Join our Telegram channel to stay up to date with the latest news

Executive Chairman of Strategy Michal Saylor has proposed the creation of Bitcoin-backed digital banking products that could attract up to $50 trillion as his company purchases an additional $962 million worth of BTC.

Indeed, Bitcoin slipped more than 1% in the past 24 hours to trade at $89,907.39 as of 1:08 a.m. EST, according to data from CoinMarketCap.

Bitcoin-backed digital banking system could offer customers higher returns

Speaking at the Bitcoin MENA event in Abu Dhabi, Saylor said that countries could use over-collateralized BTC reserves and tokenized credit instruments to create regulated digital bank accounts, which he believes will be able to offer higher returns than traditional deposits.

The strategy’s executive chairman noted that bank deposits in Japan, Switzerland and Europe offer little or no return to account holders. At the same time, euro money market funds pay around 150 basis points, and U.S. money market rates are closer to 400 basis points, he added.

Saylor argued that these low yields are why investors are turning to the corporate bond market, which he said wouldn’t even exist if “people weren’t disgusted with their bank accounts.”

He then outlined a structure in which digital credit instruments make up around 80% of a fund, combined with 20% in fiat currency and a 10% reserve buffer to help reduce volatility.

Saylor said that if such a product were offered through a regulated entity, depositors could end up sending billions of dollars to institutions to gain access to the higher returns on offer.

If a country offered such an account, Saylor predicted the move could result in “$20 trillion or $50 trillion” in capital flows. He also argued that a country adopting this model could see it become the “digital banking capital of the world”.

Offered BTC-backed accounts reflect the strategy’s own offerings

Saylor’s talk of a high-yield, low-volatility digital banking product is similar to some of Strategy’s offerings.

In July, the company launched its STRC offering, a money market-style preferred stock with a variable dividend rate of approximately 10%.

Although the product’s market capitalization reached approximately $2.9 billion, it was met with some skepticism.

I’ll rephrase this: Every share of STRC he sells gives Saylor the obligation to pay 10% with more likely MSTR stock every year, in perpetuity.

This increases the risk of selling BTC at some point.

-Daniel Muvdi (@DanielMuvdiYT) December 5, 2025

This is mainly because the unpredictable short-term volatility of Bitcoin has led to questions about the viability of high-yielding credit instruments backed by BTC.

The strategy adds more BTC to its reserves

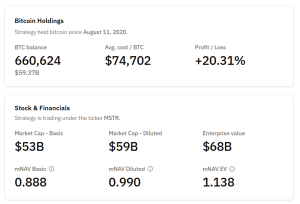

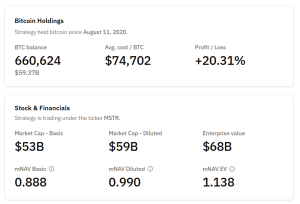

Strategy is the largest Bitcoin holding company in the world. The company began purchasing BTC in 2020 as part of a digital asset treasury plan. Over the years, the company has consistently added BTC to its reserves.

Strategy’s most recent purchase was announced yesterday. Saylor said on X that his company purchased 10,624 BTC for approximately $962.7 million last week.

The latest Bitcoin purchase brought the company’s reserves to 660,624 BTC, according to Bitcoin Treasury data.

BTC strategy holdings (Source: Bitcoin Treasures)

The strategy’s continued accumulation of BTC comes even as the company’s stock price has been on a downward trend in recent months. Data from Google Finance shows that Strategy (MSTR) stock has fallen more than 53% over the past six months.

The company also faces a potential withdrawal from MSCI, which could trigger multibillion-dollar capital outflows for MSTR, analysts warn. A decision will be made on January 15.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news