State securities regulators are sounding the alarm over legislation that could upend the nation’s digital asset market structure rules.

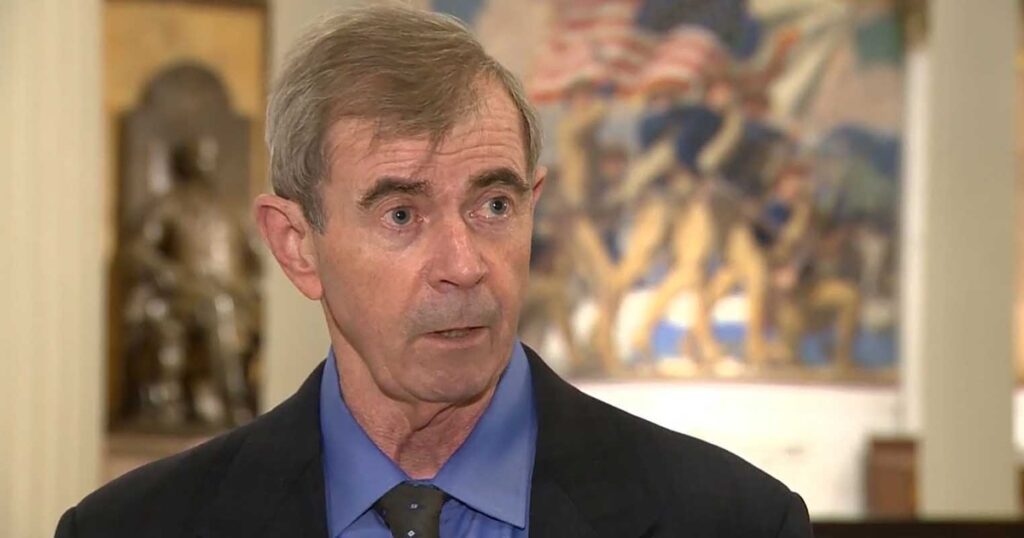

In a letter to U.S. Senators Tim Scott (R-S.C.), Elizabeth Warren (D-Mass.) and Ed Markey (D-Mass.), Massachusetts Secretary of the Commonwealth William Galvin asserted that if passed, the bill would be “a recipe for disaster for millions of savers” that would harm “well-established financial assets.” beyond cryptography.”

Galvin’s letter addressed the Responsible Financial Innovation Act of 2025, which would change the regulatory framework for digital assets between the Securities and Exchange Commission and the Commodity Futures Trading Commission.

U.S. Sen. Cynthia Lummis (R-Wyo.) first introduced the bill in 2022, but with Republicans holding both chambers of Congress and the White House, passage is closer than ever. Additionally, in July, the House of Representatives passed the clarity lawits version of a revised regulatory framework for digital assets. Senate Republicans unveiled their bill for the Responsible Financial Innovation Act in September.

In his letter, Galvin asserts that RIFA is “unacceptable due to its significant impact on the treatment of ‘real world assets'” at the state level, and urged Congress to amend certain sections of the bill “in order to preserve the state’s antifraud authority.”

According to Galvin, one section would preempt state authority “over a wide range of high-risk securities, including exploitative penny stocks and microcap stocks,” while another section is a “misplaced effort” to reduce oversight of symbolic “real-world assets,” including real estate and other contractual rights.

The new rule would designate the CFTC and SEC as the entities issuing rules affecting operations that Galvin’s office has overseen for decades.

“Merely a passing reference…to a study into potential ‘fraud and misrepresentation’ is insufficient, and the lack of state involvement is unacceptable,” the letter reads.

In addition, in a separate letter signed by 28 university leaders On securities and financial regulation, the North American Securities Administrators Association urged Congress to oppose portions of the legislation that would undermine regulators’ ability to combat fraud.

In particular, the signatories targeted Section 105, which would “redefine the investment contract,” a test that federal and state regulators often rely on to protect investors from “new and emerging frauds,” including hog slaughter, Ponzi schemes, promissory note frauds, real estate scams, and oil and gas deals. fraudulent.

“Given the epidemic of fraud perpetrated against American investors, particularly older investors, Congress should not pursue policies that will make it easier for scammers to get away with it and more difficult for law enforcement and regulators to take action,” the letter read.

Ben Edwards, a professor at the University of Nevada, Las Vegas, William S. Boyd School of Law, was one of the signatories. He said Wealth Management.com that it was “dangerous to meddle” with the investment contract test because it detects misconduct that might otherwise fall outside the scope of the securities laws.

“One of the risks you face is that if you limit testing or otherwise inhibit the ability of state securities regulators to pursue bad behavior, it may be easier for fraudsters and scammers to escape accountability,” he said.

Earlier this year, state securities regulators urged federal lawmakers not to exclude states from crypto enforcement, with a letter to senators from NASAA President Leslie Van Buskirk saying it would be a “decision with net negative and significant consequences for Americans.”

In an interview with Wealth Management.com, Alabama Securities Commission Director Amanda Senn said that without “clear authority” for states to pursue crypto-related fraud, investors in the states “will have no recourse” when it comes to pursuing legal action, and many cases will likely go unexamined due to the large number of schemes.

“They are our friends and family,” she said. “These are people in our communities, and no one wants to be helpless when it comes to helping a victim of fraud or crime. »