Bitcoin (BTC) is holding firmly above the $110,000 level after a volatile week defined by macroeconomic catalysts and lingering market stress following the October 10 selloff shock. The US Federal Reserve cut rates by 25 basis points and confirmed that quantitative tightening would officially end on December 1, signaling a significant shift towards a more favorable liquidity environment as the end of the year approaches.

While markets initially responded with volatility, Bitcoin showed resilience, stabilizing above a key price zone that traders are watching closely for signs of renewed momentum.

Sentiment remains cautious but constructive as the market continues to digest the aftermath of the October crash – the largest forced selling event in crypto history. Although leverage has been significantly reduced, flows are gradually returning to spot markets and the price structure is showing first signs of rebuilding.

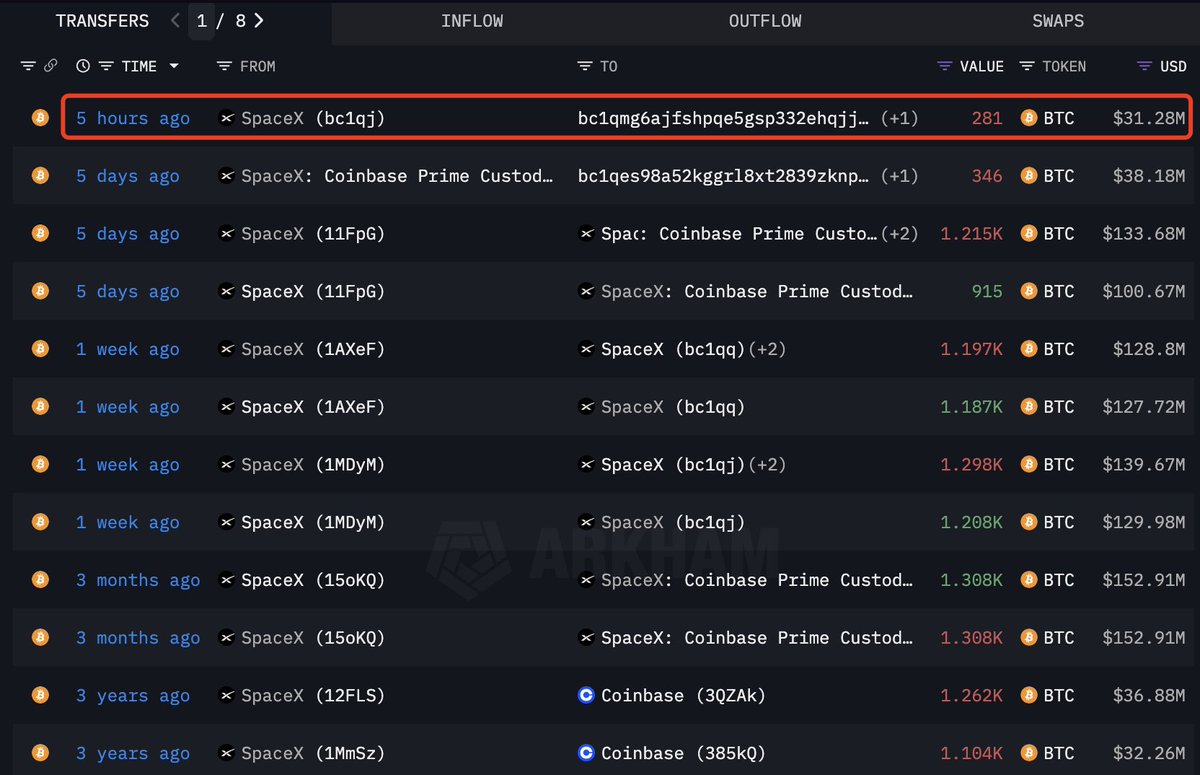

In addition to on-chain activity, new data from Lookonchain shows that SpaceX recently transferred 281 BTC (worth approximately $31.28 million) to a new wallet, marking another move of Bitcoin held by the company – likely for custody or cash management purposes.

With macroeconomic conditions changing and on-chain players repositioning, investors are closely watching whether Bitcoin can maintain its position and regain higher levels in the coming sessions.

SpaceX Bitcoin Transfers Spark Institutional Speculation as Analysts Turn Bullish

According to on-chain data shared by Lookonchain, SpaceX has moved its Bitcoin holdings three times in the last 10 days, including a recent transfer of 281 BTC. Although the movements appear to be related to custody rather than foreign exchange deposits, the frequency and scale of these transactions have fueled speculation in the market.

Some traders interpret this activity as an internal portfolio restructuring, while others see it as part of a broader trend of institutional repositioning ahead of what many believe is a phase of liquidity-driven market expansion.

These measures come at a time when macroeconomic conditions appear increasingly favorable for Bitcoin. With the Federal Reserve cutting rates and the end of quantitative tightening, capital conditions are moving toward accommodative conditions for the first time since the tightening cycle began. This pivot reinforced the bullish narrative that Bitcoin could enter a new global liquidity regime where institutional demand is accelerating.

Several analysts say BTC is now in one of the most favorable macroeconomic environments since early 2020, with long-term holders gradually distributing supply and spot markets showing strong participation.

The October 10 crash forced the elimination of excess debt from the system, thereby resetting positioning while preserving structural demand. This combination – cleaner market structure, improved liquidity and stable institutional activity – forms the basis of the current bullish thesis. Analysts point out that companies and large funds tend to make strategic adjustments before major trend changes become evident.

While short-term volatility remains possible, repeated moves in corporate-controlled BTC, like that of SpaceX, add to the growing sense that deep-pocketed players are gearing up for the next phase of the cycle. If Bitcoin can maintain its position above key technical levels and liquidity continues to flow into the spot markets, many believe a significant upside expansion could unfold faster than market participants expect.

Bitcoin holds above the 200-day MA as price consolidates below key resistance

Bitcoin (BTC) is currently trading near $110,200, defending a critical support zone after another rejection from the $117,500 resistance zone. The daily chart shows that BTC is struggling to maintain momentum above the 50-day (blue) and 100-day (green) moving averages, suggesting that short-term sellers are still active around the $110,000 region.

Despite this, price continues to hold above the 200-day moving average (red), a key long-term trend indicator that reinforces the broader bullish structure of the market.

The liquidation event on October 10 created a sharp decline in the $104,000-$106,000 range, and since then, Bitcoin has formed a lower structure, signaling a gradual stabilization phase. For bulls, the key objective remains to reclaim the $113,500-$115,000 zone, where the 50-day and 100-day MAs converge.

Clearing this zone would strengthen bullish conviction and set the stage for a retest of $117,500, a decisive breakout level that could open the door towards $120,000 – $123,000.

On the other hand, a daily close below the 200-day moving average and support at $108,000 would weaken the current bias and increase the risk of a larger pullback towards $104,000. For now, Bitcoin remains in a neutral to constructive consolidation, holding key support as it awaits new catalysts for its next directional move.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.