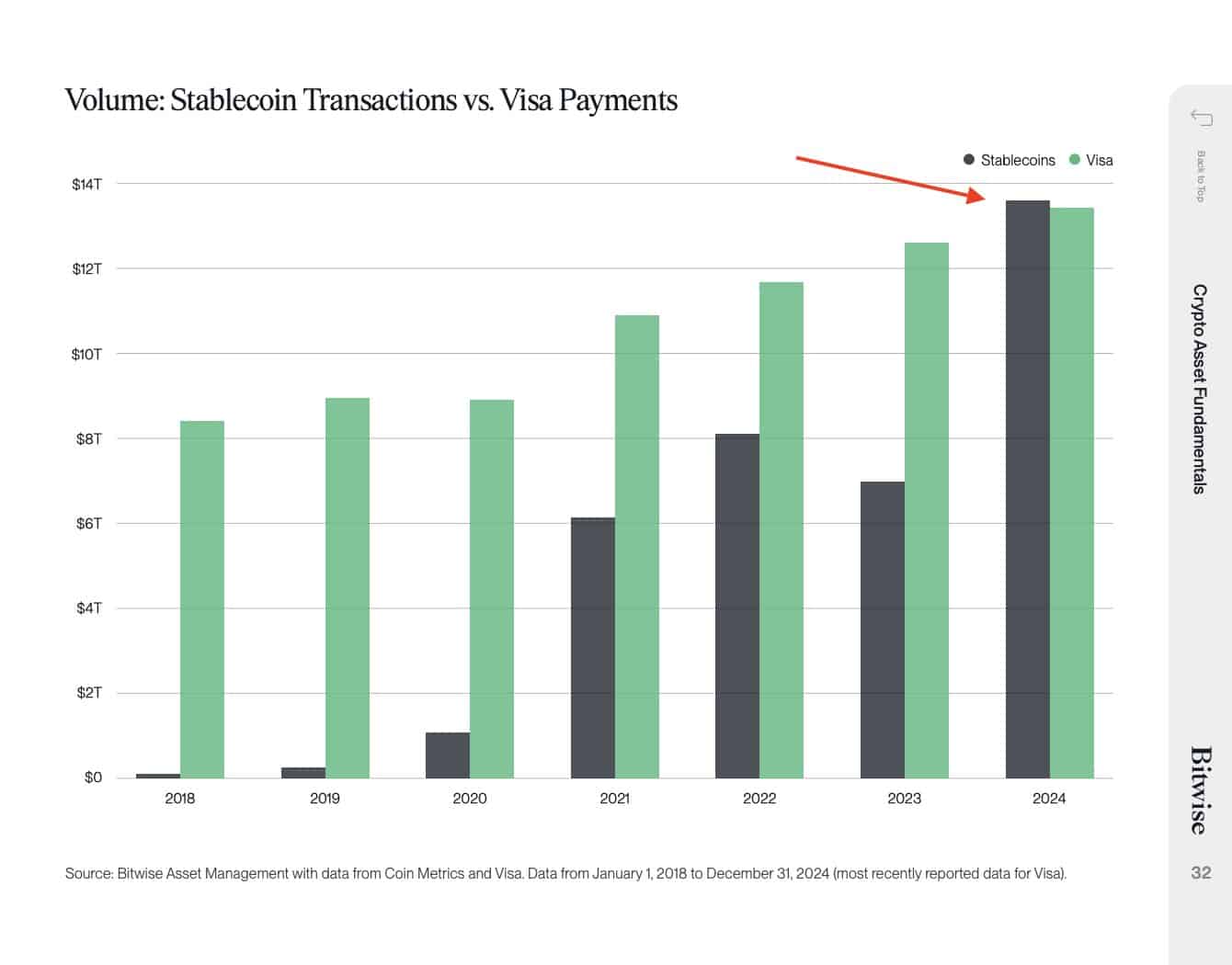

- In 2024, Stablecoins exceeded the visa in transaction volume.

- The president of the Fed noted that the legislation on the stablescoin was a “good idea” in the midst of a massive adoption.

Stable The volume of transactions exceeded the visa for the first time in 2024, according to a Bitwise report.

In 2023, the volume of visa transactions increased to approximately 13 billions of dollars, while stablecoins recorded 7 billions of dollars. First advanced in 2024, the volume of Stablecoin annualized has doubled at nearly 14 billions of dollars, while Visa marginally greater than 13 billions of dollars.

Source: Bitwisewise

What does that mean for crypto?

For the context, stablecoins have the most viable use of crypto, and cross -border payments, dominated by tradfi companies as a visa, could be the first mature segment for disturbances.

In fact, in February, Bitwise Matt Hougan CEO projected That stablecoins could dominate the cross -border payments of $ 44 billions of dollars.

“The Stablecoins will dominate 44 billions of dollars on the B2B transactions market in the next 5 years.”

Hougan has cited a renewed interest By launching or supporting the stablecoins by Paypal, Fidelity, Stripe, Bank of America, And others as a indicative signs of the next adoption.

Unlike volatile cryptocurrencies, the floors are supported 1: 1 by reserve assets to maintain a “stable” value linked to currencies such as the US dollar or products like gold. Until now, the most popular stablecoins are based on the US dollar, led by USDT de Tether and USDC de Circle.

According to the Bit report, the legislation during Stablecoin (two bills in the Senate and the House of Representatives) could be adopted by July. If this is the case, this could lead to a new large -scale adoption.

The report added that massive adoption could spread in DEFI and the overall space of cryptography.

“The growing adoption of the stallions will benefit the adjacent sectors, including DEFI and other cryptographic applications.”

In addition, the president of the Fed, Jerome Powell, echoes similar feelings, noting that the legislation on the stables was a ‘good idea“In the midst of the increased adoption of the dominant current.

In April, the TETHER USDT dominated the Stablescoin sector with $ 148 billion in market capitalization, followed by $ 59 billion in the USDC.

Source: Artemis