The crypto market is recovering with Bitcoin BTCUSDT price is trading near $107,000, while top altcoins like Ethereum

ETHUSDTSolana

SOLUSDTand Avalanche

AVAXUSDT show a steady recovery after recent declines. Market sentiment is turning optimistic, supported by renewed institutional interest and increasing on-chain activity.

At the same time, the total stablecoin supply hit a record high, signaling a massive pool of liquidity awaiting deployment. Historically, such growth in stablecoin reserves has preceded major rebounds in Bitcoin, DeFi tokens, and the broader altcoin market, suggesting that the next big crypto uptrend may be approaching.

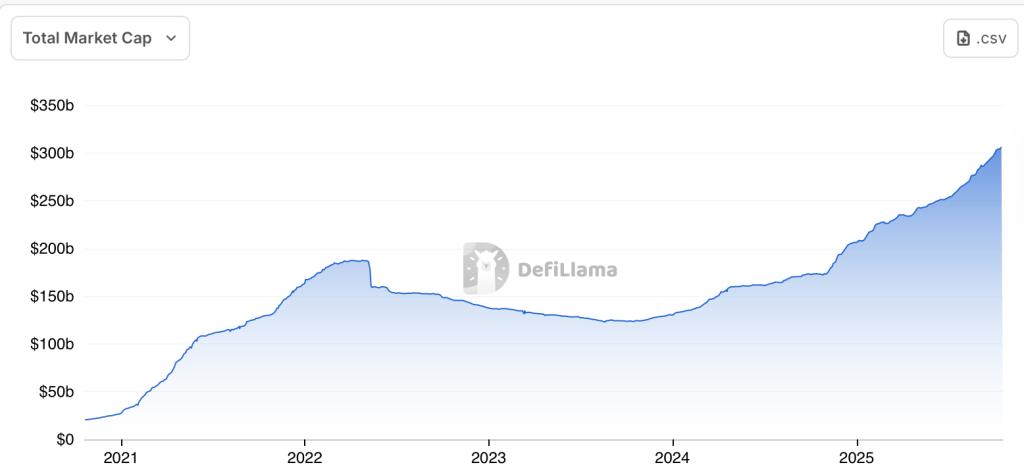

Stablecoin supply hits record $304.5 billion

The total supply of stablecoins reached an all-time high of $304.5 billion, signaling a major accumulation of liquidity in the crypto ecosystem. This massive amount of idle capital indicates growing investor confidence and willingness to redeploy their funds into high-yielding crypto opportunities. Stablecoins, pegged to the US dollar, continue to serve as the backbone of the crypto economy, providing stability, seamless transfers, and access to decentralized markets.

A stable, rising market capitalization often precedes major market movements. This suggests that investors are accumulating dry powder, waiting for the right time to enter Bitcoin. BTCUSDTEthereum

ETHUSDTand altcoin markets. Analysts note that such large reserves typically trigger bullish momentum in the broader digital asset sector once reinvested in risk assets or yield-generating protocols.

DeFi and tokenization: the next big destinations

Experts believe the next major wave of liquidity could flow into decentralized finance (DeFi) and real-world tokenized assets (RWA).

- DeFi Growth: Lending platforms, decentralized exchanges, and yield farms continue to attract stablecoin flows in search of real yield opportunities. Improved security and institutional-grade protocols further legitimize DeFi as a basic financial layer.

- Increase in tokenization: Real-world assets such as bonds, treasuries, and real estate are put on-chain. Financial giants such as BlackRock and Standard Chartered are already experimenting with blockchain-based settlements using stablecoins as their primary medium.

A bullish signal for Bitcoin and DeFi

Several catalysts could trigger this massive pool of liquidity, including regulatory clarity, institutional adoption, and macroeconomic changes pushing capital on-chain. A favorable policy decision or a major financial institution integrating stablecoin payments could trigger the next crypto-liquidity supercycle.

The record $304.5 billion in stablecoins isn’t just cash, it’s fuel for crypto’s next major expansion. With DeFi, RWA, and blockchain adoption accelerating, this liquidity could soon return to the market, potentially pushing Bitcoin, Ethereum, and DeFi tokens to new heights.