What is the difference between the impression of the attachment and a private organization such as the federal reserve printing money? Nothing.

And more and more, Tether becomes the new Fed, because she has now announced that she entered the precious metal market.

The company has just published its first certificate report for Tether Gold (XAUT), showing 7.7 tonnes of physical gold locked as guarantee. It is a daring decision to provide receipts in a market that does not easily distribute confidence.

An overview of the gold attachment market force

Tether Gold (XAUT) is now officially supported by more than 7.7 tonnes of physical gold, according to a third party certificate from BDO Italia published on Monday. This has more than $ 800 million in value.

So who knows – maybe Tether becomes better than the Fed?

By leading a wider change to hard active ingredients, Xaut went from $ 3,123 to $ 3,344 between late March and April, bringing market capitalization to $ 825 million. As Xaut grows, gold has a moment – just like tokenized gold.

@Tether_to published his first official certificate to Tether Gold ( $ XAUT ) For the first quarter of 2025:

– 7.7 tonnes of gold support 246 523 XAU ₮ chips ₮

– 770 million stock market dollars

– fully regulated in Salvador El

– Each token = 1 ounce troy of real gold stored in Switzerland. pic.twitter.com/7pzratpwfq– Satoshi Club (@esatoshicub) April 28, 2025

The CEO of Tether, Paolo Ardodino, made sure to stir up the flames, jumping on social networks to supervise Xaut as a golden alternative of the world of stablecoin.

“While central banks stack hundreds of tons of gold, Xaut should become the standard token gold product for people and institutions,” said Ardoino.

His statement comes as central banks are increasingly pivoting gold. A World Gold Council report revealed that 29% of central banks planned to strengthen their gold reserves in the next year.

Why the Xaut attachment and the gold gain ground

Digital Gold solves some old problems: no safe, no insurance premiums, no shipping. Xaut promises ingots without luggage.

But the path from Tether to legitimacy is still being examined. The recent certificate confirms that gold exists – but criticisms say that this is not enough. The absence of deeper financial disclosure continues to lift the eyebrows, echoing the familiar concerns of the USDT debate.

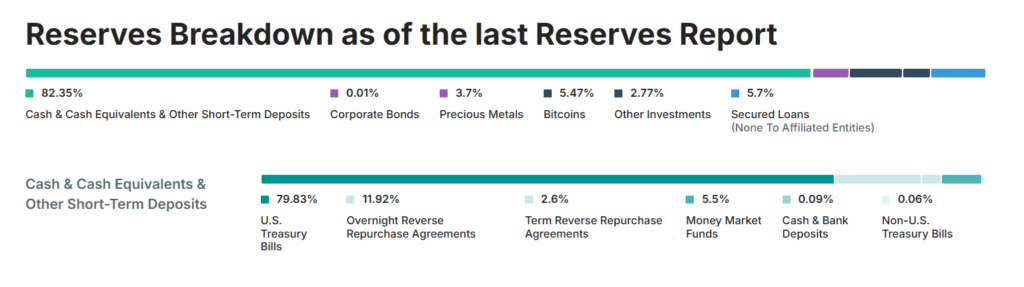

(Attachment reserves))

Despite this, it seems that Tether finally tries to clean his act. With Paxos and others that run in the same space, competition could finally force the tokenized gold market to tighten – or get rid of.

The new digital standard?

Xaut gives the capital opposite the risk of a path to the crypto without leaving gold behind.

Whether it becomes a flagship or simply a gamble on the flashy side, one thing is obvious: the gold on the chain begins to tend.

Discover: Best ICO ICO even to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Key dishes to remember

-

Increasingly, Tether becomes the new Fed because it has now announced that it entered the precious metal market.

-

Tether Gold (XAUT) is now officially supported by more than 7.7 tonnes of physical gold, according to a third party certificate from BDO Italia published on Monday.

-

Xaut gives the capital opposite the risk of a path to the crypto without leaving gold behind. .

The entire position has more than $ 800 million in gold: a look inside the Tether gold reserve appeared first on 99Bitcoins.