Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is responded in Español.

Ethereum shows a renewed force while it is consolidated above the $ 2,500 mark, signaling resilience in the face of broader volatility on the market. After several weeks to test the region of $ 2,700, the ETH remains at a striking distance from this critical resistance, keeping an optimistic moment alive. The feeling of the market has changed in favor of Ethereum, analysts and investors increasingly pointing out the possibility of a next season.

Related reading

The Top Big CEDS analyst has shared technical ventilation, noting that ETH is currently back to a key mobile average after bending a movement above the $ 2,700 beach. This movement aligned itself on the underside of a level of key resistance, forming a confluence area which could act as a springboard or a point of rejection in the days to come.

While Bitcoin is just consolidated under its top of all time, Ethereum seems to gain ground while traders are looking for opportunities beyond the BTC. With ETH holding higher stockings and establishing a stable base, a break higher than the range of $ 2,700 to $ 2,800 could confirm a wider market rotation in altcoins. For the moment, the bulls must maintain control over $ 2,500 to maintain the intact structure and hopes of fuel from a higher movement.

Ethereum at a central level while the bulls defend support

Ethereum faces a crucial test because he has trouble recovering higher prices and confirming a sustained increase trend. After several attempts to screen the resistance zone of $ 2,700, the price was reached by volatility, creating an agitated environment which reflects a broader uncertainty on the cryptography market. Despite this, analysts remain optimistic about the prospects of Ethereum, especially since the alts-season chatter becomes stronger.

CHEDS recently shared a key overview: Ethereum is now back to its mobile average (DMA) at 20 days after having briefly exceeded the range of $ 2,700. This push encountered the underside of the simple 200 -day mobile average (SMA), creating a confluence area which could serve as a launch for the following rally, or the line in the sand which decides the short -term steering. Holding this DMA support is essential. If the bulls defend this level, it could point out a renewed force and trigger a break that returns ETH to $ 3,000 and beyond.

In the midst of increasing speculation and technical pressure, the current structure of Ethereum is still leaning optimistic. It maintains higher stockings and continues to show signs of accumulation, which supports the thesis of a possible season in allus in the near future. If BTC stabilizes and the ETH eliminates resistance, the entire market could change quickly.

Related reading

Ethereum tests support at short -term key levels

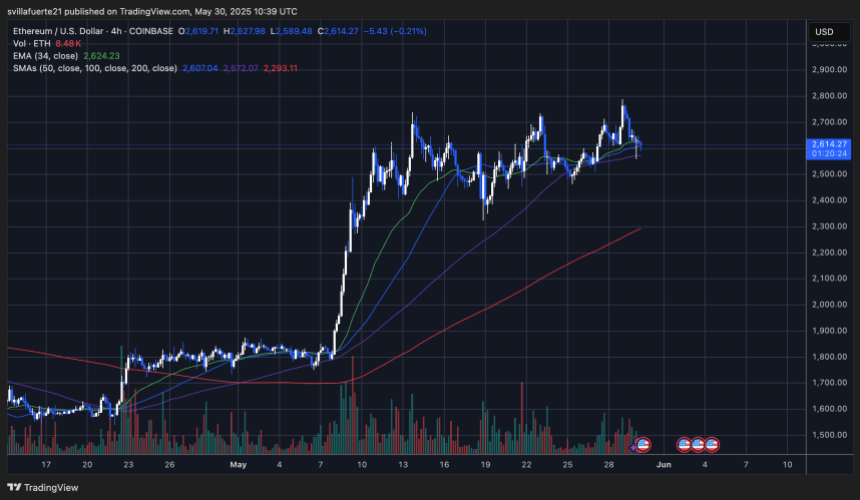

Ethereum is consolidated on the 4 -hour table while it oscillates approximately $ 2,614, after a minor withdrawal from the upper room of $ 2,780. The graph shows that the ETH retests the EMA of 34 periods (currently nearly $ 2,624) and found short -term support along the confluence of SMA 50 and 100 periods. These mobile averages act as a dynamic support strip which held firm during previous retractions in May.

The structure remains overall optimistic, with higher hollows maintained since the breakdown of May 9. However, the action of current prices forms a tightening corner model, which suggests that an escape – up or down – is imminent. The volume has slightly decreased, indicating a potential break before a decisive decision.

Related reading

For bulls, the detention of the $ 2,580 zone to $ 2,600 is essential. A rebound clean from here could set up another attempt to break the resistance zone from $ 2,700 to $ 2,800. On the other hand, a break below the 100 SMA could expose the ETH to a deeper retirement around $ 2,500, or even the $ 2,400 area if the sales pressure accelerates.

Dall-e star image, tradingview graphic

(Tagstotranslate) Eth (T) Ethereum (T) Ethereum Analysis (T) Ethereum News (T) Ethereum Pollback (T) Ethereum Resistance (T) Ethereum Retace (T) Ethusdt

Source link