The Ethereum Layer-2 Starknet network reportedly suffered another mainnet outage, adding another outage to a growing list of reliability issues in 2025. Although Starknet token price data remained limited at the time of publication, the network still secures approximately $548 million in value, so every hour offline traps real money and freezes real transactions.

This comes as Ethereum scaling solutions race to attract users and developers, even as the outages remind everyone that faster and cheaper doesn’t always mean more secure.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

What just happened to Starknet and why should everyday users care?

Starknet is a so-called layer 2 network for Ethereum. Think of it as an expressway built on top of the Ethereum highway that aggregates many transactions and then settles the result on Ethereum for security. It uses a technology called ZK-rollup, which relies on advanced cryptography to prove that batch transactions are valid without displaying each step on Ethereum itself.

In 2025, this expressway has continued to stagnate. Starknet’s own crash report, earlier outages related to its Grinta (v0.14.0) upgrade caused sequencer crashes and issues with old Cairo0 code. The sequencer is the software that controls transactions on Starknet, much like a traffic cop decides who goes first at a busy intersection.

When this traffic cop fails, everything saves. In September 2025, Starknet’s downtime lasted up to nine hours and even forced two transaction reorganizations that erased about an hour of network history.

During a reorganization, the chain “rolls back” to a previous state and creates a new version, which can undo transactions and transfers that users thought were final. This means that a trade you made or a loan you repaid on Starknet could disappear and require a second try.

STARKNET BREAKUP UPDATE

Starknet has been down for over 2 hours and the network is currently experiencing downtime.

• The team recognized the problem

• The investigation is ongoing

• Restoration efforts are underway

• The price is holding steady so farMonitoring updates.… pic.twitter.com/pJAu2uahen

– Wise Advice (@wiseadvicesumit) January 5, 2026

Starknet now ranks among the largest layer 2s on Ethereum with approximately $548 million locked. This money is found in DeFi applications, NFT marketplaces, and wallets which all depend on the survival of the network.

So when Starknet goes dark, users can’t move funds, close positions, or react to price fluctuations, while markets elsewhere on Ethereum continue to move without them.

If you want a refresher on how Ethereum scaling works more broadly, 99Bitcoins covered it in detail when Ethereum stablecoin transfers reached $8 trillion in volume on the Ethereum network. This overview helps you understand why these layers are so important.

How does this outage change the race to layer 2 on Ethereum?

Starknet competes with other Ethereum Layer‑2s like Arbitrum, Optimism, zkSync and Coinbase’s Base. Each offers lower fees and faster confirmations than the Ethereum mainnet, but each remains an independent network with its own risks.

Users choose them like they choose banks or brokers: whoever feels safest and smoothest over time gains deposits and volume.

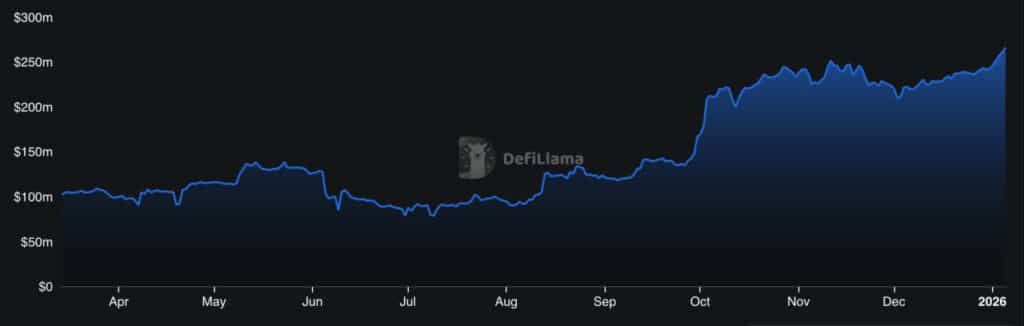

(Source: Starknet total value locked increase before incident / DefiLlama)

Repeated outages erode Starknet’s history of reliability. Although it markets advanced cryptography and strong Ethereum security, users experience something simpler: “Can I send my money whenever I need it?” Networks like Arbitrum and Optimism have their own problems, but they haven’t suffered the same pattern of long outages in 2025. This difference determines where developers launch new apps and where users park funds.

Meanwhile, the ZK‑rollup industry continues to evolve. ZKsync Lite will be retired in 2026 as teams migrate to newer versions. When the core infrastructure evolves this quickly, outages remind everyone that this technology is still young.

Even though Ethereum’s own upgrades, like the ones we covered in our guide to upcoming Ethereum upgrades, aim to make the main chain more efficient, the upper layer 2s still need to prove they can stay online.

Starknet is also working to decentralize its sequencer so that a single entity no longer controls the order of transactions. Recent incidents have raised doubts about the network’s ability to make this jump safely. Rushed or shaky decentralization could spread instability rather than reduce it, especially since billions of dollars depend on this infrastructure.

For Ethereum itself, these setbacks cut both ways. On the one hand, they highlight the risks associated with the construction of new infrastructure. On the other hand, they show the demand for scalability and the pressure on teams to improve quickly, which aligns with the long-term goals Vitalik Buterin has set for network growth, which we discussed in our Ethereum article.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

What should Starknet and Ethereum users actually do now?

Before transferring funds to Starknet, ask three simple questions. First: do I understand the risk of my money being temporarily blocked? Second: Do I really need lower fees for this trading or yield strategy? Third: Can I afford to leave this money alone if something breaks for a few hours or even a day?

DeFi traders and users should also review incident reports like the one Starknet posted on its blog. If I were an investor, I would closely monitor how the team handles this incident over the coming days.

Teams that publish clear deadlines, fixes, and follow-up plans generally manage issues over time better than teams that remain silent. But transparency does not eliminate risk. This only helps you judge how seriously a project treats your deposits.

(Source: STRKUSD/TradingView)

For beginners choosing where to start with Ethereum DeFi, a simple rule is helpful: prioritize stability first, speed second. Learn how the Ethereum mainnet, major Layer 2s, and DeFi applications work before striving for additional yield on less tested networks.

Starknet’s next actions, how quickly it stabilizes the sequencer, how it reports patches, and how it handles decentralization, will determine whether users trust it with more of their ETH. As Layer 2 competition heats up, these reliability stories will matter as much as APY and fees.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The article Starknet Hit by Another Outage: What It Means for ETH Users appeared first on 99Bitcoins.

STARKNET BREAKUP UPDATE

STARKNET BREAKUP UPDATE