- South Korea could follow the example of Japan on Bitcoin FNB.

- The Asia BTC ETF race is expected to warm up as Japan’s eyes in the second half of 2025.

South Korea can jump on the Bitcoin (BTC) ETF Bandwagon according to a softer position of Japan on cryptocurrency.

According to a report by the South Korean publisher Maeil Business Newspaper, Seoul could approve BTC ETFs if Tokyo Greenlight les.

The media indicated that the South Korea regulator, the financial supervision service (FSS), monitored the trends in virtual assets in Japan and noted its opening to the Crypto ETF.

In addition, the report indicates that the current discussion of Japan on virtual assets will be made in the first half of 2025, and that the legislation will be carried out in the second half. By 2026, the National Assembly of Japan will be ready to vote for the frame.

Bitcoin ETF: Will South Korea follow Japan?

Japan’s intention is crucial because the South Korean authorities hesitated to products, citing Japan and the Soul of the United Kingdom. In February, Kim So Young, vice-president of the FSS of South Korea, said,

“I will come back carefully (Bitcoin Spot ETF), and it is always similar in a large context … There are countries that have not yet introduced them, there is the United Kingdom or Japan.”

It remains to be seen how Seoul in Japan’s decision. However, several jurisdictions have become open to FNB BTC since the United States approved products last year.

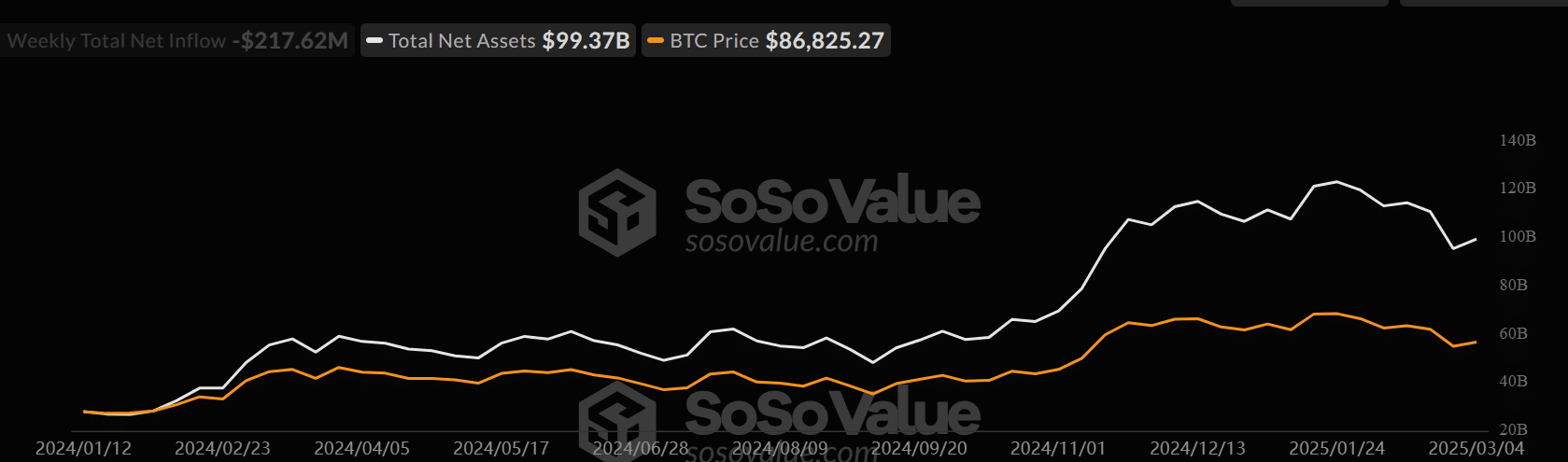

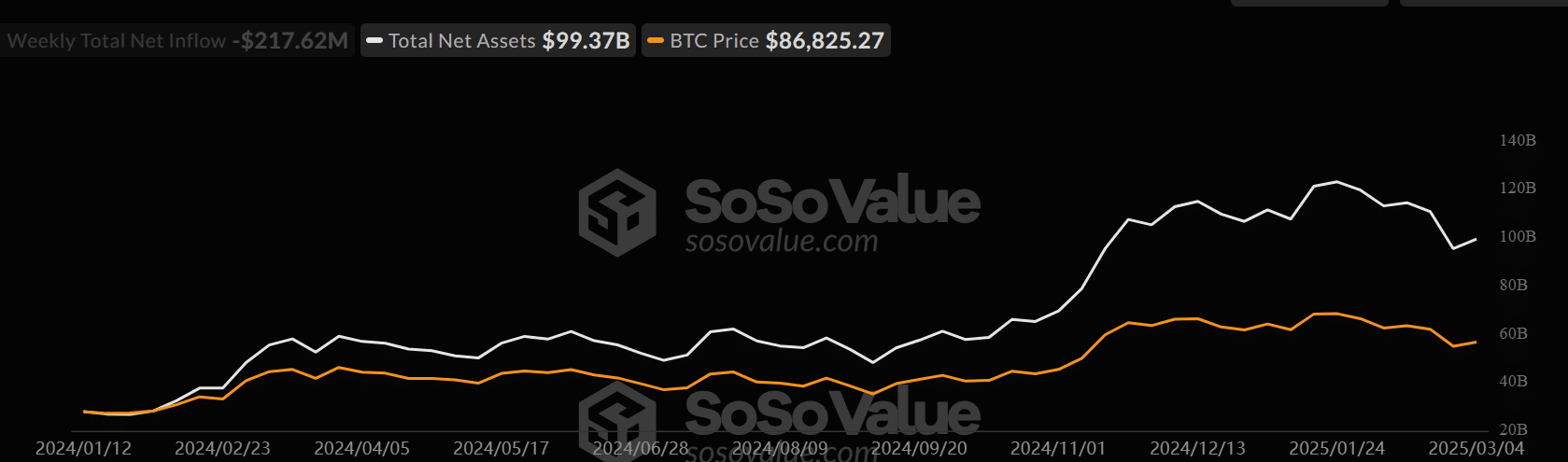

This facilitated the purchase or sale of BTC via traditional stock markets. In fact, the FNB BTC Spot US now have $ 100 billion in management assets (AUM).

Source: Soso value

Hong Kong followed the United States, Greenlight products last April and now has $ 354 million in Aum.

BTC increased from $ 40,000 to $ 70,000 with stock market integration, then exceeded $ 100,000 due to the “Trump trade”.

State Street predicted Crypto ETF Aum could go beyond precious metals and Aum by the end of 2025, reflecting the growing confidence of the market.

In the ETF 2025 perspectives reportRobert Mitchnick de Blackrock, Robert Mitchnick, said that the American budget debt and the adoption of the BTC nation state as an alternative reserve ratio could stimulate the value of the cryptocurrency.

“An increasing accent on the challenges of the debt and the American deficit has the potential to serve as a catalyst for the adoption of Bitcoin, while the possibility of longer interest rate represents a wind from face to potential prices.”