The U.S. Securities and Exchange Commission (SEC) announced it has secured $4.5 billion from Terraform Labs as part of a record $8.2 billion in fiscal 2024 financial relief.

According to a November 22, 2024 press release, Terraform Labs, Hyperfund and NovaTech accounted for 81% of the total recovery, which included $6.1 billion in restitution as well as $2.1 billion in civil penalties.

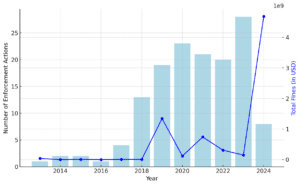

THE #SECOND set a new record in fiscal year 2024, collecting $8.2 billion in fines and penalties (a 65.57% jump from 2023).

More than half of that total came from the $4.47 billion settlement with Terraform Labs and #DoKwonfollowing 2022 #TerraUSD And #LUNA collapse.

The number of cases… pic.twitter.com/3sIyVCxvla

– TheNewsCrypto (@The_NewsCrypto) November 25, 2024

EXPLORE: SEC Returns $4.6 Million to Investors in Ethereum-Based BitClave ICO

Crypto Sector in Spotlight, Terraform Labs Leads Recovery

Although enforcement actions were part of the agency’s broader efforts to ensure compliance, the cryptocurrency sector remained a focal point of the SEC’s enforcement activities.

A significant portion of the recovery figure is due to the $4.5 billion judgment against Terraform Labs and its co-founder Do Kwon. The case, involving one of the largest securities frauds in U.S. history, accounted for 56 percent of the total financial relief awarded.

In January 2024, the SEC charged HyperFund with operating a fraudulent pyramid scheme that raised more than $1.7 billion from investors around the world. Meanwhile, NovaTech Ltd. was accused of operating a fraudulent crypto investment platform, amassing more than $650 million from more than 200,000 investors worldwide.

These two cases alone represented more than $2.2 billion in losses for investors, with operators facing charges for running pyramid schemes disguised as crypto investment platforms.

The SEC also targeted Silvergate Capital, accusing the company of misleading investors about its compliance programs and its oversight of high-risk crypto clients like FTX.

In total, crypto-related enforcement actions accounted for a smaller percentage of cases, but led to disproportionate financial recoveries. High-impact cases, such as those against HyperFund and NovaTech Ltd., have highlighted the agency’s focus on combating large-scale fraud schemes.

Social capital markets have reported a dramatic increase in fines related to crypto cases, up more than 3,000% from 2023.

The SEC also continued its crackdown on non-compliance with recordkeeping and marketing rules. More than $600 million in penalties have been levied against companies for recordkeeping violations, including early cases against city councilors.

Similarly, the SEC has targeted investment advisers for reporting misleading performance measures without appropriate safeguards, resulting in significant settlements.

EXPLORE: Indian police arrest suspect linked to $234 million WazirX cyberattack

Record SEC Collections Despite Fewer Actions, Focus on Crypto Firms

The Commission filed a total of 583 enforcement measures in the 2024 financial year, a decrease of 26% compared to the 787 cases filed in 2023. These included 431 stand-alone cases, 93 follow-up procedures aimed at ban or suspend people and 59 cases targeting companies. late in required deposits.

According to the report, despite this decline, financial remedies obtained far exceeded previous years, with a record $8.2 billion in civil penalties. Was this possible because crypto companies were targeted?

Gary Gensler, chairman of the SEC, who is set to resign after Trump’s victory, said: “The Division of Enforcement is a steadfast cop on the ground, following the facts and the law wherever they lead to seek account to the criminals. »

EXPLORE: Bitcoin hits record high as Trump wins US election

Ripple’s turning point, XRP soars amid settlement speculation

Ripple’s legal saga has continued to attract attention, with the community closely monitoring each development. Gensler’s unexpected resignation added fuel to the fire, sparking debate over its timing and implications.

Meanwhile, XRP has seen a stunning rally in recent days, surging nearly 200% and hitting a multi-year high of $1.60. The rapid price rise reflects renewed investor confidence, driven by speculation over a Ripple-SEC settlement and broader optimism in the crypto market.

Analysts have highlighted this rally as a pivotal moment, with XRP surpassing critical resistance levels and reviving hopes of a return to its previous all-time highs.

Market watchers believe Gensler’s departure could pave the way for new leadership at the SEC, potentially changing its stance on ongoing crypto cases. However, veteran analysts like Marc Fagel have cautioned against jumping to conclusions, citing the complexities of finalizing a settlement.

Additionally, the appointment of Scott Bessent as Treasury Secretary instilled a wave of confidence among investors. Known for his pro-crypto views, Bessent’s influence could steer the United States toward more favorable digital asset policies.

For Ripple and XRP, these developments represent a critical moment, which could redefine its trajectory in an evolving regulatory environment.

The article Terraform accounts for more than 50% of SEC’s record $8.2 billion enforcement effort in 2024 appeared first on .

THE

THE