- Sui Network surpassed $33 billion in DEX volume, up 1,479% year-to-date

- $3 Support Zone Will Be Critical for SUI’s Next Move on the Charts

At the time of writing, SUI was trading at $3.25, following a 5.48% rise in the last 24 hours. In fact, the altcoin the price ranged between $3.19 and $3.53 during the aforementioned period, with the trading volume also reaching $1.21 billion.

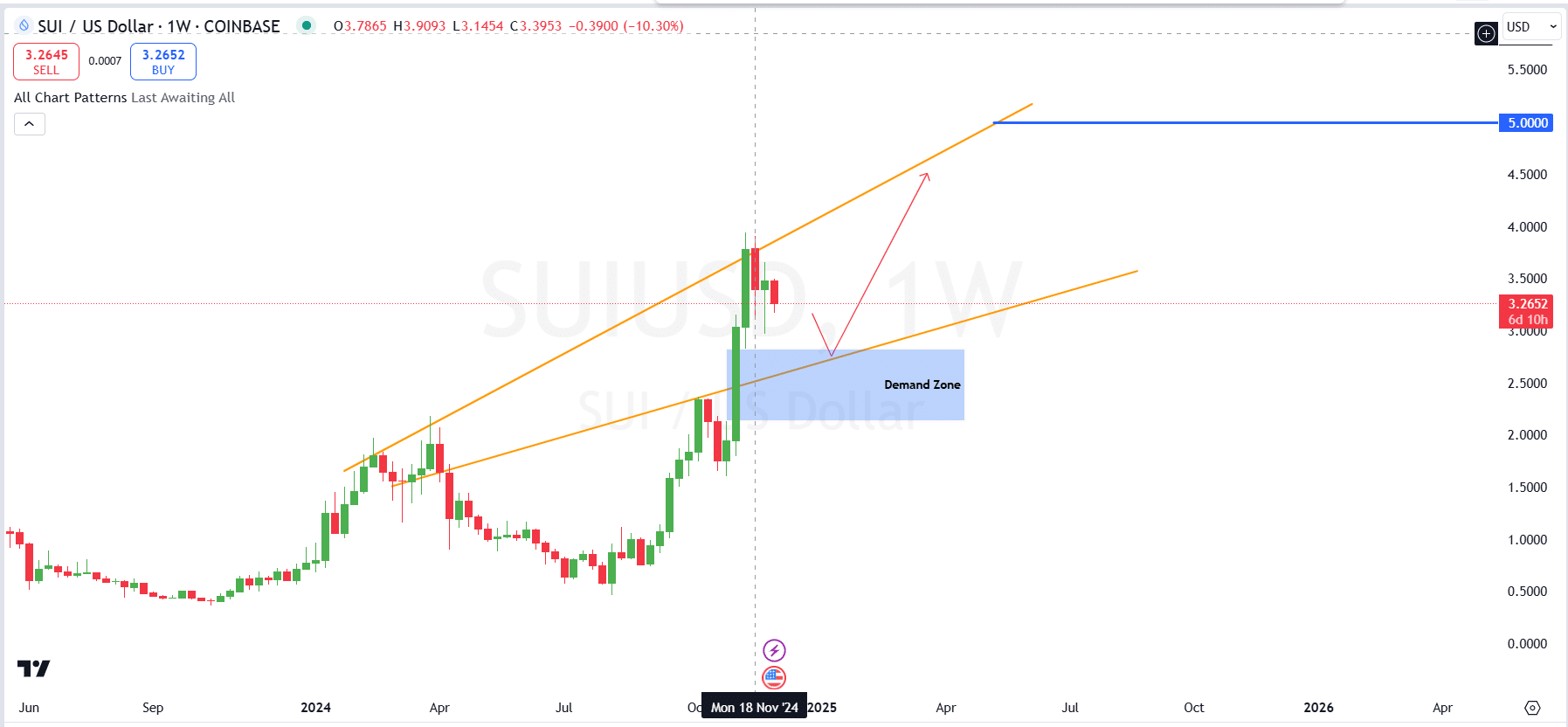

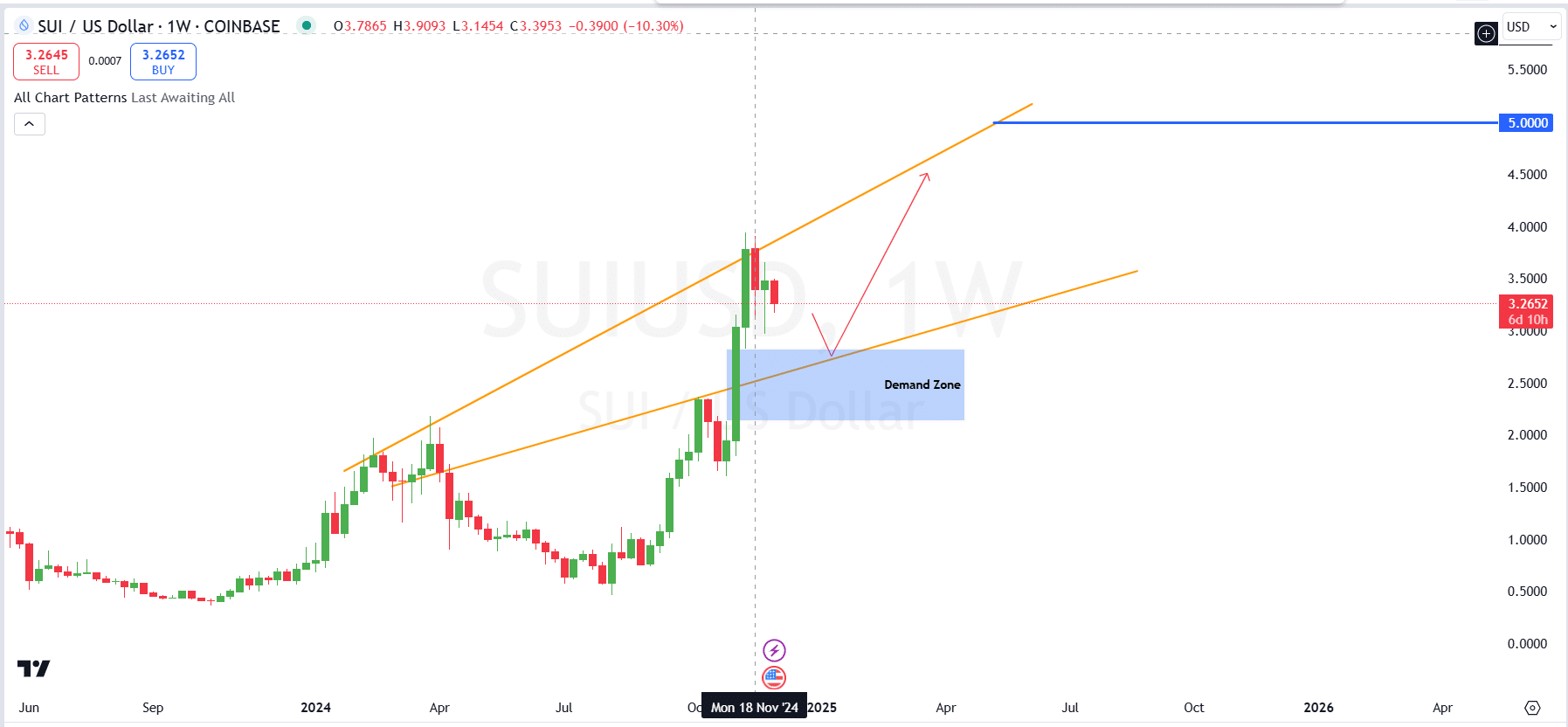

After recovering from its all-time high of $3.93 on November 17, the token appeared to test the critical demand zone of $3.20 to $3.25.

Critical Key Support Zones for SUI’s Next Price Movement

This area is critical to maintaining bullish momentum, as it coincides with the lower trendline of an ascending channel that has supported the price’s upward movement.

The weekly chart highlights the potential for a rebound if the demand zone holds, with resistance at $3.35 and $3.40 and a target of $5.00.

Source: TradingView

Breaking through the $5 level could pave the way for a rally towards the next major milestone at $7. However, failure to defend $3.20 could lead to a deeper correction, with the next support at $3.

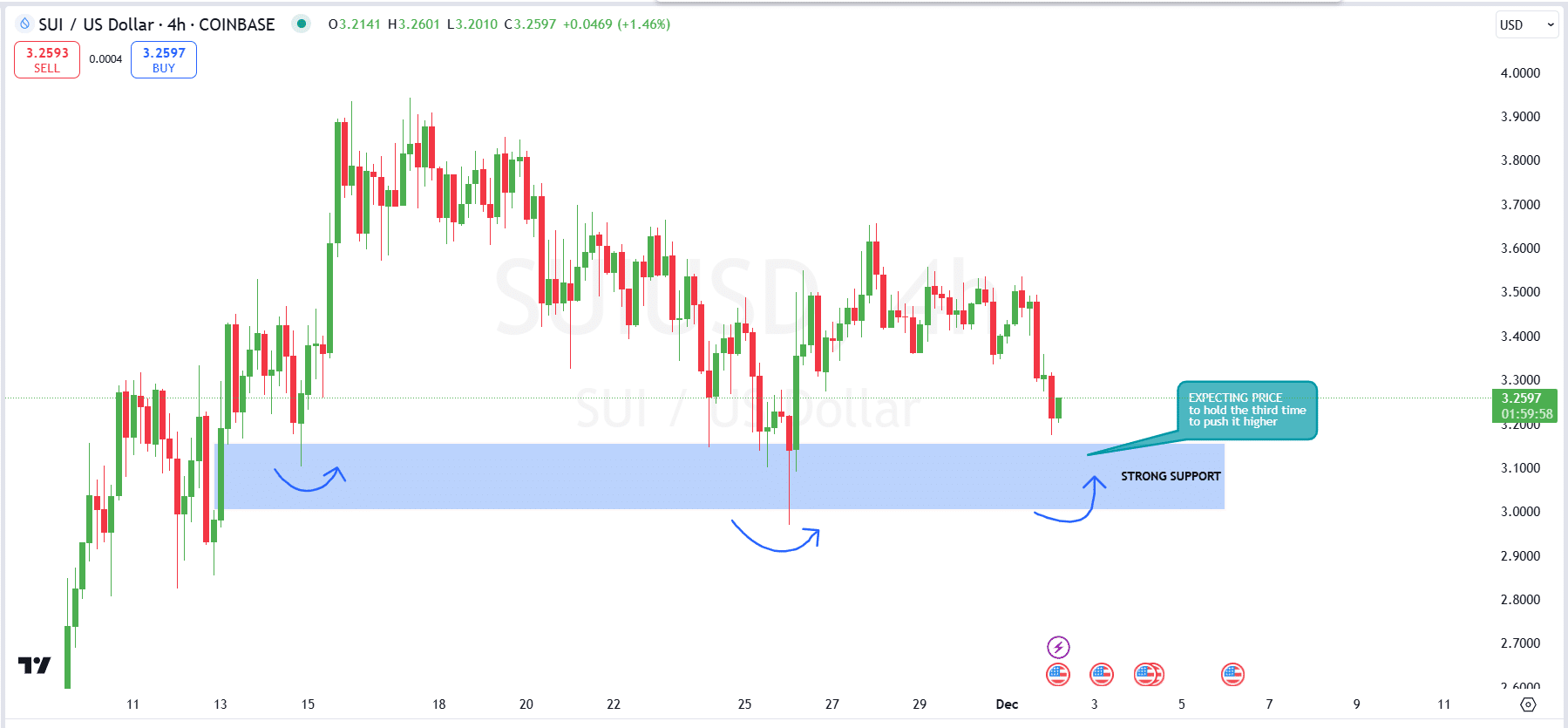

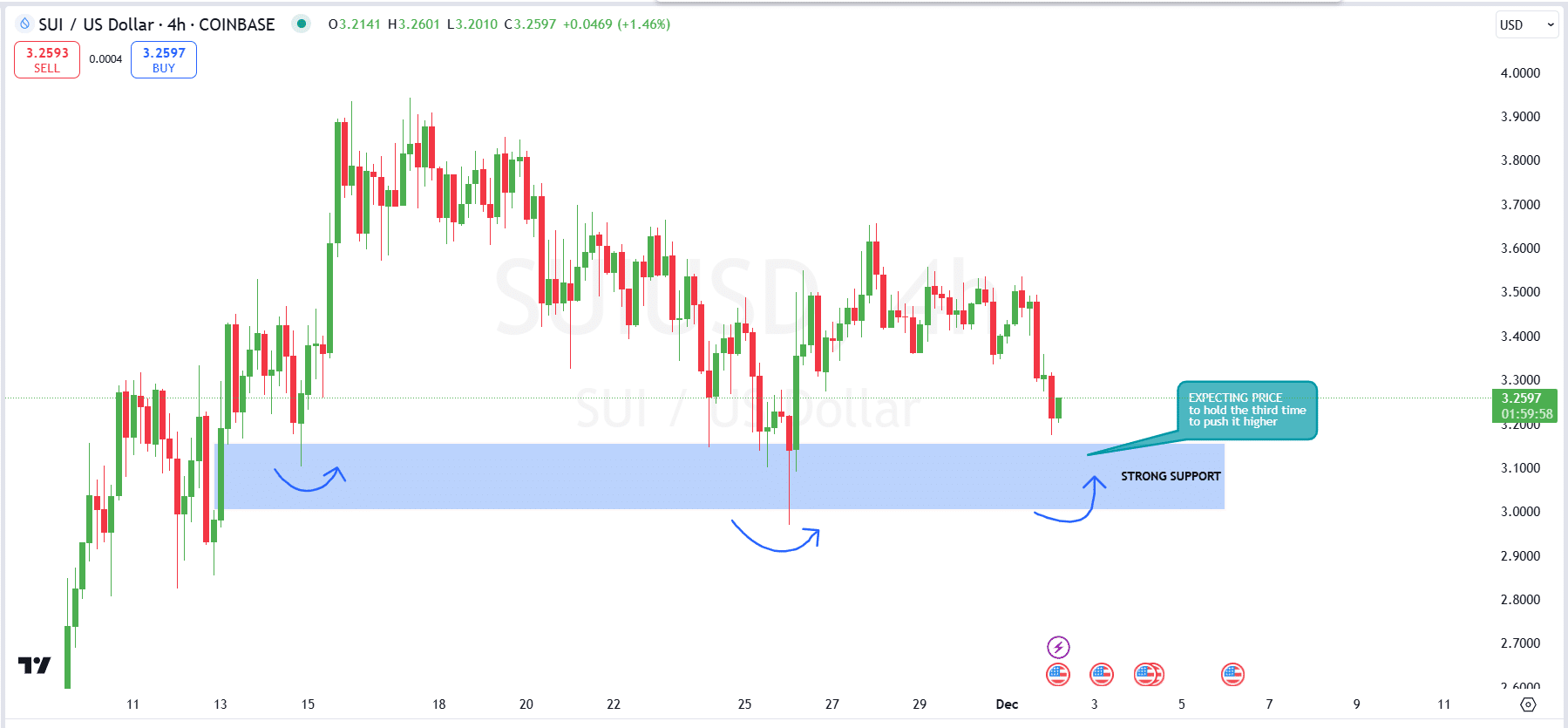

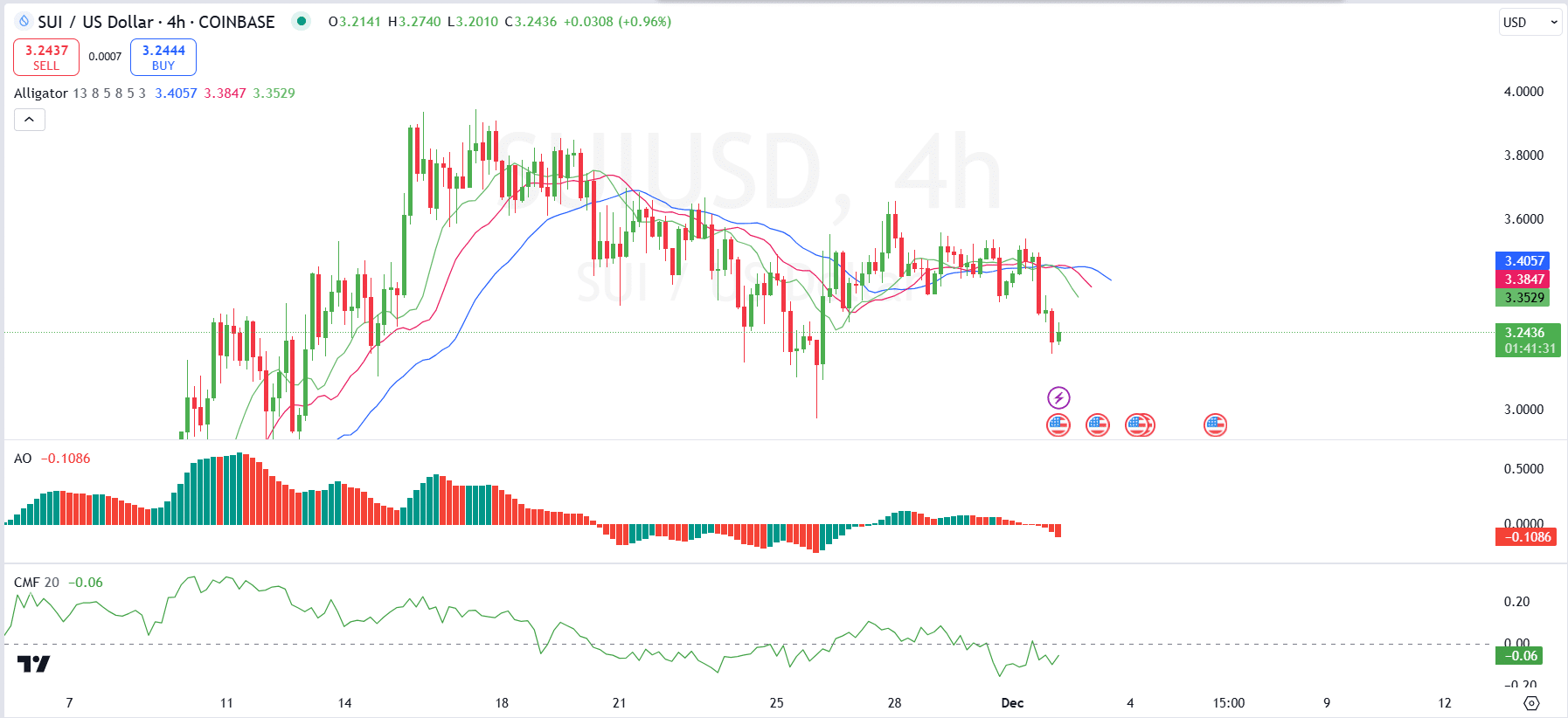

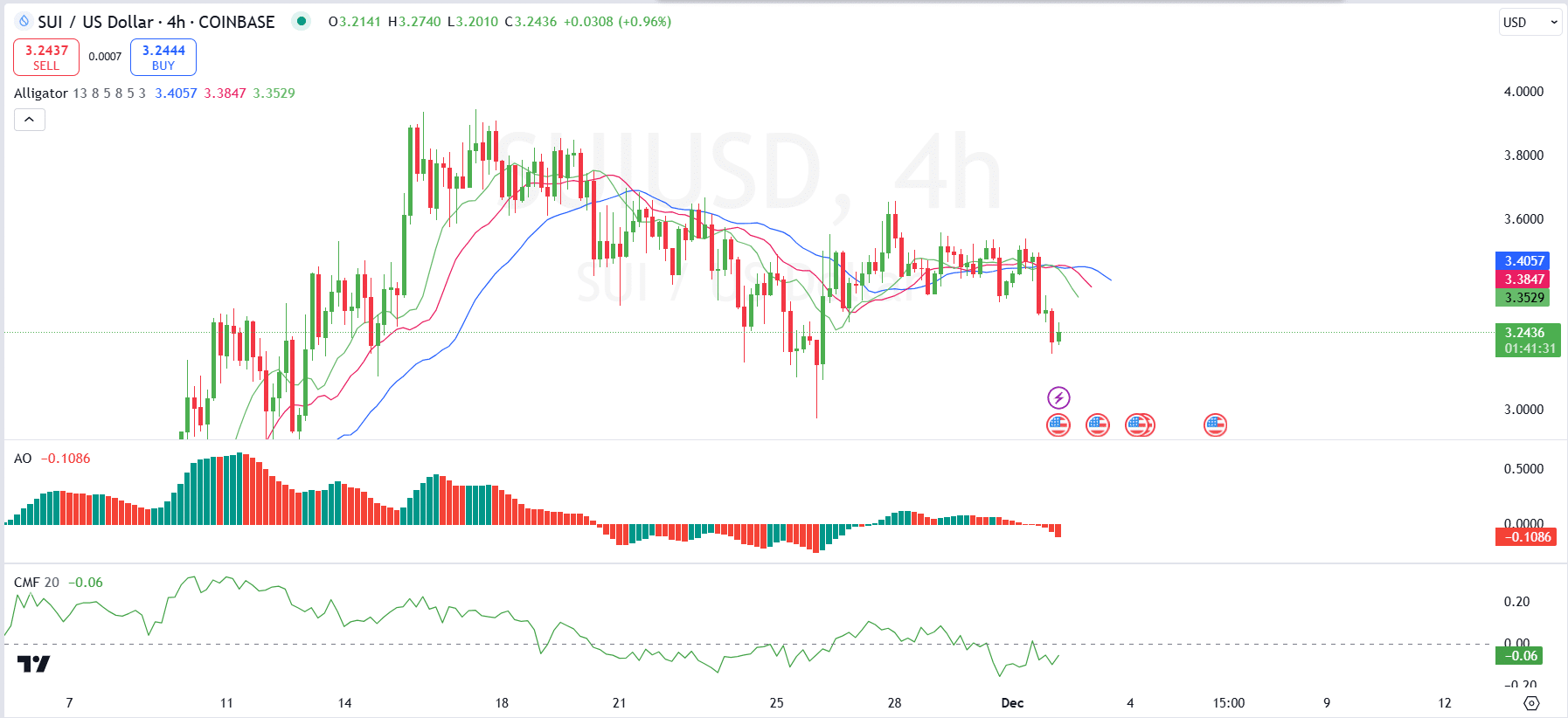

On the 4-hour chart, SUI tested the $3.20 level several times, signaling its importance as a key support area.

Source: TradingView

A break above $3.40 could take the price to $3.50 – a psychological barrier and an important area of prior price activity.

Conversely, a break below $3.20 would likely intensify selling pressure, pushing the price towards $3 or lower on the charts.

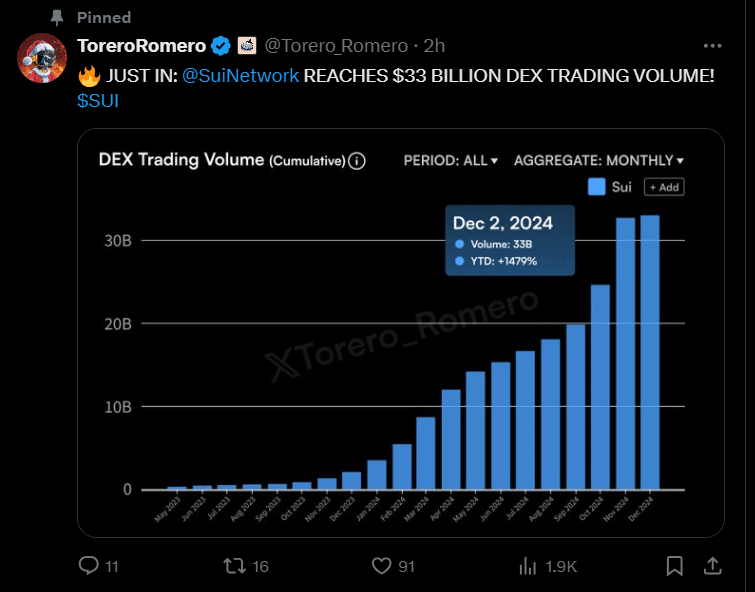

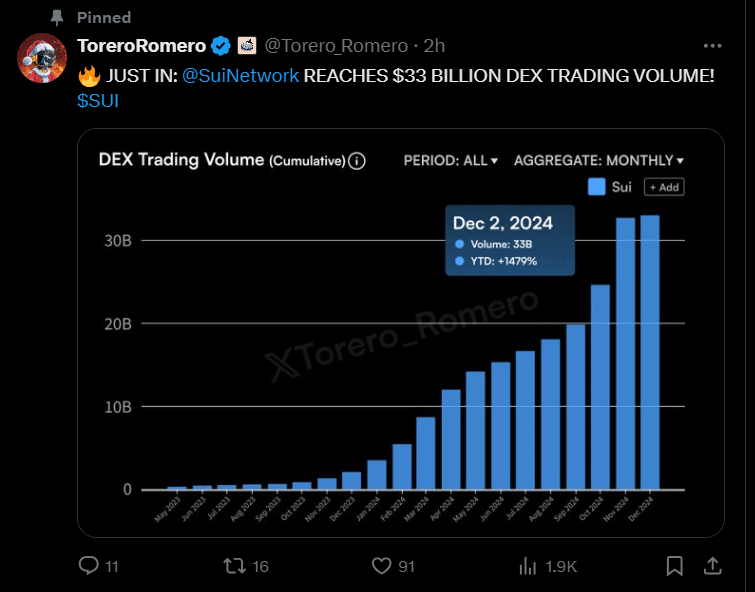

Sui Network Reaches $33 Billion in DEX Trading Volume

Sui Network (SUI) recently reached a major milestone, surpassing $33 billion in cumulative DEX trading volume on decentralized exchanges. This achievement represents a staggering 1,479% year-to-date growth – highlighting the rapid adoption of Sui’s blockchain ecosystem.

Source:

The network’s ability to attract liquidity can be seen as a sign of strong market confidence and its growing footprint in the decentralized finance (DeFi) space.

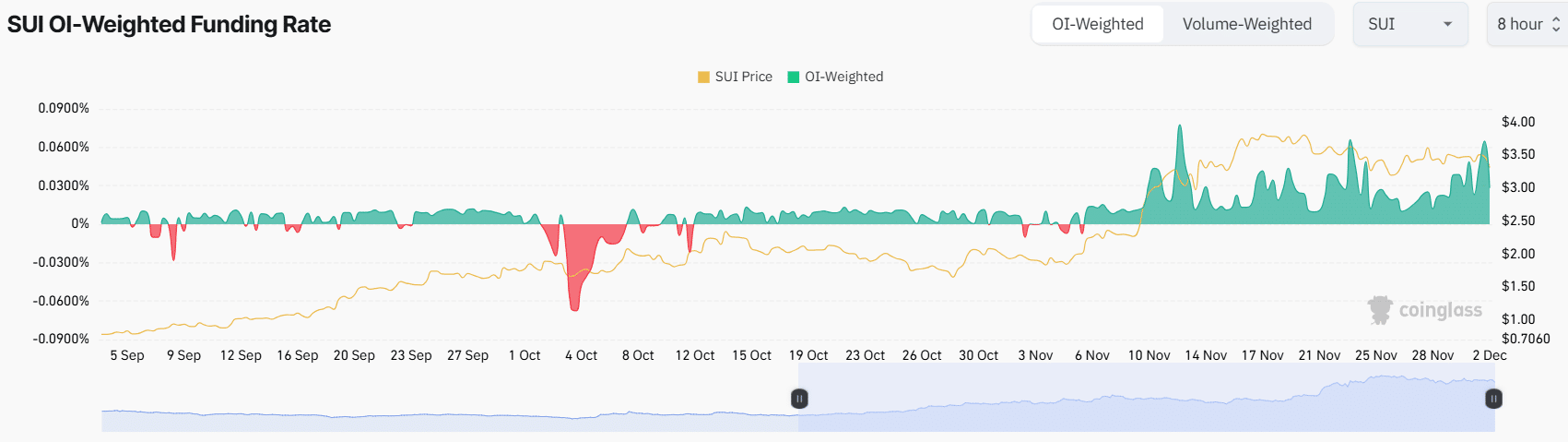

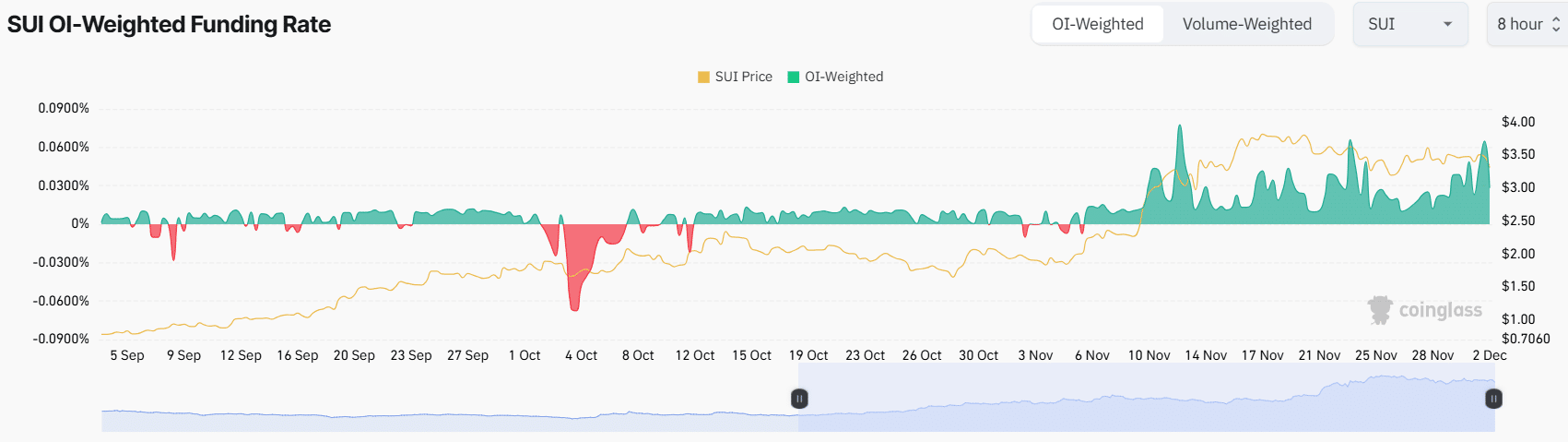

Positive Funding Rates Reflect Bullish Market Sentiment

SUI funding rates have consistently remained positive – a sign of bullish sentiment among perpetual contract traders. Consider this: Since mid-November, rates have remained above 0.03%, peaking at 0.06% as prices rose from $2.80 to $3.60.

This indicates that traders are paying a premium to hold long positions, underscoring confidence in SUI’s bullish momentum.

Source: Coinglass

On the contrary, funding rates briefly turned negative in October when the price fell to $2.50 to signal temporary bearish sentiment.

As the price rebounded, funding rates moved back into positive territory, aligning with an increase in open interest activity. Sustained bullish funding rates imply that market participants remain optimistic about SUI’s long-term growth potential.

What do market indicators say?

The Alligator indicator on the 4-hour chart revealed a bearish alignment, reflecting short-term selling pressure.

Likewise, the Awesome Oscillator demonstrated negative momentum, with a pressure time value of -0.1086, despite a shift in its histogram.

Source: TradingView

The Chaikin Money Flow Index at -0.06 highlighted slight outflows, indicating limited buying interest at press time.

Despite these bearish indicators, however, SUI appears to remain in an ascending channel. This suggests that its overall bullish structure has remained intact.