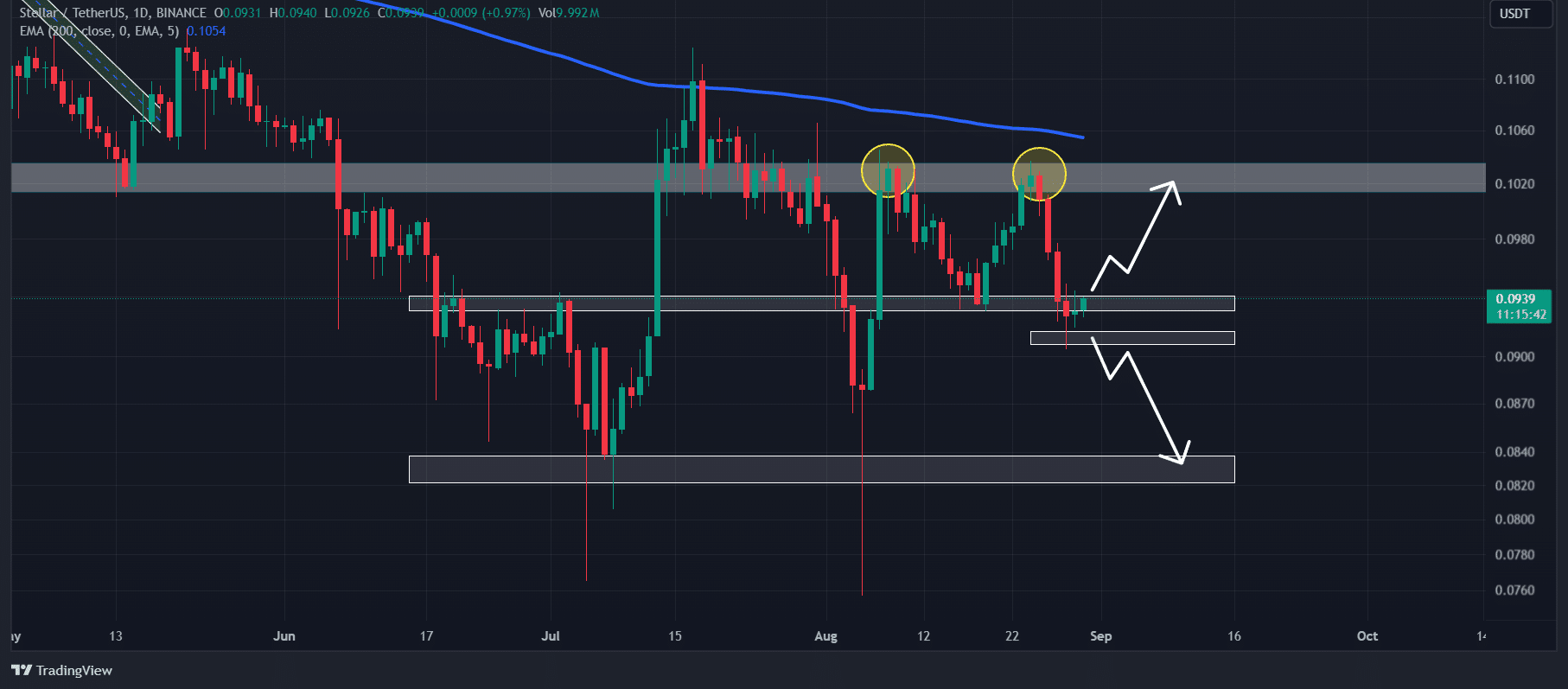

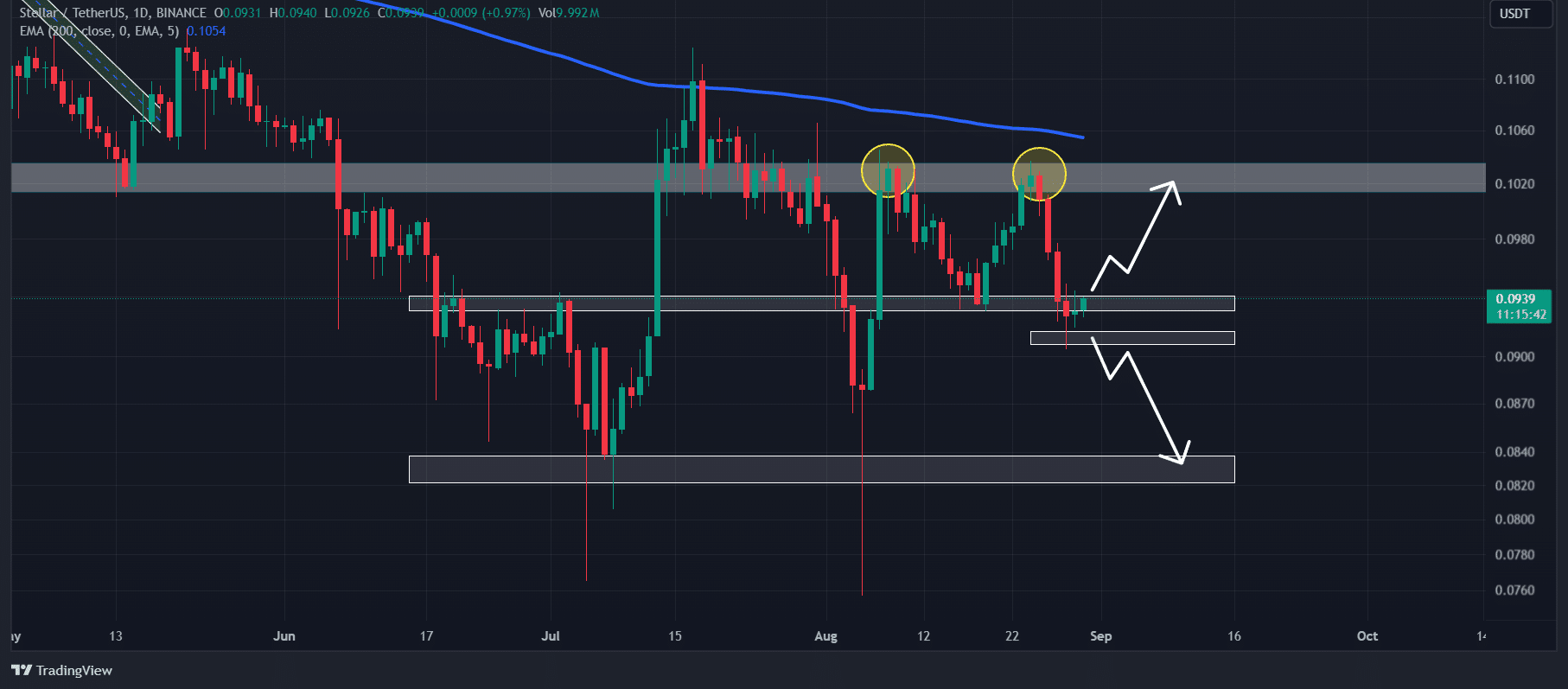

- XLM was trading below the 200 exponential moving average (EMA) on the daily timeframe

- XLM price could drop 12% to $0.083 if it closes a daily candle below $0.0915

At the time of writing, Stellar (XLM) appeared poised for a potential decline after breaking out of a double-top price action pattern. This is significant, especially since the overall sentiment across the cryptocurrency landscape is bearish at the moment. And major cryptocurrencies have been under significant selling pressure recently.

Double Top Breakout Signals Bearish Outlook

Based on price action and technical analysis, the double top is a bearish pattern that signals a potential sharp decline in price after a break of its neckline.

In addition to this bearish outlook of the price action pattern, XLM was also trading below the 200 exponential moving average (EMA) on a daily time frame, indicating that it was in a downtrend.

Source: TradingView

Due to these factors, there is a high probability that XLM price will drop by 12% to $0.083 in the coming days. However, traders should wait for the daily candle to close below $0.0915.

If this happens, it would confirm a successful failure.

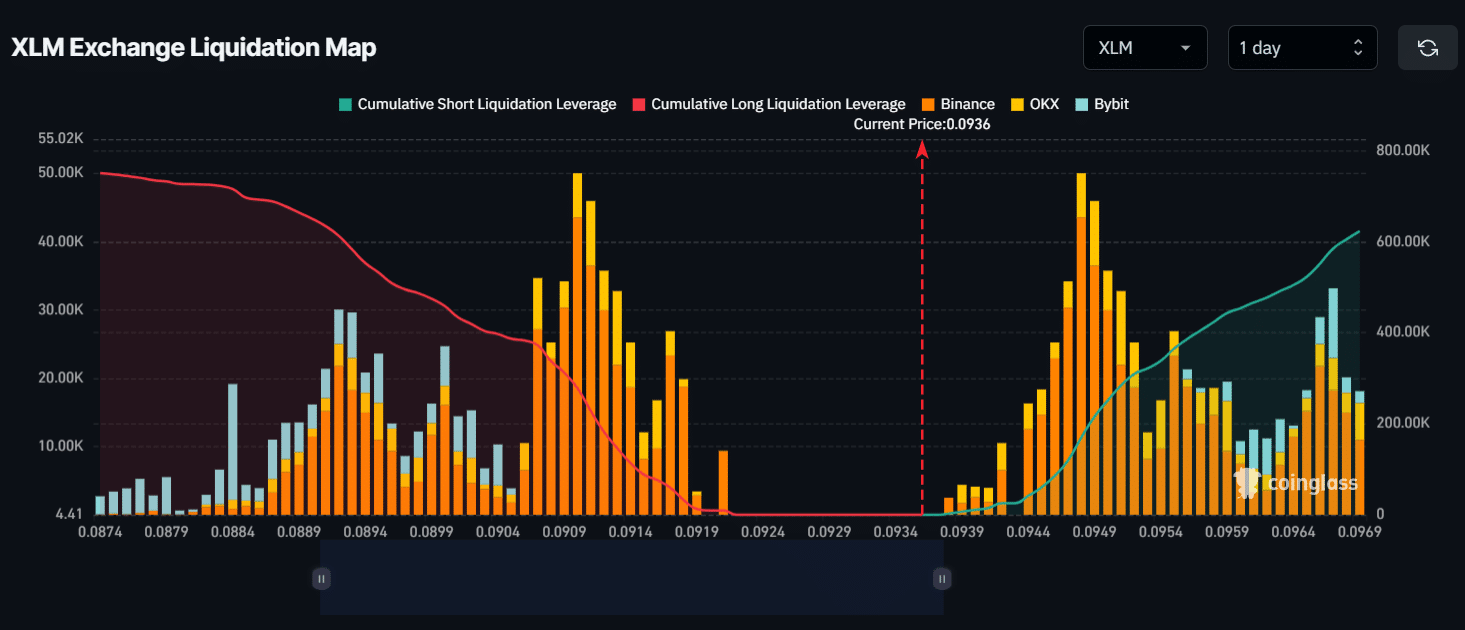

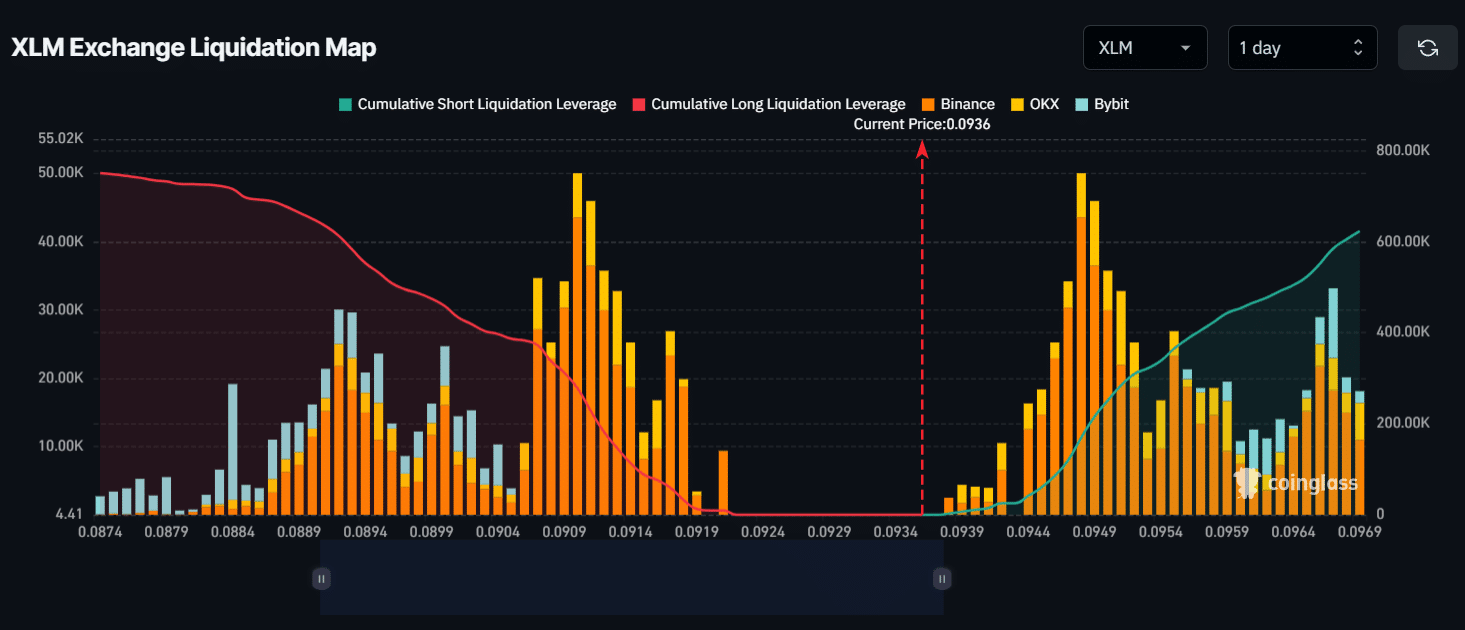

Liquidation Levels and Market Sentiment

Currently, the main liquidation levels are near the $0.091 level on the downside and $0.0948 on the upside, according to data from on-chain analytics firm CoinGlass.

In fact, these data also indicate that traders are overleveraged at these levels.

Source: CoinGlass

If the market sentiment remains unchanged and XLM falls to the $0.091 level, nearly $280,000 worth of long positions will be liquidated. Conversely, if the sentiment changes and the price rises to the $0.0948 level, $170,000 worth of short positions will be liquidated.

On-Chain Metrics and XLM Price Analysis

Additionally, the liquidation chart from exchange CoinGlass suggested that sellers have been less dominant lately. Furthermore, this implies that XLM could see a price reversal, despite a crucial breakdown.

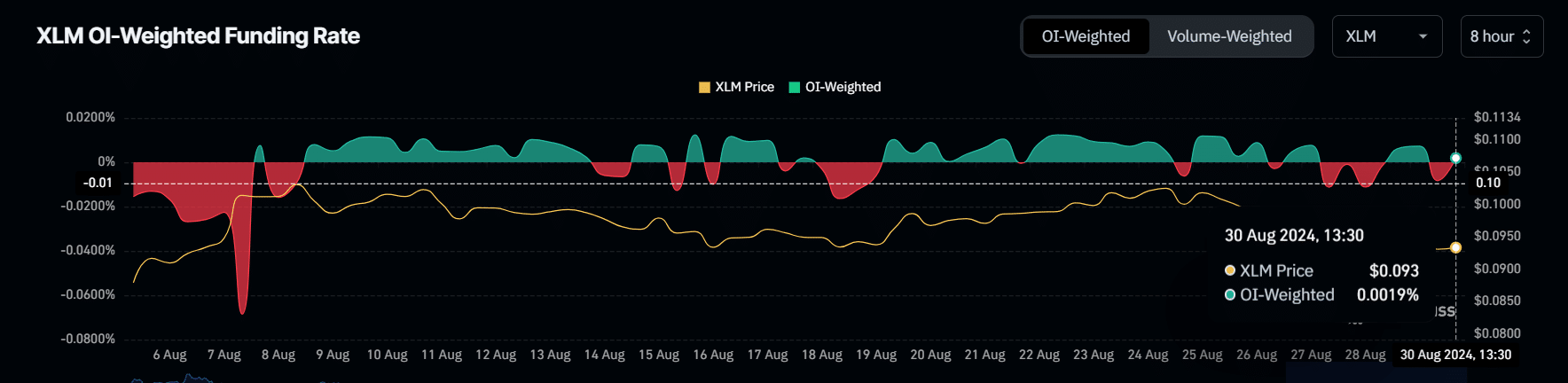

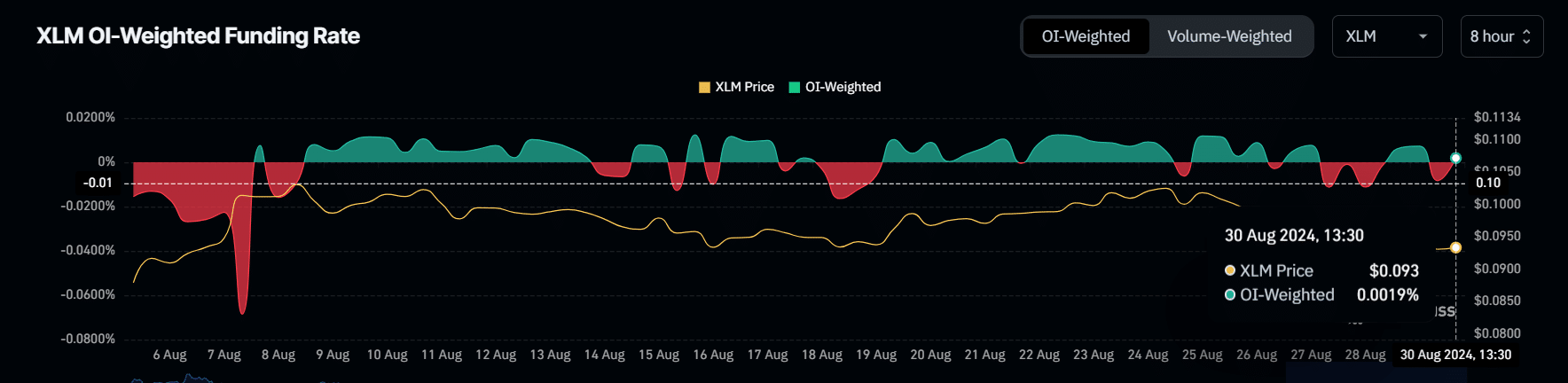

Here, it’s worth looking at another on-chain indicator: the OI-weighted funding rate. It’s used to track market sentiment and helps predict the potential upward movement of an asset’s price. According to CoinGlass, XLM’s OI-weighted funding rate is positive, with a figure of 0.0019% at press time.

Source: CoinGlass

Considering all these indicators and price action, it is difficult to predict the direction the price will take in the coming days. However, the outlook could change if XLM closes a daily candle below the $0.0915 level.

At press time, XLM was trading near the $0.0938 level after registering a modest price decline of 0.2% over the past 24 hours. At the same time, its open interest also fell by 2.3% over the same period, indicating less interest from traders amid the market downturn.