STX has formed a candle of God today, gathering up to 19.5% after its exit from a bullish scheme as the wider market has recovered.

The batteries (STX) reached an intra -day summit of $ 0.717 on April 21, Asian time, before settling at $ 0.714 from press time. Its market capitalization has been set at nearly $ 1.1 billion, while its daily negotiation volume increased by more than 200% to 153 million dollars, indicating an increase in commercial activity.

Being a Bitcoin -based protocol, STX gains today can be widely attributed to what it reflects the upcoin rise (BTC), which increased by almost 3.4% in the last day to $ 87,573, its highest level since Trump announced its “release day” prices. The larger market of cryptography also increased by 1.1% to almost 2.85 billions of dollars.

The rally was accompanied by an increase in demand among the derivative traders who were betting on the prices of STX. According to Coinglass data, an interest open for Stx jumped from 31% to more than $ 51 million.

STX technical analysis

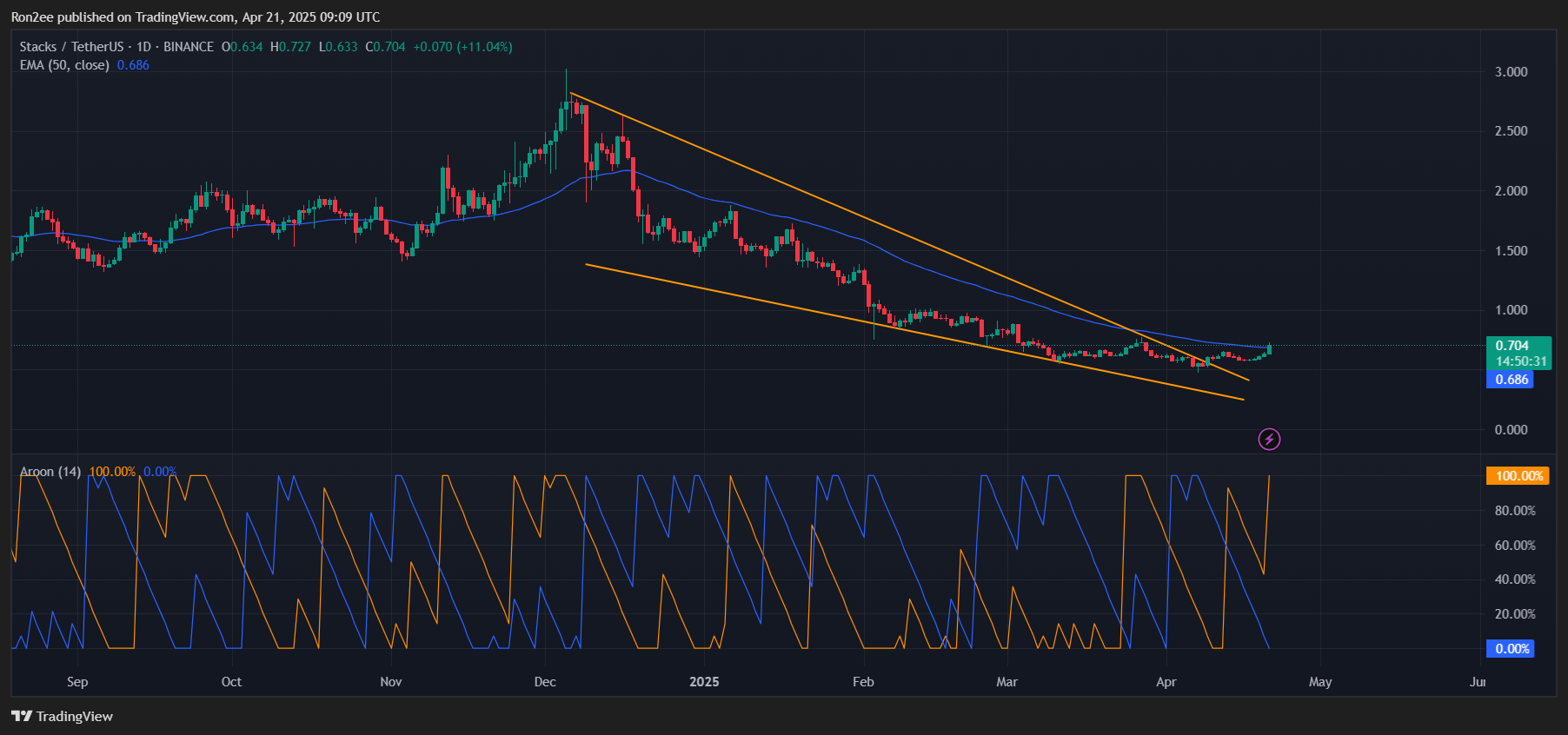

Meanwhile, on the USDT price table for a day, Stx broke over a downward corner diagram, defined by two descending and convergent trend lines.

In the technical analysis, an upward escape of this model is often considered as a bull’s inversion signal, indicating the potential of a price rebound.

According to the analyst, Captain Faibik, the break could trigger almost 100% upwards, with a short -term objective of $ 1.40.

Adding to upward prospects, STX has exceeded its 50 -day exponential mobile average, generally a sign of momentum improvement which could encourage additional purchase activity.

In addition, the Aroon Up is 100% while the Down Aroon is 0%, which shows that the purchase of the pressure clearly dominates on any sale at the moment.

In addition, Chaikin’s money flow is in positive territory, indicating that capital entries are strengthening and buyers control.

Bitcoin supplied can maintain its positive momentum, the most likely target for STX seems to be the psychological resistance at $ 1. A break above this level could push him to target from $ 1.3 to $ 1.4, a key resistance area that aligns the previous swing summits and the projected movement of the breakdown of the fall.

For the uninitiated, Stacks is a Bitcoin Layer-2 network which allows developers to create smart contracts, DEFI applications and NFT while remaining anchored to Bitcoin safety. It uses a unique consensus mechanism called proof of transfer to connect its Bitcoin blockchain, allowing advanced use cases without modifying the Bitcoin basic protocol.

STX is the native token of the Stack network. It is used to treat transactions, feed smart contracts and gain Bitcoin rewards thanks to a locking of tokens.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.