Key notes

- The network’s transaction speed has only decreased by 13% while the price fell by 20%, which indicates that strong fundamental demand remains intact.

- The technical indicators show a bullish reversal above the support of $ 136 with MacD reversing the positive and parabolic SAR becoming bull.

- Solana same as Snorter Bot is gaining traction while traders are looking for alpha opportunities during current price consolidation.

Solana Price opened its doors below $ 135 on Monday, June 23, down 20% compared to the monthly peak of the deadline recorded on June 12. Despite the lively removal, the main metrics for using techniques and the network show increasing signs of a local rebound forming.

Solana holds the strength of the network despite a decline of 20%

Solara

GROUND

$ 144.4

24h volatility:

7.6%

COURTIC CAPESSION:

$ 76.63 B

Flight. 24 hours:

$ 7.16 B

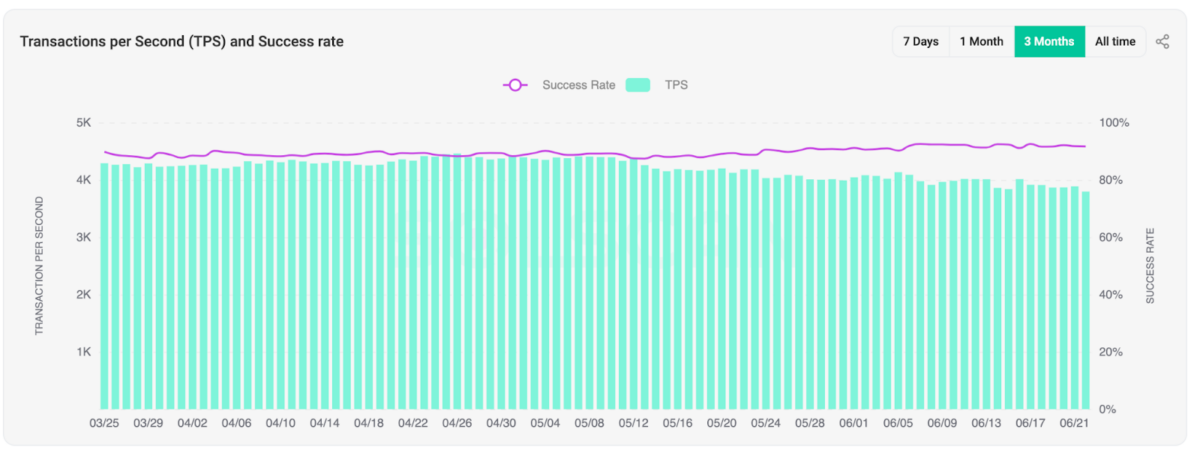

The price fell briefly at $ 130 this week, but the network transaction rate remained stable. Data on the Solscan chain show that Solana currently processes 3,796 transactions per second (TPS), only a decrease of 13% compared to its peak of June 12 of 4,370 TP.

Solana transactions per second | June 2025 | Source: Solscan.io

These data indicate a strong underlying demand for block space on the Solana network, even if prices dropped by $ 163 at the start of the current decline on June 12, reaching $ 133 on Monday, June 23. When such differences between prices and network activity occur, it often signals an undervaluation. With the levels of use always healthy and the ground token occurring compared to its fundamental network principles, a rebound towards fair value could materialize if the feeling of the market is stabilized.

Solana price prediction: Haussier reversal in play above $ 136

On the 4-hour table, Solana Price recovered land above the $ 136 mark, where the parabolic group SAR and Bollinger Midline converges. The parabolic points have overturned the current candlesticks, which suggests that a short -term bullish overthrow is underway.

Solana price forecasts | Tradingview

The parabolic SAR is a technical indicator showing potential trend reversals through points positioned above or below price candles, while Bollinger strips consist of three lines – an average mobile average with higher and lower strips that develop and contract according to price volatility, helping to identify excessive or occurring conditions when the price.

In addition, MacD overturned optimistic, the signal line starting to converge up, another indicator that short -term feeling can move. If soil will maintain this momentum and close above the psychological level of $ 140, the bulls can push towards the Bollinger’s upper strip at $ 147, with a target extended almost $ 155 if the feeling of macro aligns.

Conversely, not holding more than $ 136 could see a remedy of $ 130, which acted as a solid request zone this weekend.

Snorter Bot ($ Snort) takes momentum while Solana Memecoins warms up

While Solana Price finds the sole, the attention of investors turns to Solana based in Solana with solid utility. A winning project of the field is Snorter Bot, an intelligence tool Solana from a native telegram propelled by the $ Snort token.

Snorter Bot runs through the Solana Mecoin markets to discover the tendency tokens before they pump. It offers ultra-basic costs, flamboyant transaction speeds and risk protection before and MEV, all operating natively on Solana’s rapid infrastructure.

With the meter currency cycle heating again and resolving at attractive levels, Snorter Bot positions $ Snort as the next Solana escape. Merchants looking for alpha beyond the graphics are increasingly turning to tools like snorter boot to stay ahead.

To reach the presale $ Snort, visit the official Snorter Bot or the telegram channel and connect your wallet.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but must not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn