Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

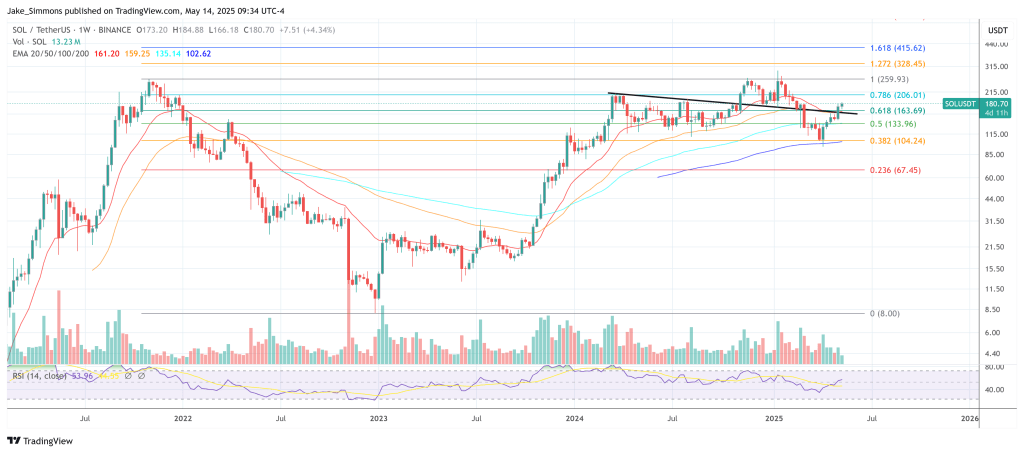

The native token of Solana extends an impressive May course which has already transported the market leader among the platforms of intelligent contract Non EVM from $ 146 at the end of April to $ 18 in negotiations on Wednesday, the highest daily fence recorded since mid-February.

In this context, the independent analyst More Crypto Online (MCO) has published a new video update explaining why the move is technically “very complete but not necessarily too extensive or over-extent”. In the clip, the MCO reiterates that the advance of the decrease in the swing of April 30 traces “a reason of five waves” and stresses that, because “there was no high confirmed, one more high was always probably especially as long as this micro-support area.” The micro-zone he referenced earlier in the week was between $ 159.67 and $ 168.23, a Solana range was briefly tested before feeding.

Solana could reach $ 360

The front zoom, the number of elliott waves of the chain now shows five clean waves even on what MCO calls “the nano level”, a configuration which, in the theory of conventional waves, generally ends a first impulsive wave or the ending leg of a diagonal.

“If it is a five wave movement, it can be a so-called wave,” explains the analyst, which “would cause a B wave, ideally lower, then a C”. The alternative – and MCO’s favorite scenario – treats the structure as the spell 1 of a much larger impulse which could ultimately “reach easily $ 360 or more”.

Related reading

For merchants trying to calibrate short -term risks, MCO isolates the most two numbers that count the most. On the rise, it appoints $ 191.25 as “the next level up to watch”, describing it as the extension of 61.8% of waves 1 and 3 – a target of manual fibonacci for a fifth wave.

Un decrease, he warns that “it takes a break below $ 172, which is the last low swing, to indicate that a price summit was formed in wave 1.” In a monitoring article on X, he said it even more succinctly: “The 5th upward wave is confirmed. $ 191.25 is the next level up to watch… you need a break below $ 172… to indicate that a price is formed. ”

Related reading

A clean and high -volume rupture of $ 191.25 would confirm that the immediate correct risk was deferred; A decisive daily closure under $ 172 would rather point out that the first step in the new advance has exhausted and that a retraction towards the upper $ 160 or even the $ 150 midfielder is in progress.

As always, traders must remember that Elliott water projections are probabilistic rather than predictive. With the volatility historically high in Solana, the dimensioning of the position – alongside a clear plan for the two technical levels distinguished in today’s analysis – is the first line of defense.

At the time of the press, Sol exchanged $ 180.

Star image created with dall.e, tradingView.com graphic