- Stacks has a bullish short-term outlook.

- Increased demand is needed to break the token out of the three-month range formation.

Stacks (STX) has been on a rapid bullish run recently. Since the lows recorded on September 16, the token has increased by 22%. This follows the bullish sentiment of the market over the past two weeks.

Since the second week of September, Bitcoin (BTC) has surged from $54,000 to $64,500. This 20% move for the king of cryptocurrencies has rejuvenated bullish belief, including the sentiment behind Stacks.

STX Heads Back Towards Range Highs

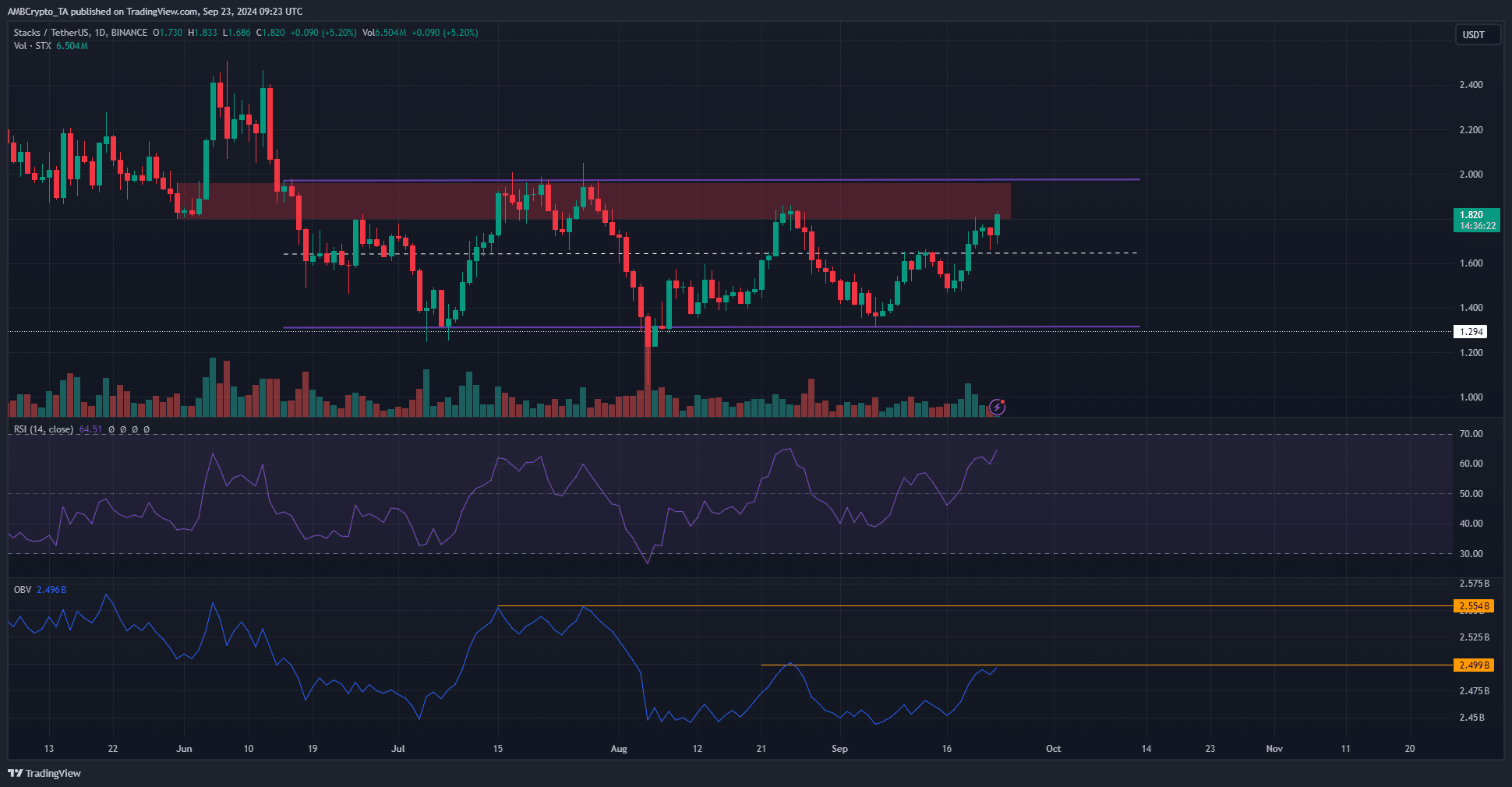

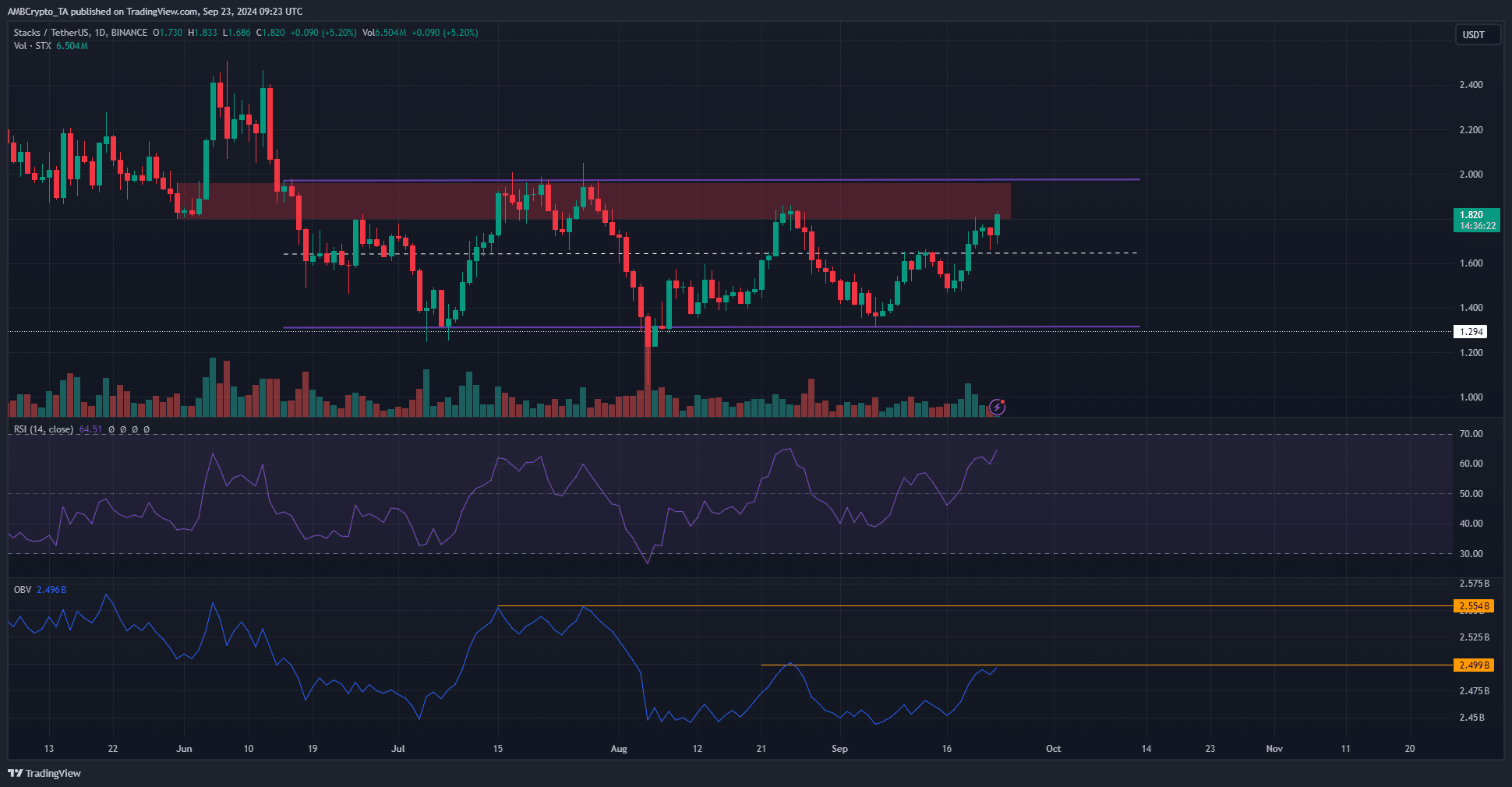

Source: STX/USDT on TradingView

Since the first week of July, Stacks has been trading in a range of $1.32 to $1.97. The median level at $1.645 has served as both support and resistance over the past three months.

In early September, STX bulls were pushed back by resistance at $1.645 before last week’s rally pushed that level into support.

Along with the range highs, a bearish breakout block was present on the daily chart below the $2 region. This provided substantial opposition to bullish growth.

A retest of this resistance might also fail to result in a breakout on this attempt.

The daily RSI was bullish and showing upward momentum. The OBV was at a local high that has acted as resistance over the past month.

Even if buyers manage to break through this threshold, there is a local top formed by the OBV in July, which was not enough to break the range.

As things stand, a significant influx of capital is needed to push Stacks prices beyond $2. In the meantime, traders can use the extremes of the range as targets.

Social sentiment has seen a massive positive shift

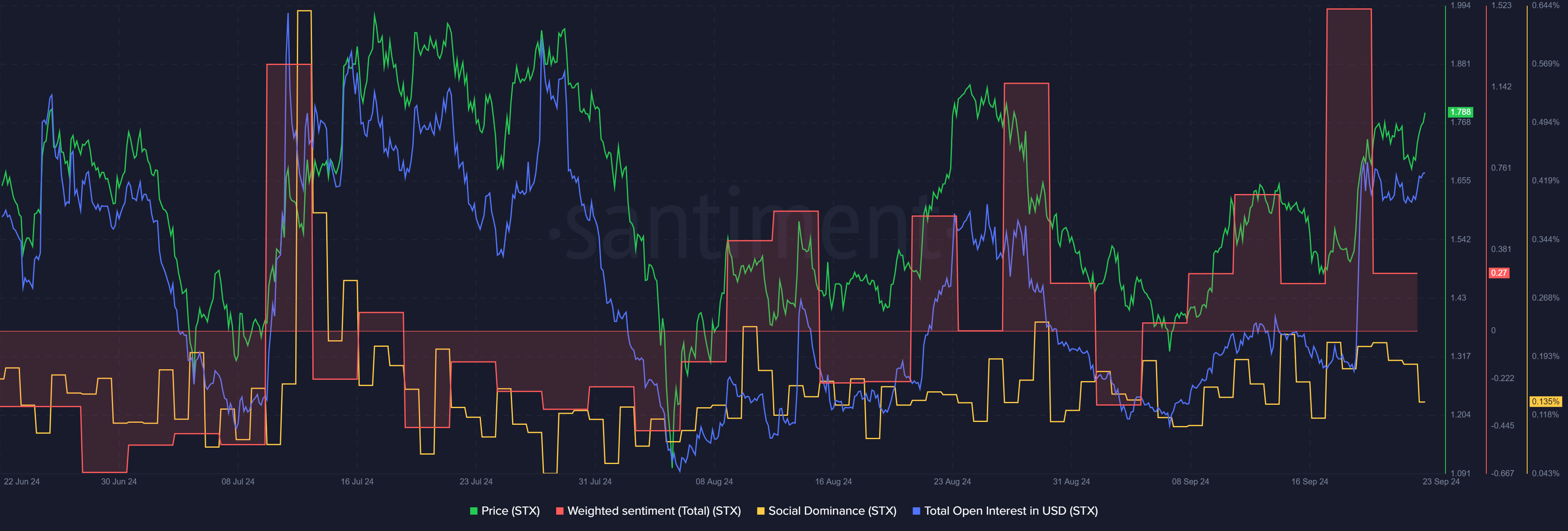

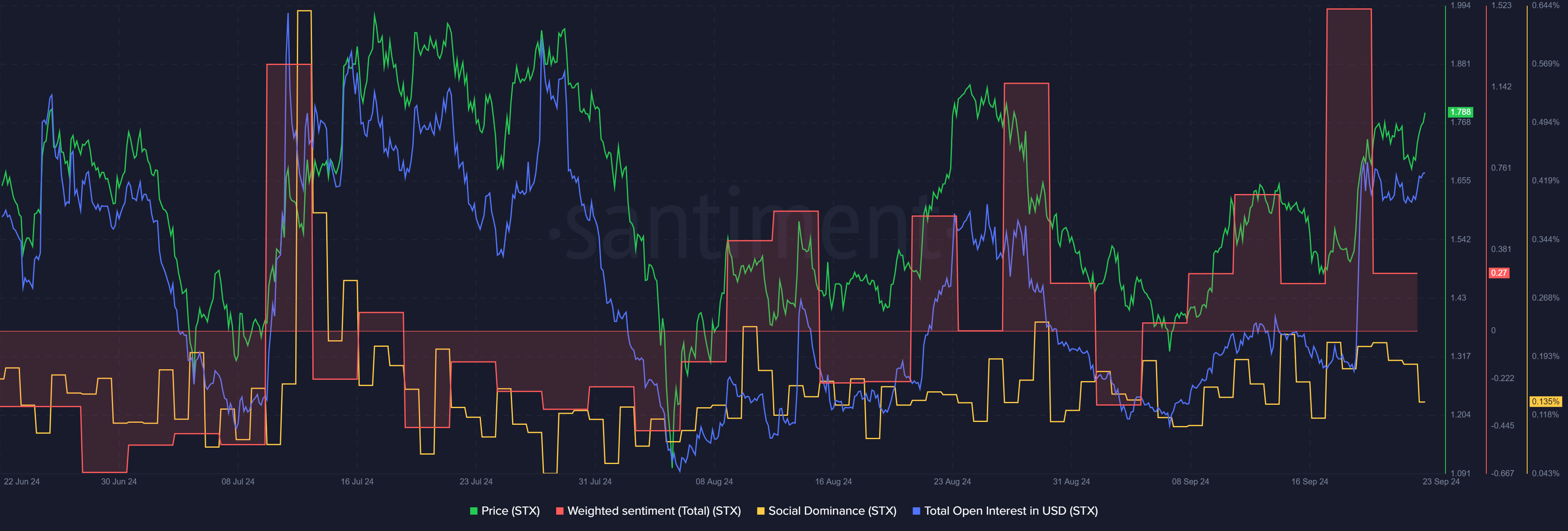

Source: Santiment

AMBCrypto looked at data from Santiment and noted that the weighted sentiment on social media has been positive throughout September. This spiked last week as prices also broke through the middle resistance.

Realistic or not, here is the market cap of STX in terms of BTC

This could be due to the news that Stacks was integrating with the Aptos (APT) network, enabling the use of BTC in decentralized applications (dApps) on the APT network.

The rise in open interest also indicates that bullish sentiment has strengthened in recent days.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.