Key notes

- Tether Gold (XAUT) crossed the milestone in the market capitalization of $ 1 billion on October 1, becoming the second tokenized gold product to do so.

- The value of the token has exceeded the threshold with the recent Gold rally at a new summit of more than $ 3,800 per OCE.

- The tokenized gold market now has a duopoly between Tether’s Xaut and the Gold Paxos regulated by the NYDFS (Paxg).

Tether Gold, a digital token supported by physical gold, has officially exceeded the $ 1 billion market capitalization brand. The milestone, reached on October 1, 2025, highlights the growing interest of investors for real assets in tokenized (RWA) and was largely motivated by a historic gathering in the Gold Prize, a feeling recently taken up by the CEO of Tether.

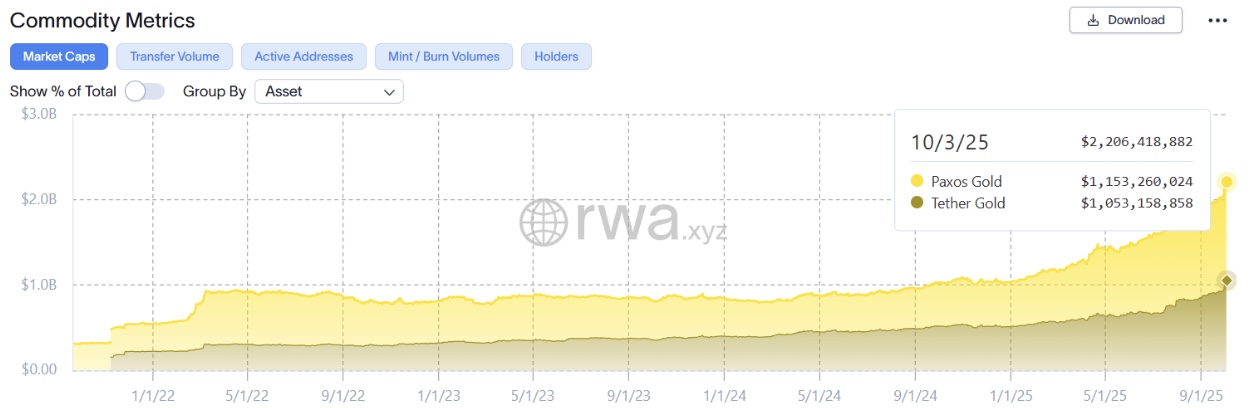

The market value of the token increased directly due to its underlying assets. According to the data aggregator on the Rwa.xyz market, the total value of Xaut officially crossed the billion dollars line at the beginning of the month. This price wave has directly increased the value of physical gold maintained in the reserve, pushing the total value of Xaut beyond the threshold. With this achievement, Xaut follows its main competitor, Paxos Gold, which reached the same stage a month earlier, September 3.

The success of the two tokens solidifies a duopoly in the digital golden space. He also underlines a mature market where investors now have two separate options and billions of dollars to be exposed to gold on blockchain. The Xaut gold support is maintained separately from the general reserves of Tether, which include an additional $ 8.7 billion in the gold bars supporting its other stablescoins, according to its T2 2025 certificate report.

Two billion dollars billion, two different strategies

-

Graphic showing Xaut and paxg superimposed on a chronology | Source: App.rwa.xyz

One of the most important distinctions is regulatory surveillance. PAXG is published by Paxos Trust Company, an American company regulated by the New York Department of Financial Services (NYDFS). On the other hand, Xaut is issued by a subsidiary of attachment approved in Salvador, placing it in a different international regulatory framework. It has long been a key element in Tether’s gold strategy, which works largely outside the strict American financial system.

Transparency and reports also differ. Paxos provides monthly reserve reports for Paxg, which are verified by the main accounting firms. TETHER provides quarterly certificates for its reserves, including XAUT, led by BDO Italia. This reflects the different standards of conformity to which each company adheres. The discussion around Tether’s Reserve Holdings was a coherent subject within the cryptographic industry.

The two tokens also seem to serve different user bases. Rwa.xyz data show that PAXG has a much larger base of more than 74,000 holders and a higher daily negotiation volume of approximately $ 67 million. Xaut has a more concentrated property, with just over 12,000 holders and a daily volume of around $ 23 million. This suggests that PAXG has a higher adoption among retail users, while XAUT can be favored by larger and native Crypto holders or institutions. These trends are important to look at because the prices of record gold could attract new types of investors in space.

The two tokens also diverge on a technical level. XAUT has significant multi-chaînes flexibility and now works on at least six blocks, notably Ethereum, Tron, Ton, Arbitrum, Polygon and Hyperliquid. On the other hand, Paxg remains exclusively on the Ethereum blockchain as an ERC-20 token and uses a variable cost structure based on the size of the transactions.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

As a Duckdao web3 and old CMO marketing strategist, Zoran Spirkovski translates complex cryptography concepts into convincing stories that stimulate growth. With training in cryptographic journalism, he excels in the development of marketing strategies for Defi, L2 and Gamefi projects.

Zoran Spirkovski on x