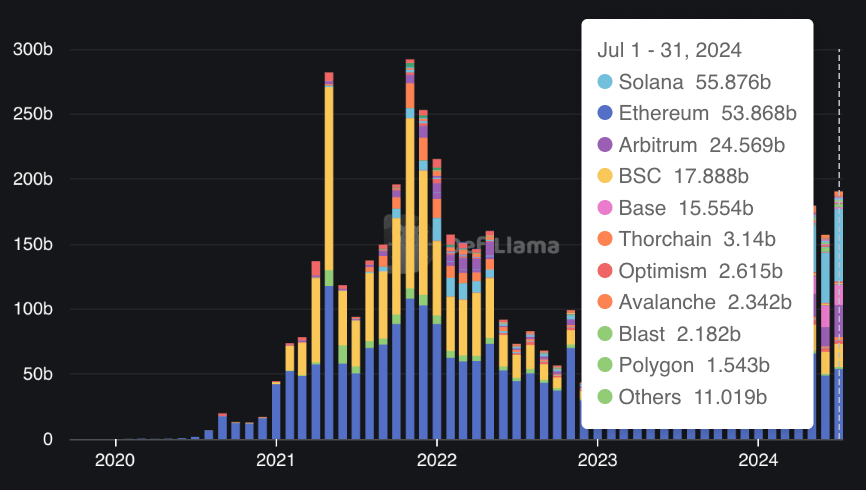

According to data from DefiLlama, the Solana network surpassed Ethereum in terms of monthly decentralized exchange (DEX) volume in July.

Solana’s DEX transactions reached $55.8 billion, surpassing Ethereum’s $53.8 billion for the same period. This marks Solana’s second-highest monthly volume, after its March 2024 peak of $60.7 billion.

Solana’s volume spike is primarily driven by activity on platforms like Raydium, Orca, and Phoenix. In contrast, Ethereum’s volume is primarily driven by the Uniswap exchange.

Despite these numbers, Ethereum remains the leading DeFi platform, holding around 61% of the market and locking $67 billion in assets. In comparison, Solana only controls 4.64% of the market, with a total value locked (TVL) of $5.16 billion.

What’s driving Solana’s growth?

Analysts point to increased memecoin activity as one of the main drivers behind Solana’s DEX volume increase.

Over the past year, the blockchain has seen significant growth in various memecoins, from cat-themed tokens to politically inspired tokens. This has led to an increase in liquidity as traders look to capitalize on these assets.

Institutional backing has also fueled interest in Solana, and speculation about a potential Solana exchange-traded fund (ETF) may have contributed to its growth. In June, asset management firms VanEck and 21Shares filed an application with the U.S. Securities and Exchange Commission (SEC) to create a spot-market-based Solana ETF.

Additionally, market analysts have noted increased usage of stablecoins on Solana. Data from Allium on Visa’s stablecoin dashboard shows that trading volume for the USDC stablecoin on Solana has surpassed $8 trillion since the beginning of last year, followed by USDT on the Tron blockchain with $6.5 trillion.

Concerns about wash trading

Meanwhile, the recent rise of Solana DEX exchanges has raised concerns about potential wash trading. A recent report from pseudonymous crypto analyst Flip Research claims that 93% of transactions on the blockchain are inorganic.

The report states that Solana’s daily trading is heavily influenced by wash trading, MEV bots, and scams, which offer minimal value to retail traders. Flip Research noted:

“Looking at the affected wallets, the vast majority appear to be bots in the same network with tens of thousands of transactions. They generate fake volumes independently, with random amounts of SOL and a random number of transactions until the project fails, before moving on to the next one.”