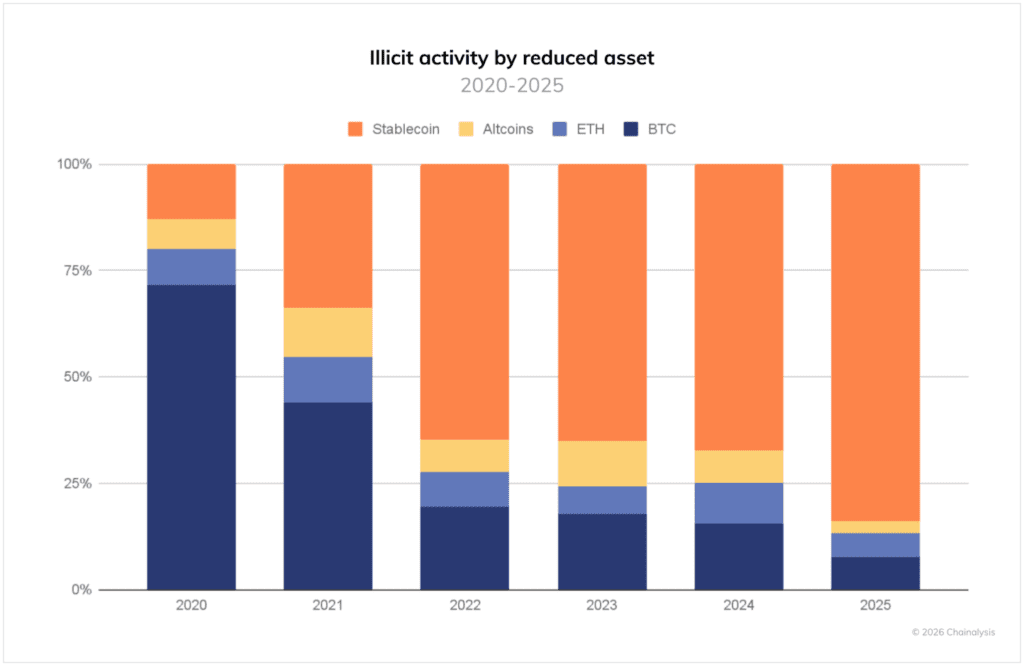

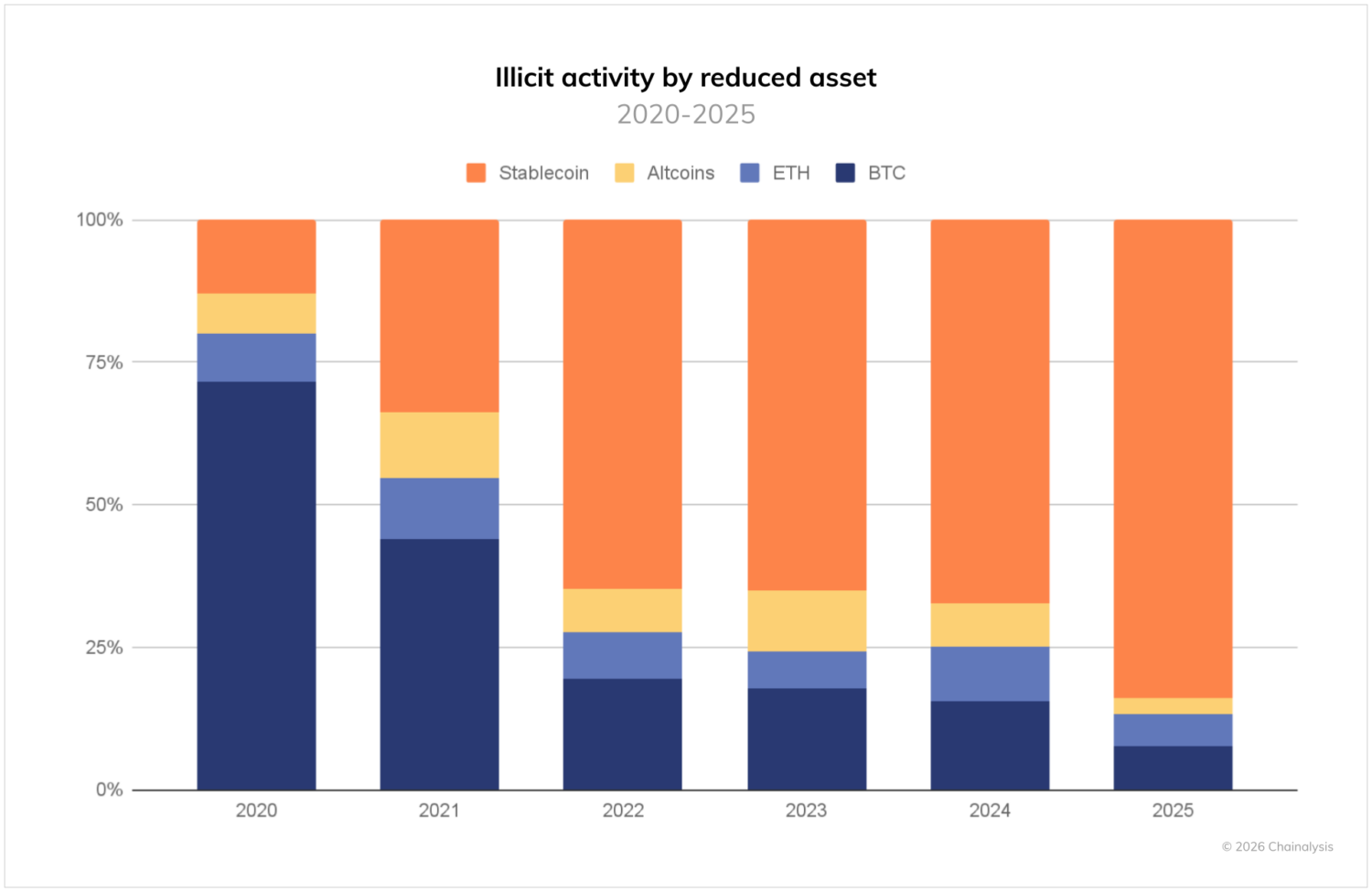

Stablecoins are now the focus of most illegal crypto activity, not Bitcoin, according to new data from Chainalysis. This comes at a time when governments are tightening crypto rules and stablecoins are becoming more common in everyday payments.

Why Do Criminals Choose Stablecoins Over Bitcoin?

Stablecoins are cryptocurrencies designed to maintain a stable price, usually around one US dollar. You can think of them as digital money that moves on blockchains. Popular examples include USDT, also known as Tether, and USDC.

Earlier this week, Chainalysis reported that stablecoins accounted for approximately 84% of illegal crypto transactionsactions in 2025, much more than Bitcoin. The reason is simple. Criminal groups want consistency.

If someone asks for a million dollars today, they want it to be worth another million tomorrow.

Bitcoin prices go up and down too much for that. These fluctuations can be interesting for traders, but they create problems for anyone who needs a fixed amount. Stablecoins remove this uncertainty.

DISCOVER: 9+ Best High-Risk, High-Reward Cryptocurrencies to Buy in January 2026

What this data says about crypto’s growing difficulties

This trend does not mean that the use of cryptography is primarily criminal. Illegal activities still account for less than 1% of all crypto transactions. The change is about what people use in this small portion.

A significant share now comes from groups trying to circumvent international sanctions, often using stablecoins on fast and cheap networks like TRON. WIRED reported that some state-linked groups prefer these networks because they can move funds across borders without relying on banks.

For regular users, this highlights the need for greater oversight of stablecoins. Governments around the world are already debating stricter rules for them, as the current debate shows. discourse on stablecoin regulation.

How This Affects Daily Crypto Users

If you use stablecoins to trade or send money, you are not doing anything wrong. They are still a vital part of how crypto markets function. At the same time, exchanges and wallet apps are now subject to stricter controls.

This often leads to more identity requests, more transactions reviewed, and sometimes accounts being frozen while platforms investigate the activity. This pressure is also increasing as banks begin to build their own stablecoin systems, as noted in our report on stablecoin infrastructure.

Over time, this can make payment systems more reliable, although it can also mean less privacy and a few extra steps for users who value speed.

DISCOVER: Next 1000X Crypto: 10+ crypto tokens that could reach 1000x in 2026

Risk Check: Don’t Confuse Headlines with Personal Danger

Cryptocrime news may seem alarming, but context helps. Cash is still used for far more crimes than crypto.

Still, beginners should treat stablecoins the same way they treat online banks. Stick to trusted wallets. Avoid random links. Check addresses carefully before sending money. And remember that “stable” only refers to price, not security.

As regulators focus more on the illegal use of stablecoins, the rules will likely become stricter, while the systems themselves will become more robust. For users, the result is simple. Learn how the tools work, then use them carefully.

DISCOVER: More than 20 next cryptocurrencies that will explode in 2025

Follow 99Bitcoins on X for the latest market updates and Subscribe on YouTube for the daily expert market Analysis

The post Stablecoins Now Powers Most Crypto Crime, Not Bitcoin appeared first on 99Bitcoins.