Key notes

- Solana Price exceeds $ 210 on Sunday, August 24, reaching its highest level since February, while other major cryptocurrencies found themselves during the weekend.

- The chain data confirms that Solana exceeded Ethereum in the DEX negotiation volumes for 10 consecutive months, exceeding $ 124 billion in July.

- Ver holes’ bridge flows reveal a persistent soil transfers demand, emphasizing the internal catalysts active behind the solara rally.

After crossing the bar of $ 210 on Friday for the first time since February, Solana Price progressed during the weekend. While macro-piloted gatherings have cooled elsewhere, with Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) finding itself considerably, the momentum of the Solana increase has persisted. At the time of the press, Solana Price marked a new intrajournal peak of $ 211, its highest since February 12.

The chain activity shows that the Haussier Catalyst of Solana extends beyond the speculation of the Federal Reserve Cup, which triggered significant market rallies on Friday.

This week in data by @Solanafloor::

Solana exceeded Ethereum in the DEX negotiation volume for the 10th consecutive month, reaching 124 billion dollars in July, 42% higher than Ethereum. pic.twitter.com/tt0nb8wrtm

– Solana (@Solana) August 23, 2025

According to data shared by the contributor to the Solanafloor community, Solana has now exceeded Ethereum in decentralized exchange transaction volumes (DEX) for 10 consecutive months. In July alone, Solana treated $ 124 billion in Dex transactions, exceeding Ethereum by 42%.

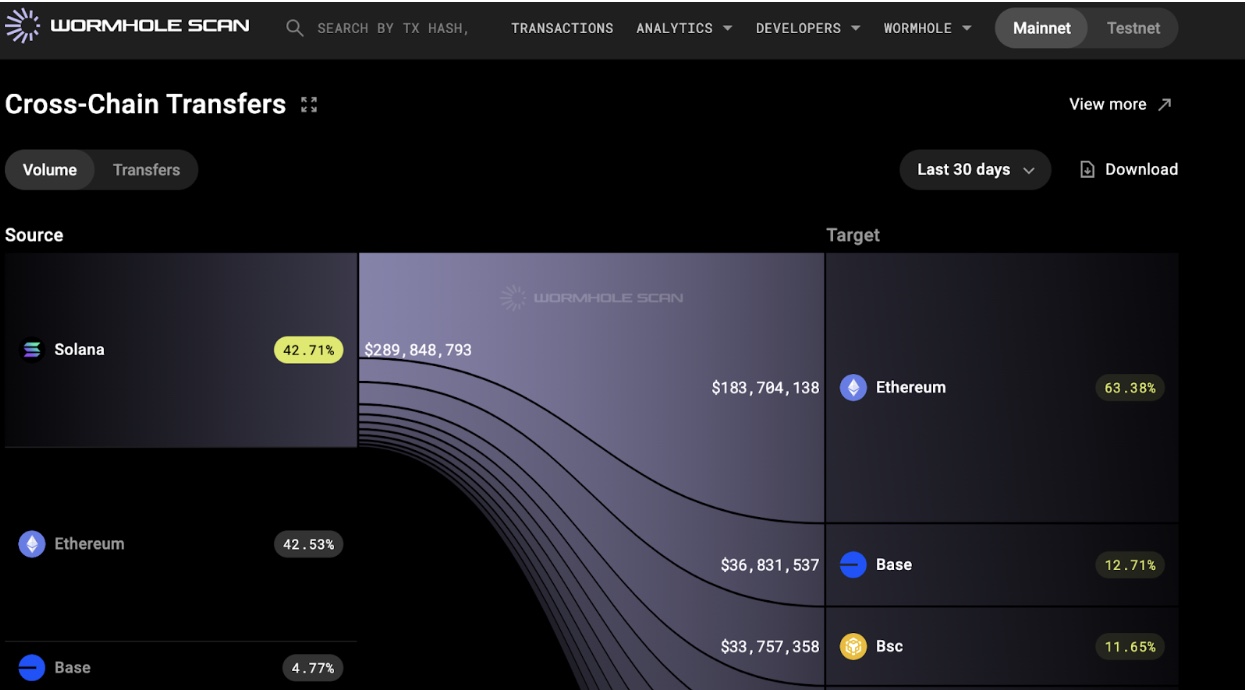

Wormhole Bridge’s latest data also show why this trend can maintain. Solana represented 42.71% of all chain transfers, by little 42.53% of Ethereum.

Solana Cross Chain transfers in the last 30 days | Source: Wormhole, August 24

In addition, Solana attracted more than $ 222 million in entries, while Ethereum only obtained $ 183 million in Solana entries in the last 30 days. This suggests that Solana becomes the most attractive liquidity center, moving away from Ethereum’s capital and the encroachment of the DEFI market share.

In summary, Solana’s advantage in the DEX volumes, combined with the increase in point trading volumes, signal that the soil demand in DEFI transactions continues to propel prices, even if a speculative moment cooled in other main cryptocurrency markets during the weekend.

Solana price forecasts: Can Sol can be maintained above $ 200?

Solana’s prices action is consolidated above the $ 205 area after last week rupture. The daily graph shows that buyers firmly defend this threshold, the SMA from 20 days to $ 191 acting as a reliable short -term support.

The MacD indicator is up to the height, with the printing histogram of the green movement bars, while the mobile averages remain in bullish alignment. This validates the break up of $ 200 and suggests a range for new gains if the momentum persists.

Solana price forecasts | Tradingview

Uplining, the immediate objective is at $ 215, where the resistance of the March of March could emerge. A movement specific to $ 215 could open the door at $ 228 and finally $ 240. For the bullish momentum to remain intact, Solana must maintain more than $ 200 on closing times.

Conversely, if the ground price slides below $ 200, sellers can try to bring soil back to a support of $ 191. Ventilation there could trigger a deeper withdrawal to the $ 179 request zone. Losing this level could invalidate the wider optimistic trend and put $ 158.

Solana Price Action will probably continue on the bull’s bull’s hand as long as the $ 200 support keeps. However, it remains to be seen if the low market momentum will limit the demand for DEFI transactions in the coming week.

The best presale of presale exceeds $ 15 while Solana wins the market share of

Solana’s overvoltage in the DEFI activity has also drawn the attention of investors to secure multi-chained solutions like Best Wallet (BEST).

Best portfolio presale

The project has already collected more than $ 15 million in presale, offering users low transaction costs, attractive implementation yields and priority access to decentralized applications. Designed with multi-chaînes compatibility, the best portfolio is positioned as an essential choice for traders who sail between ecosystems like Solana and Ethereum.

The moment of the presale indicates the increase in demand from users priority both the safety of assets and the performance opportunities. With reduced entry levels still available before the next price increase, investors have a window to secure the best tokens early via the official website for the best portfolio.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn