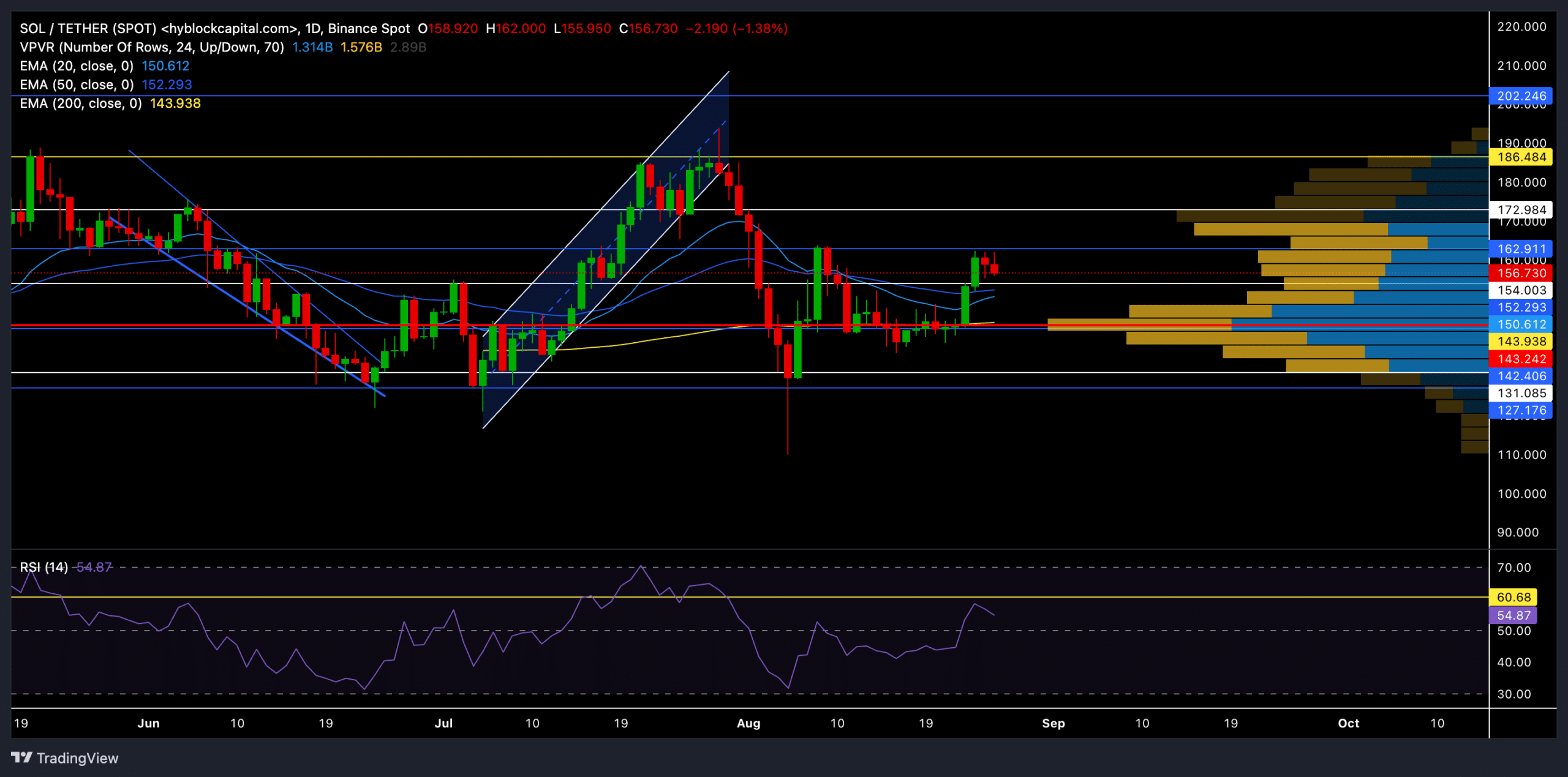

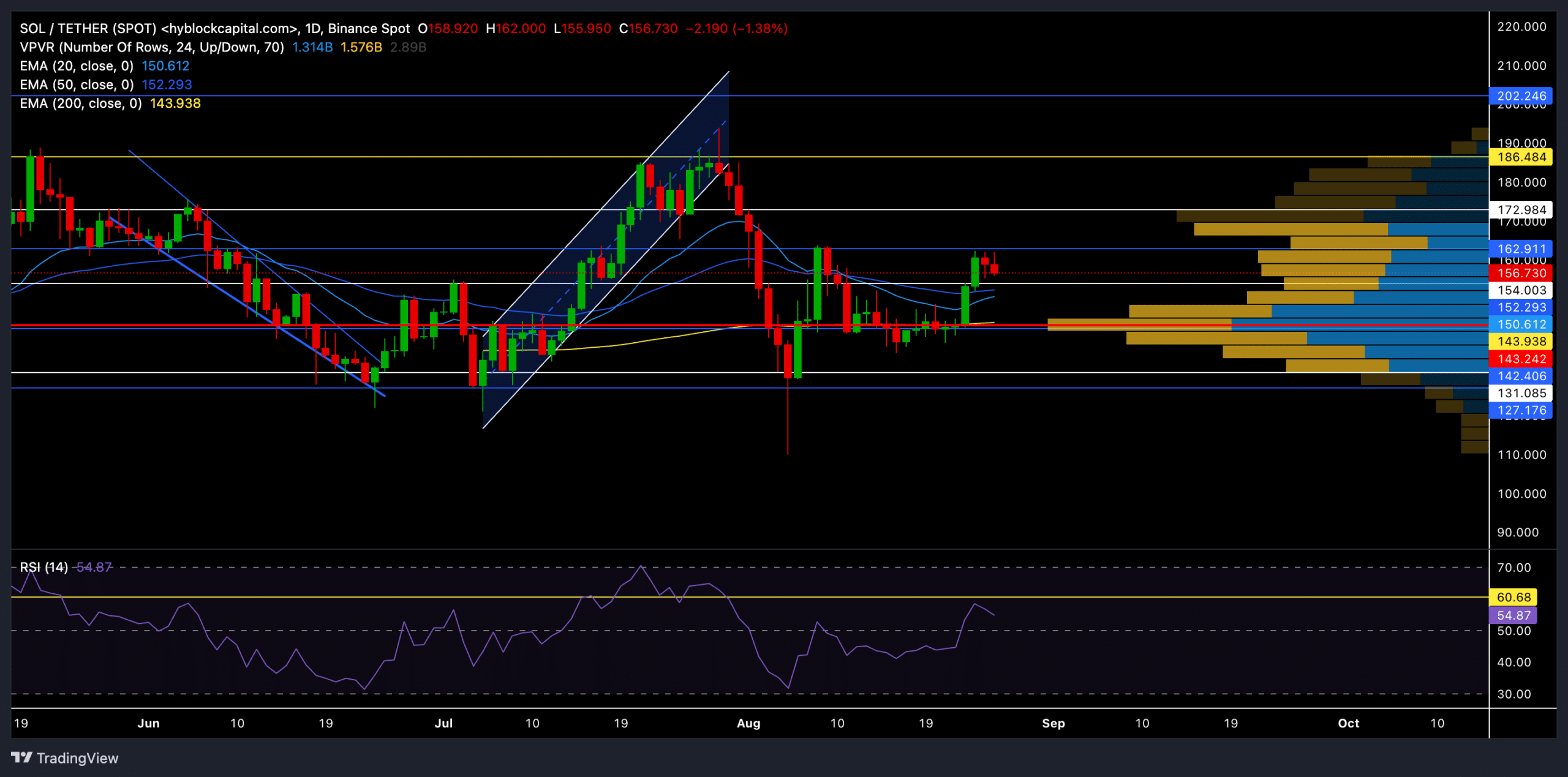

- Recent price action suggests that bulls have taken control, but strong resistance at $162 could prevent an immediate rally.

- Traders should closely monitor the $162 resistance, as a break above this level could signal a stronger recovery.

Solana (SOL) has recently been on a decline after witnessing a classic ascending channel breakout and falling below critical support levels as bearish momentum took over. The question is whether the bulls can regain control or if further decline is imminent.

Solana bulls are back in the market

Source: TradingView, SOL/USDT

SOL came under bearish pressure in early August after failing to hold above the crucial $172 level. Currently trading at around $156.7, SOL has fallen by nearly 1.26% over the past 24 hours.

After bouncing from the $142.15 support level on August 6, SOL managed to register a 20% gain in just over three weeks. However, this bullish momentum was short-lived as the price encountered resistance at $162, a level that bulls have struggled to overcome this month.

Nevertheless, the price reclaimed some crucial support levels and hovered above the 20-day, 50-day and 200-day EMAs at the time of writing.

It is worth noting that there was a slight bearish pressure as the altcoin reversed from the $162 resistance and the price hovered in an area that could see more volatility.

At press time, the RSI was above the 50 mark, indicating a slight uptrend. However, buyers should look for a potential close above the RSI resistance point at 60 to gauge the chances of a rally in the coming days.

Key levels to watch

The immediate support level to watch is near the $150 mark (20-day EMA). If SOL manages to hold above this level, it could attempt to retest the $172 resistance zone in the coming days.

However, if the bears continue to exert pressure and SOL falls below $150, it could retest the Point of Control (red) level of the VPVR indicator near the $143 level.

While overall volume increased by 13% to $6.73 billion over the past day, open interest increased by 3.15% to $2.43 billion. This suggests that traders are still actively participating, but sentiment is leaning towards the bearish side.

Source: Coinglass

The long/short ratio over the past 24 hours was 0.9249, indicating a slight bearish sentiment among traders.

Is Your Portfolio Green? Check Out the Solana Profit Calculator

However, on Binance, the SOL/USDT long/short ratio was bullish at 1.7917, showing that a significant portion of traders were still optimistic.

Buyers should also keep an eye on Bitcoin sentiment and other macroeconomic factors that could impact SOL price action in the coming weeks.