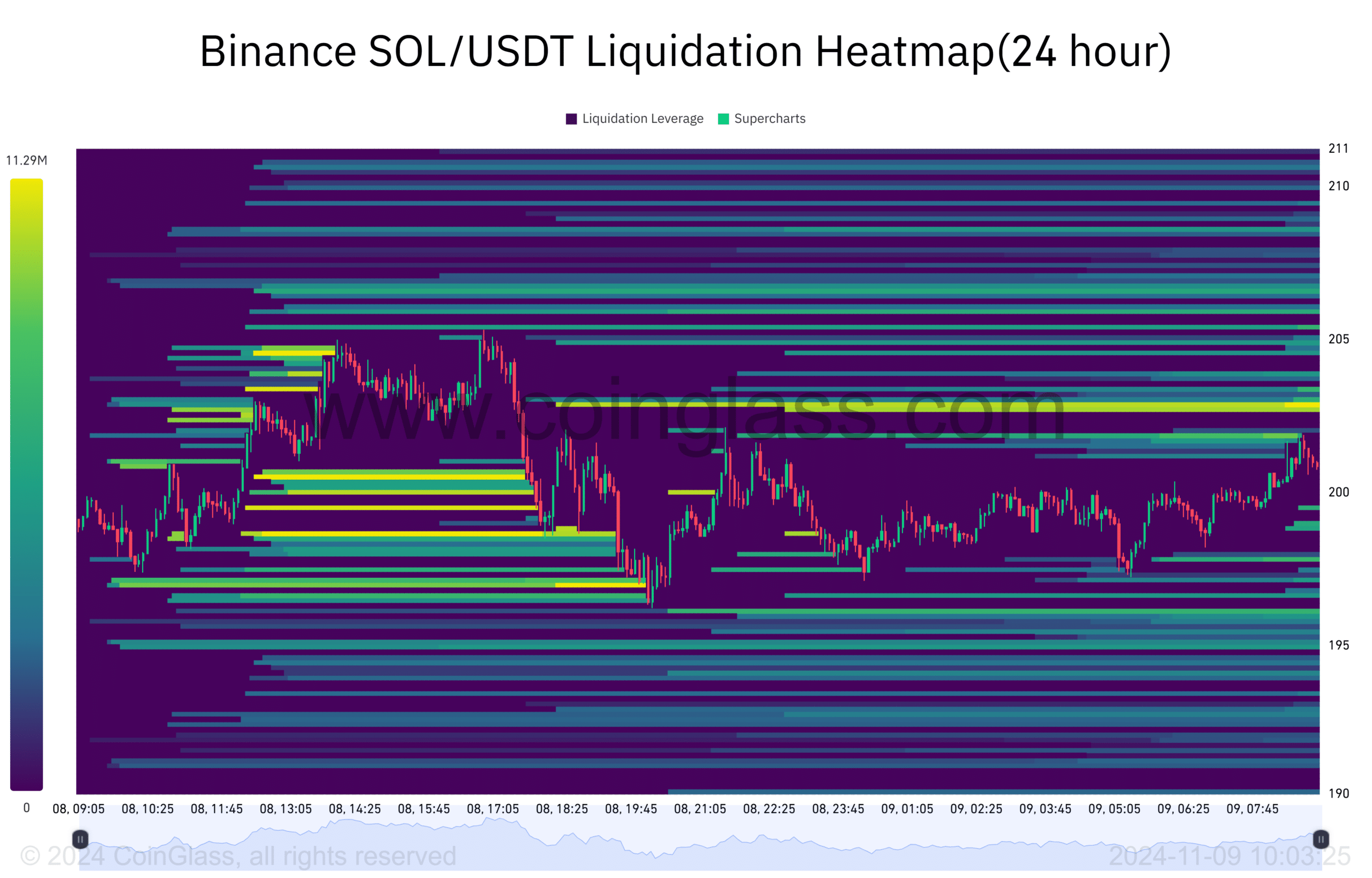

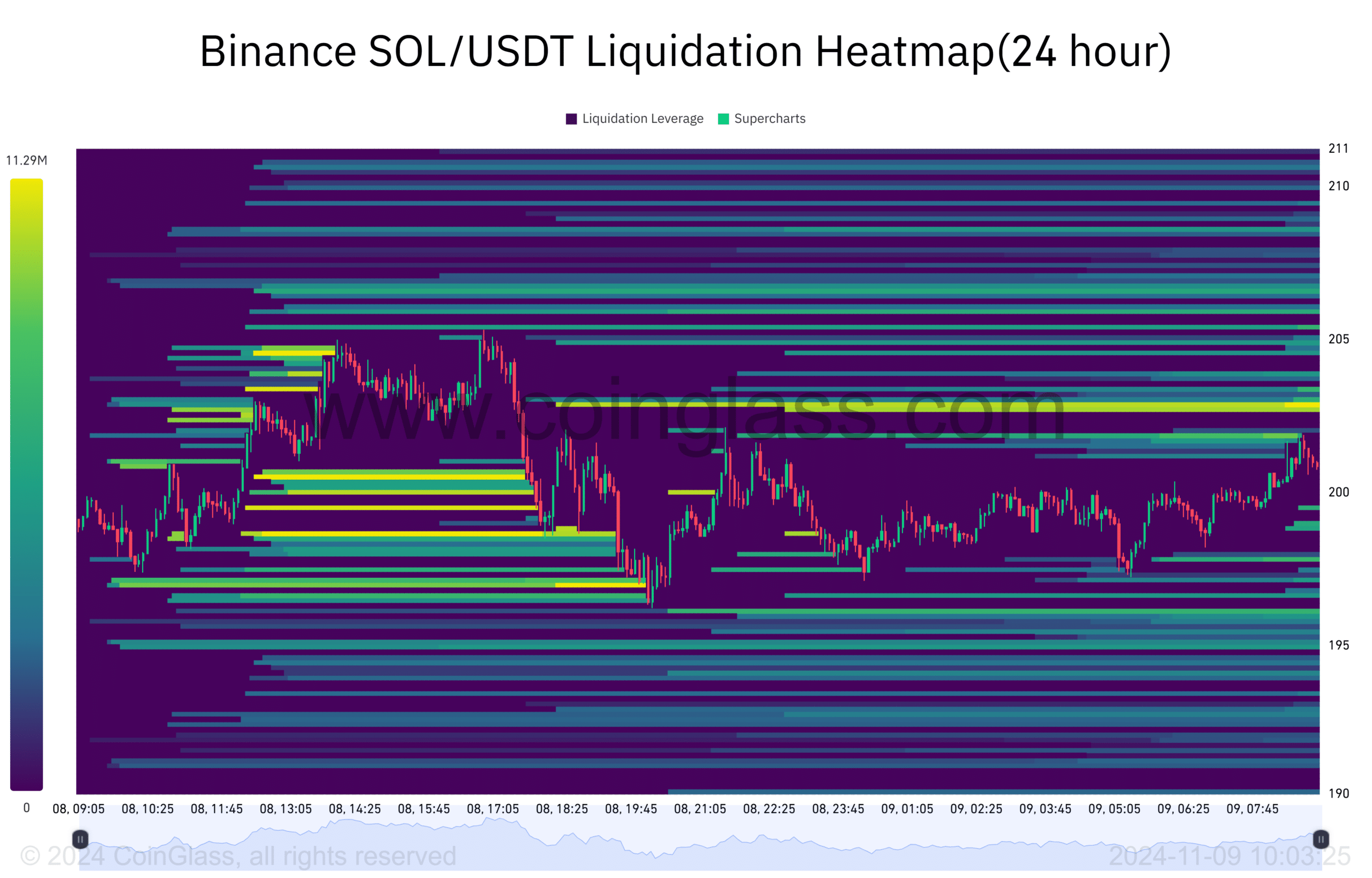

- At press time, its technical setup suggested strong resistance at $205 with significant liquidation events.

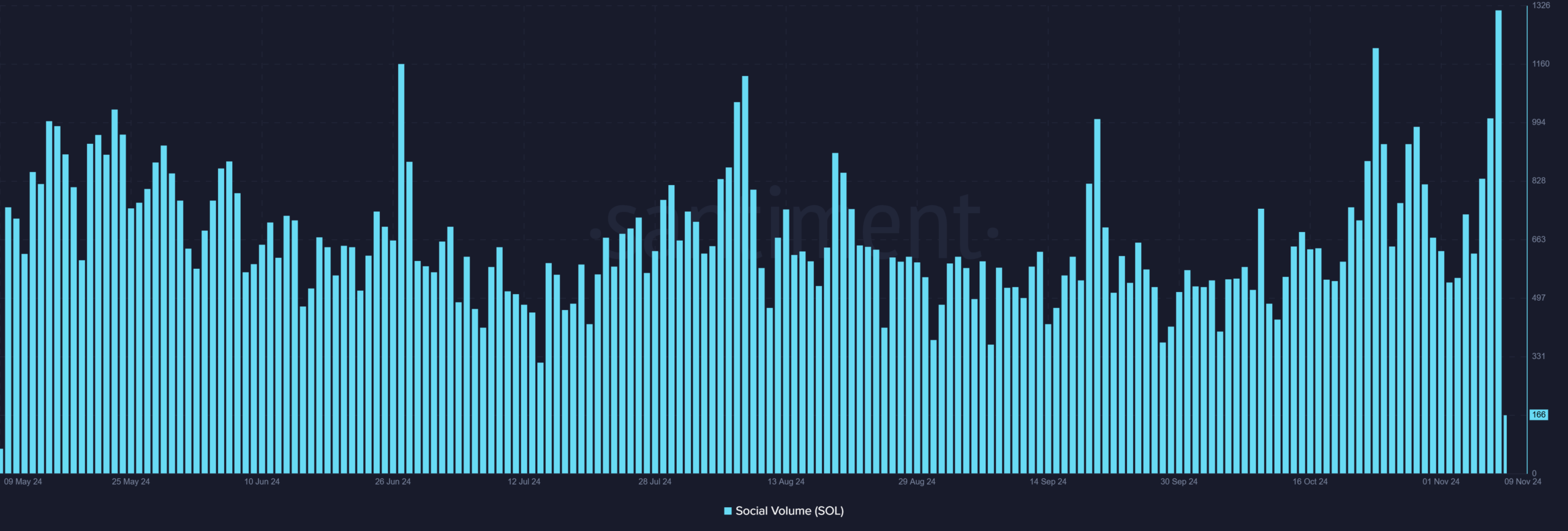

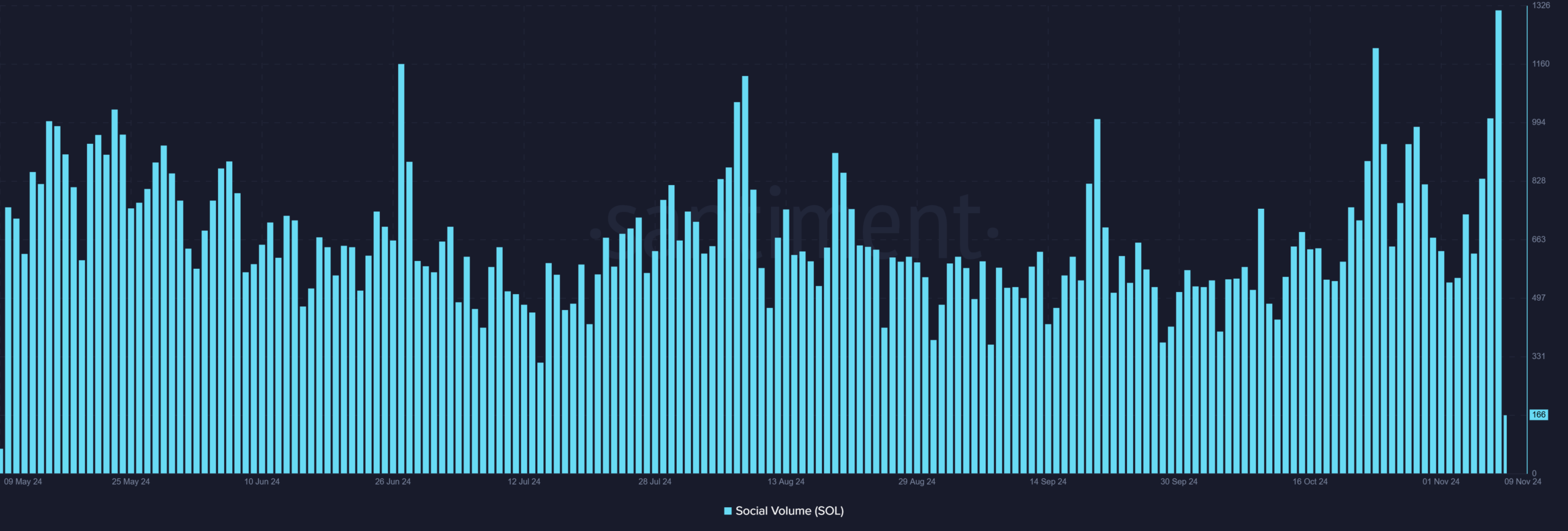

The Solana (SOL) ecosystem is currently experiencing unparalleled social engagement, marking a significant shift in market dynamics.

Source: Santiment

Notably, recent data from Santiment indicated that the altcoin claimed the second position in social trends – a sign of increased market interest and potential price action to come.

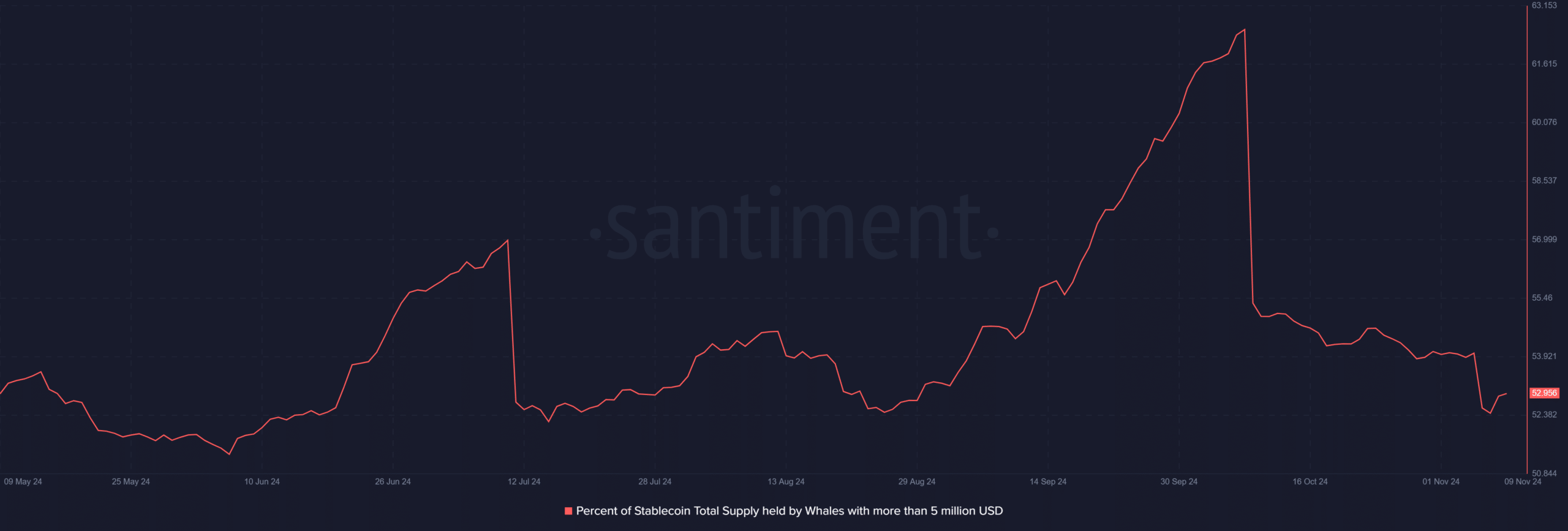

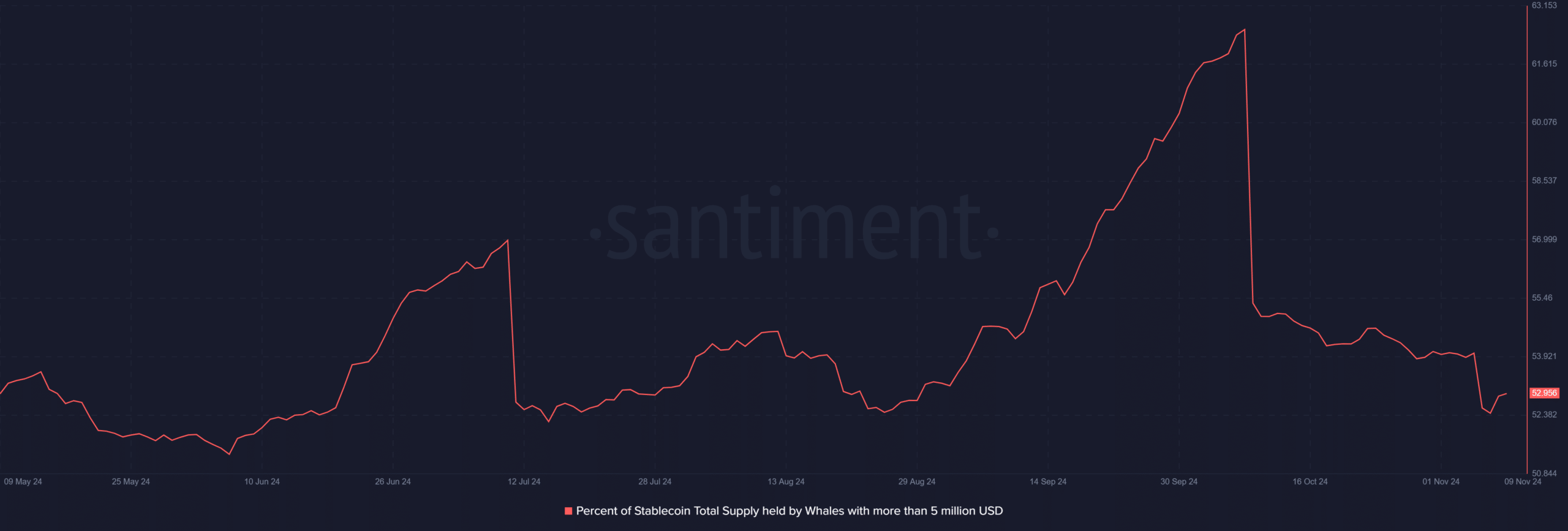

Solana market structure and whale behavior

That’s not all, as the transformation of SOL’s whaling holdings also revealed some interesting market dynamics. Consider this: Large Solana holders have significantly reduced their positions since their October 8 peak.

This phase of SOL distribution, rather than signaling weakness, coincided with broader market participation and increased retailer interest.

Source: Santiment

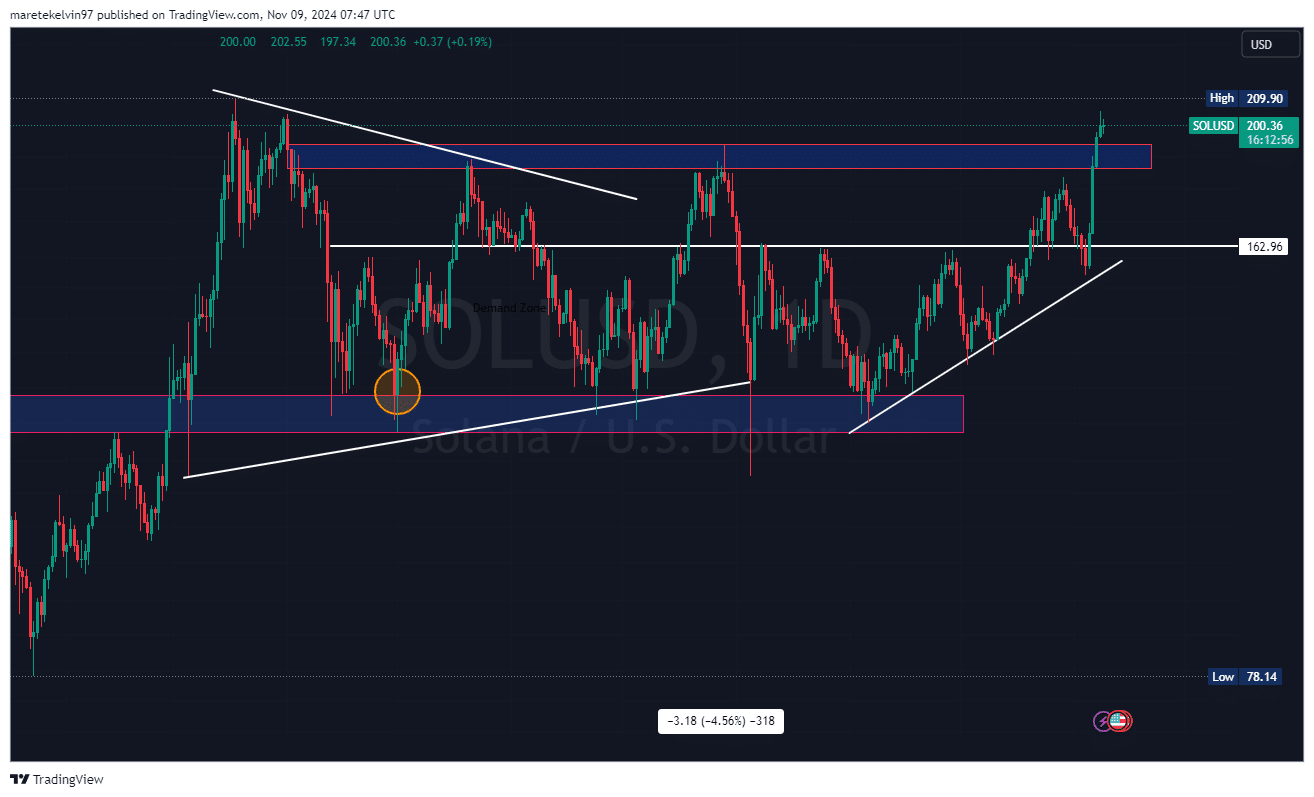

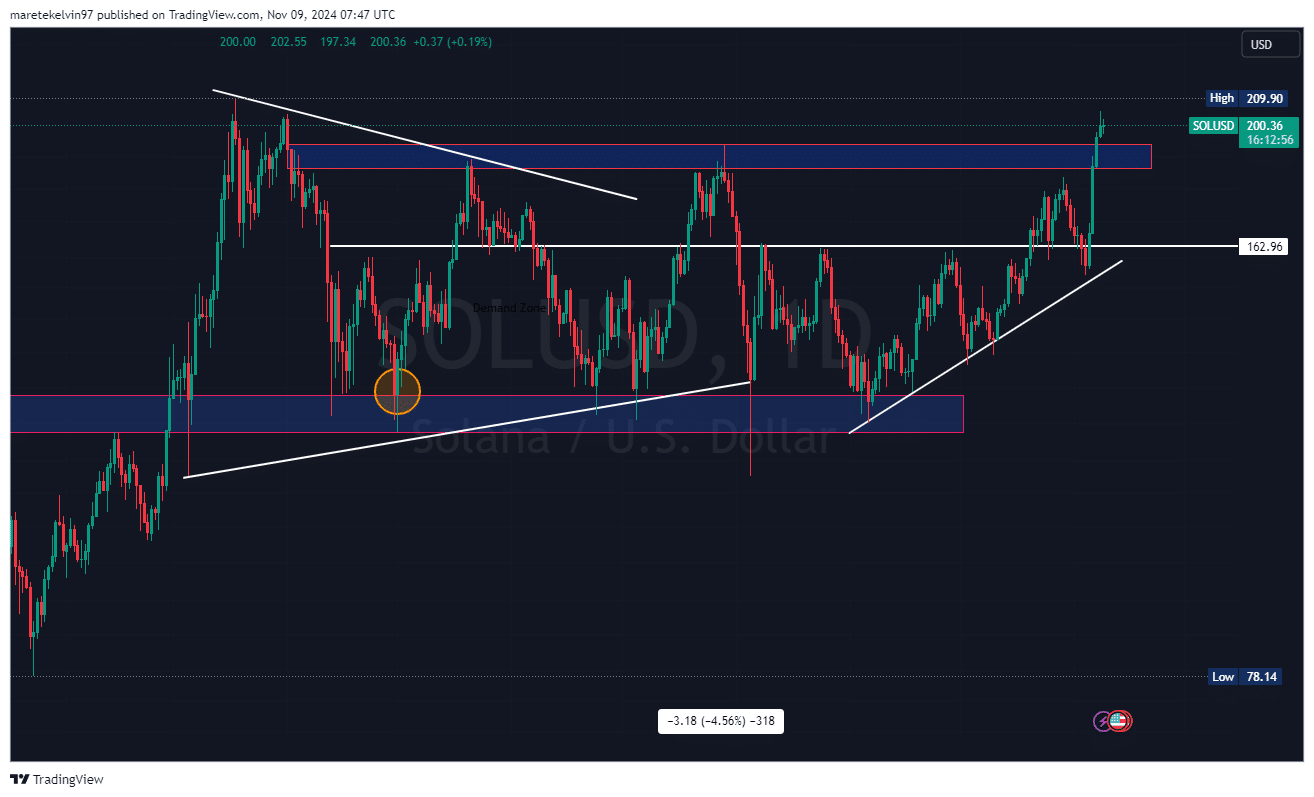

Furthermore, the price action highlighted a clear bullish formation on the daily chart, with resistance around the $205 mark being the only obstacle in the way.

This technical pattern, combined with the liquidation heat map showing over $12 million in potential liquidations between $203 and $205, indicates a critical price zone. This could fuel a significant bull rally.

Source: Coinglass

Social measurements and volume analysis

Here, it is also worth noting that the correlation between social volume and price action presents a compelling narrative.

Solana’s social engagement metrics have reached new all-time highs – a finding that could precede major price movements in the altcoin market.

Its latest rise in social volume appears to differ from previous peaks by showing more consistent growth, rather than sudden surges. Such consistency could encourage investors to take more positions in the altcoin.

Source: Santiment

Technical Outlook and Market Sentiment

Finally, Solana press time market structure indicated a strong ascending trendline support level at around $156. This can be seen as possibly creating a solid foundation for a potential uptrend.

Liquidation heatmap data also revealed a concentrated area of positions, which could fuel a breakout if the $205 resistance is breached.

Source: TradingView

What’s next for Solana?

Although social metrics and technical indicators project a potentially bullish scenario, the market remains sensitive to broader cryptocurrency trends. The distribution of whale ownership has created a more diverse ownership structure, potentially reducing the impact of a single entity on the market.

Therefore, the confluence of high social engagement, strategic whale distribution, and clear technical levels presents a unique market setup.

Whether this combination will propel Solana to new highs largely depends on maintaining its current momentum and successfully converting $205 resistance into support.