- SUI led the cryptocurrency market in terms of gains for the month of August

- SUI Poised to Replicate Solana’s Early Success as TVL Has Recorded Steady Growth

The cryptocurrency market has seen a strong rebound after the August 5 crash triggered by the fall of Japanese stock markets. Despite heavy initial losses, major cryptocurrencies have since recovered.

In fact, according to CoinMarketCap, the top five gainers in August were: Sui (SUI) surged 68.65%, Helium (HNT) rose 49.27%, Aptos (APT) gained 32.29%, Toncoin (TON) rose 26.28%, and Fantom (FTM) rounded out the list with a 26.13% gain.

Source: CoinMarketCap

This recovery highlights the resilience and continued strength of the SUI network, making it a good investment opportunity for long-term gains.

SUI is emerging as a serious contender among Layer 1 (L1) blockchains this cycle, similar to how Solana ($SOL), Avalanche ($AVAX), and Fantom ($FTM) dominated the previous cycle. In fact, the SUI ecosystem appears to be showing significant potential for a parabolic rise.

Key factors include robust technology, support from top industry players, consistent growth in total value locked (TVL) and listings on major exchanges.

It’s worth noting here that SUI’s current trajectory mirrors Solana’s early days – a sign that it could replicate Solana’s success.

That’s not all, as some analysts are predicting potential gains of 2,500% for SUI. They do this by looking at Solana’s initial performance and identifying that SOL’s 2-day market cap chart mirrored SUI/USDT’s 2-day price chart.

Source: TradingView

Total Cryptocurrency Market Cap on Weekly Chart Forms Doji

At the time of writing, the total cryptocurrency market cap chart revealed the formation of Doji candles for consecutive weeks, signaling a balance between buyers and sellers and a potential trend change.

After the capitulation, the market tested and failed to test demand, leading to a significant rebound. It is common for prices to retest support after breakouts, sometimes quickly, but this time it took months to retrace.

Although many technical indicators suggest that altcoins have bottomed out, the future remains uncertain, so it is wise to prepare for a possible rise in SUI Network.

Source: Will, TradingView

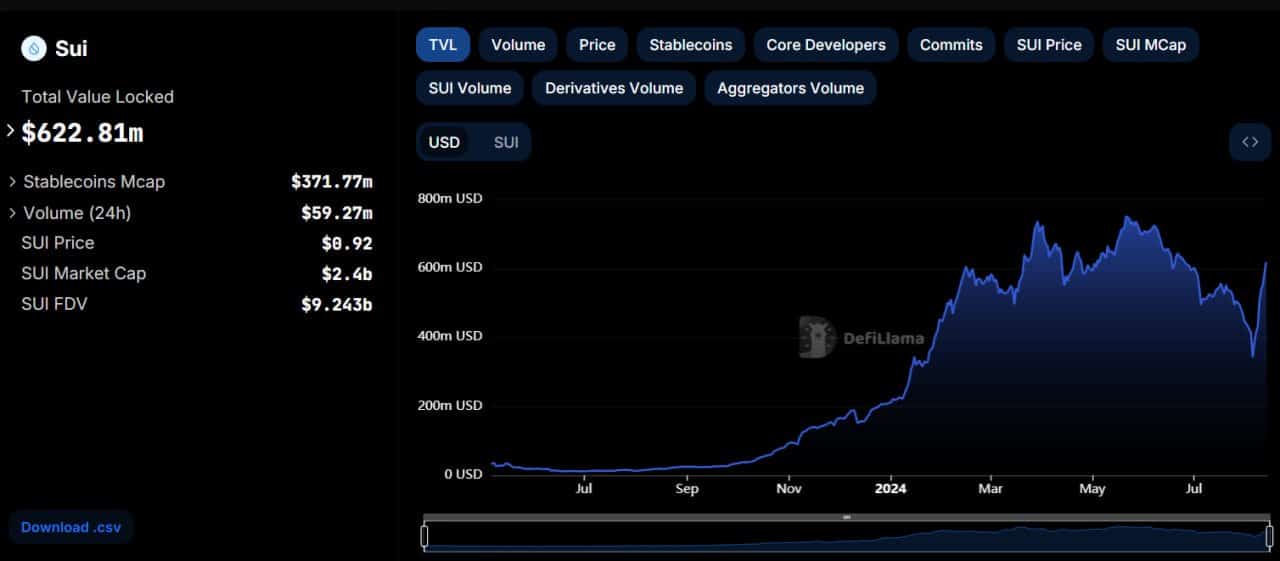

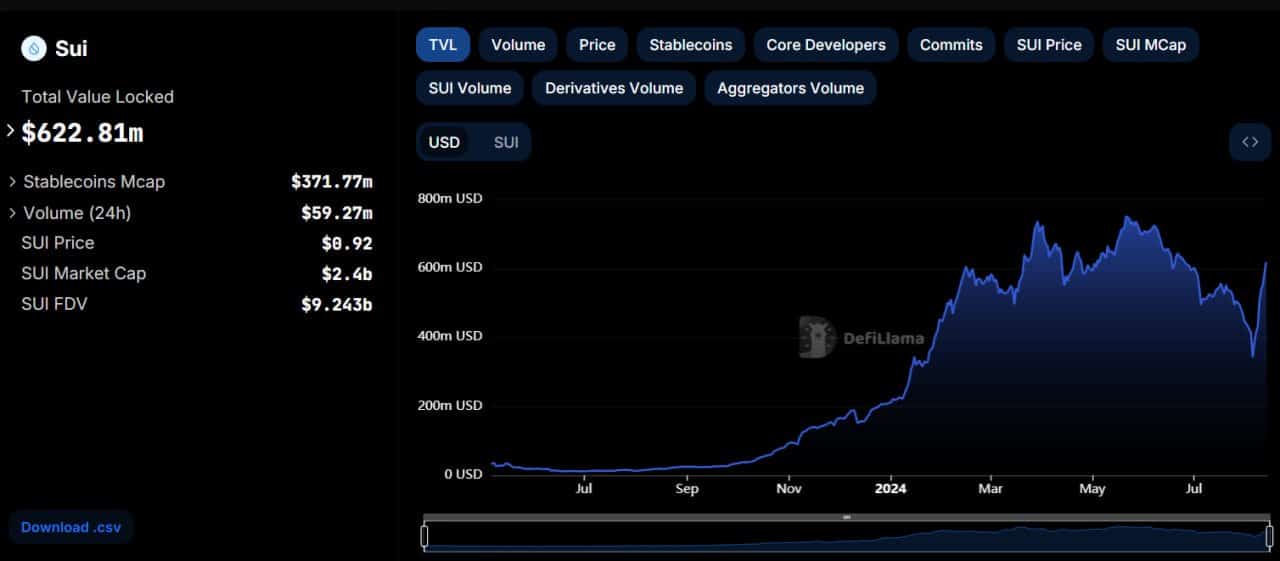

Increase in total locked value

Finally, the SUI ecosystem has also seen remarkable growth on other fronts, with total value locked (TVL) growing from less than $12 million in mid-2023 to over $622 million at press time.

In fact, while SUI has dropped 58% from its all-time high, its TVL has only dropped 17%, indicating strong user retention. This stability suggests that users are staying loyal to the platform.

Source: DefiLlama

Additionally, the ecosystem is thriving, with four SUI protocols now boasting over $90 million in TVL.

This only underlines the platform’s strong performance and its potential for long-term sustainable success.