Key notes

- Solana Price Rally could remain intact with daily negotiation volumes that drop to $ 6 billion.

- Recently approved Alpenglow’s upgrading aims to improve consensual efficiency and reduce the end times to 150 milliseconds.

- The chances of the approval of Solana ETF Solana increased 99% on Polymarket, which could potentially lead to strong institutional entries.

Despite Solana

GROUND

$ 205.0

24h volatility:

2.9%

COURTIC CAPESSION:

$ 110.87 B

Flight. 24 hours:

$ 4.81 B

The price showing a force with 23% on the rise in last month, the recent gathering was interrupted because the Altcoin does not reach $ 210.

However, the bullish account remains intact, daily trading volumes remaining about $ 6.0 billion.

Solana Price Action to come

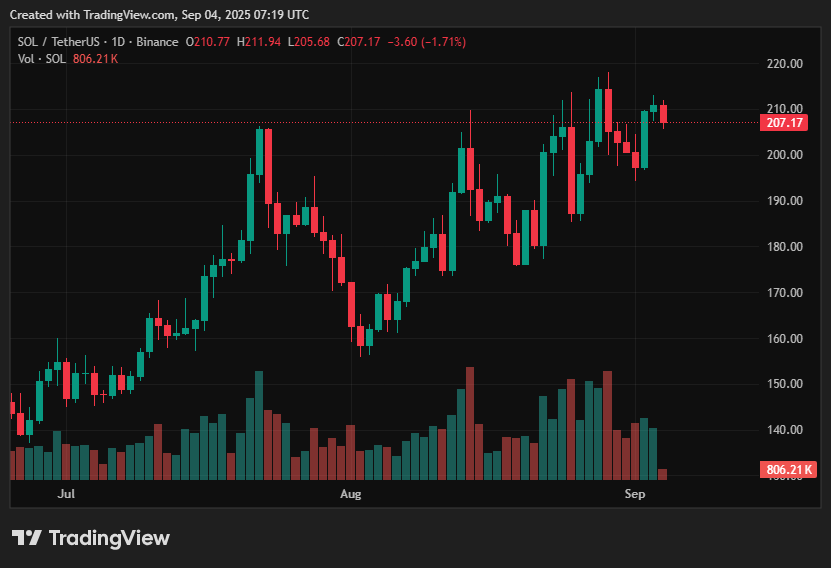

Solana Price is negotiated at $ 206.8, with an intraday movement between $ 206.2 and $ 212.4. The price continues to follow a higher upper bottom scheme, with $ 19 $ at $ 200 acting as a key support area.

Uplining, the range of $ 215 to $ 220 remains a major level of resistance. An escape above this area could pave the way at $ 236 at $ 252, and with a high volume of negotiation, some analysts of analysts project up to $ 260.

Solana Price Eyes Breakout above $ 215. | Source: tradingView

A large part of the upward perspectives depends on the successful deployment of Alpenglow, which should offer a close block purpose and improved scalability.

These two characteristics are considered essential for broader adoption and growth of ecosystems.

The recently approved upgrade uses technologies such as rotor and votor to improve consensual efficiency. It also reduces the end times to around 150 milliseconds, improving network performance, suitable for Rwas and Defi.

On the other hand, if Solana Price does not hold the support of the range from $ 206 to $ 200, it could decrease around 190 to $ 186, with a new additional drop extending to $ 180.

Optimism Solana ETF increases again

Optimism surrounding the approval of the Solana ETF spot was increasing. Solana currently has ETF spots and guarantees in examination.

The SEC has requested updated S-1 deposits, which indicates that the process is in its last step, with the expected approval from October and a probability of 90%.

According to Polymarket, the chances of Solana ETF approval reached a huge 99%.

Approval could possibly lead to strong institutional entries in Solana, which increased the soil price.

Solana’s approval ratings increased by 99%. Source: Polymarket

On the other hand, the cryptographic investment company of Mike Novogratz, Galaxy Digital, has become the first company listed on the stock market in Tokensize its equity recorded on the dry on a large blockchain.

In a collaboration with the company Fintech Superstate, the ordinary actions of class A of Galaxy can now be tokenized and maintained on Solana’s blockchain.

This is an important step towards the integration of traditional actions into blockchain technology.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Bhushan is a fintech enthusiast and has a good flair in understanding the financial markets. Its interest in the economy and finance draws its attention to the new technology of emerging blockchain and the markets of cryptocurrencies. He is permanently in a learning process and motivates himself to share his acquired knowledge. In free time, he reads fiction novels to thriller and sometimes explores his culinary skills.