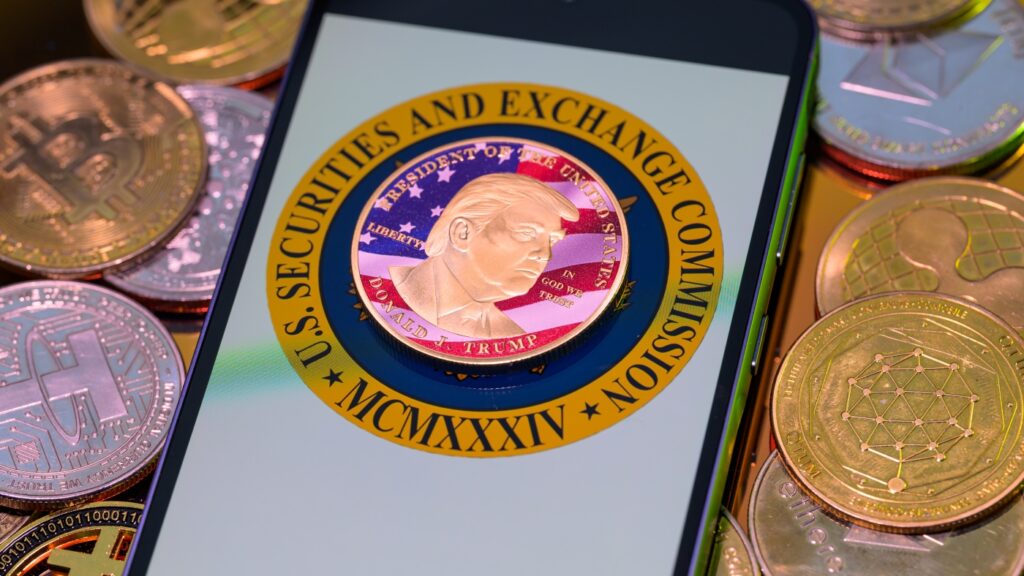

A photo illustration shows a representation of cryptocurrency parts with the $ Trump $ play (Coin collection) in Brussels, Belgium on Monday.

Jonathan Raa / Nurphoto via Getty Images

hide

tilting legend

Jonathan Raa / Nurphoto via Getty Images

President Trump announced plans for a “cryptographic strategic reserve”, which would set up the United States to buy and sell cryptocurrencies and could change the situation for industry.

In articles on Truth Social on Sunday, Trump said that a reserve was underway as part of his decree on digital assets published in January. He said that the reserve should contain five cryptocurrencies – Bitcoin, Ether, XRP, Solana and Cardano.

The prospect of a reserve is a major step in Trump’s vision to establish the United States as a cryptographic world capital – which was one of its promises during its candidacy for the president last year.

Here’s what you need to know.

The United States already have strategic stocks from other assets

The United States already has several strategic stocks, including military and medical equipment. The idea is that the government can use these special hiding places if necessary.

A stock and a reserve are sometimes used interchangeably, but a reserve often refers to the government playing a more active role in the management of assets than with a stock. In particular, Trump’s decree in January created a working group to assess the creation of a stock, but does not refer to a reserve.

Maintaining a federal reserve would probably mean that the government would buy actively and sell a cryptocurrency. While supporters say that crypto benefits could be used to reduce the country’s significant debt, criticism argues that the crypto is historically volatile and a speculative investment.

ESWAR PRASAD, professor of commercial policy at Cornell University who wrote the book The future of money About digital currencies, said the United States has a precedent to hold a stock of a speculative active ingredient: gold. Some have called Bitcoin “digital gold”.

But unlike digital assets, gold has a certain intrinsic value and the United States is not a key player in the gold market, according to Prasad.

“Bitcoin being a relatively new asset and given the type of amounts they are talking about, you know, (the United States) will become a very important player in this market,” he said. “The difference is therefore subtle but important.”

The reserve would hold five types of cryptocurrency

The United States contains around 200,000 Bitcoin tokens from criminal crises. On Monday, this corresponds to more than $ 17 billion in value, according to figures from the Exchange Coinbase.

With a reserve, these participations could be extended to also hold Ether, as well as three less known cryptocurrencies – XRP, Solana and Cardano.

Bitcoin is the oldest, most precious and popular cryptocurrency on the market. In market capitalization, Ether is second, with XRP in fourth, Solana in sixth and cardano in eighth, according to CoinMarketcap.com.

The president’s announcement led to important peaks in the five cryptocurrencies on Sunday, followed by declines the next day.

Certain donors of the eminent crypto said they were opposed to the creation of a reserve using assets other than Bitcoin. The CEO of Coinbase, Brian Armstrong, said on X: “Just Bitcoin would probably be the best option – the simplest and clearest as a successor to gold.”

A senator’s bill described how a federal strategic reserve could work

Trump did not publish more details on the plans of a cryptographic strategic reserve. But some proposals have been put forward on what she could look like.

Last year, republican senator Cynthia Lummis of Wyoming presented a bill to establish a Bitcoin strategic reserve, ordering the federal government to buy 1 million bitcoins – worth more than $ 86 billion at today – during the five years.

In December, Bitcoin Policy Institute, which promotes Bitcoin, prepared a proposal for the secretary of the Treasury, Scott Bessent who also approved a Bitcoin strategic reserve reaching 1 million bitcoins.

Prasad, the Cornell Professor, has feared that such a reserve to put the federal government in a delicate obligation, where it will become a major player in the cryptography market and largely influences the price of assets. Prasad added that if the government tried to liquidate its digital assets in order to withdraw its debt, it could lower the value.

“So, in a sense, the government acquires an asset which has not only a very volatile value, but where it plays a very big role in determining the price. And it would be essentially locked in these assets,” he said.

Bitcoin Policy Institute argued that, although the Bitcoin price is currently undergoing fluctuations, a federal reserve would be a long -term “financial resilience” tool for the federal government.

“As Bitcoin matures and its market deepens, its volatility is likely to decrease, which makes it more stable as a reserve of value,” said the group.

Trump has links with crypto and has eminent supporters of industry

Although Trump has once criticized Crypto, calling this a “scam” and “potentially a disaster that awaits to perform” in 2021, the president now has several links with the industry.

During last year’s campaign, Trump received millions of dollars of donations from investors and Crypto founders. He spoke at a Bitcoin conference last summer.

A few days before its inauguration, Trump also published a “same corner” cryptography, known as $ Trump. We do not know how much the token increased Trump’s net value, but that reported his willingness to kiss the crypto while he was heading towards power.

Trump and his three sons are also involved in a cryptocurrency startup, World Liberty Financial, who sells his own token.

Rafael Nam of NPR contributed the reports.