Bitcoin Price has resumed its upward trend this week when it was going through the large resistance to $ 97,000 and has reached its highest level since February.

Bitcoin (BTC) was exchanged about $ 96,500 in the last check on Saturday. This increased by 30% compared to the lowest in April. This article examines some of the three main reasons why it could reach a new summit of all time this year.

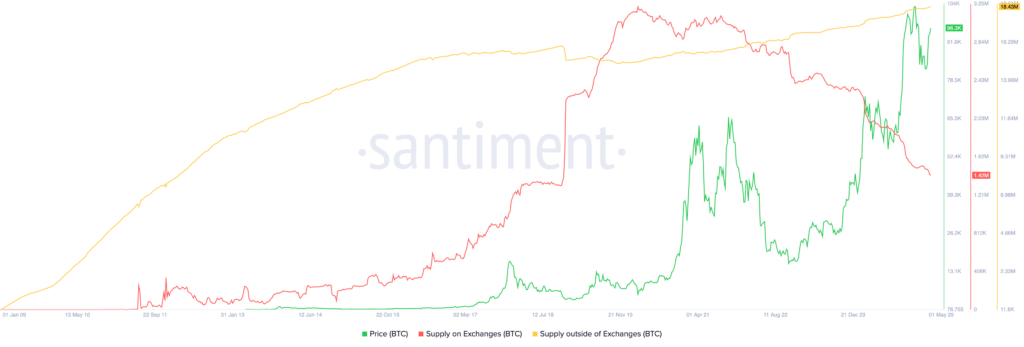

Bitcoin supply in exchanges decreases

The first main bruise aspect is that the bitcoin offer on exchanges increased to 1.42 million, the lowest level in more than six years. There are now 1.42 million pieces on centralized exchanges, its lowest level since November 2018. The offer amounted to 3.21 million at its highest level in 2018.

More data show that Bitcoin’s offer outside the exchanges reached 18.43 million. These figures mean that investors do not sell their parts, which can lead to a compression of the supply, because the continuous demand for the increase.

Some of the best Bitcoin holders do not intend to sell anytime soon. Michael Saylor’s strategy, which holds more than 2% of the total offer, continues to buy. Likewise, the best companies like Coinbase, Tesla, Galaxy Digital and Block have not suggested that they will sell.

The request for retail and institutional is high

The other main reason why the price of bitcoin will probably continue to increase is that retail and institutional demand continues to increase.

An indicator of this is the negotiated funds in Bitcoin. Sosovalue data show that the Bitcoin ETFs have only had four months of outings since their creation in January of last year.

These funds cumulatively added more than $ 40 billion in assets. The Ibit of Blackrock has 60 billion dollars in assets, while the FBTC ARKB and Ark Invest in Fidelity has 20 billion dollars and $ 19 billion respectively.

The increase in FNB entries is a sign of institutional demand in the United States, there are signs that the next demand phase will come from countries seeking to diversify from the US dollar.

These dynamics of supply and demand explain why analysts are very optimistic about Bitcoin. Standard approved analysts see the coin at $ 200,000, while ARK Invest expects it to reach $ 2.4 million in 2030.

In addition, the demand for Bitcoin should increase as trade tensions facilitate ease.

Technical analysis of the price of bitcoin

Finally, Bitcoin price has solid technical solids that can push it much higher in the long term. He stayed above the ascending trend line, connecting the lowest swings since August 5 of last year.

Bitcoin jumped above the level of resistance of the keys to $ 88,690, the neckline of the double-bottomed pattern. He also jumped above the exponential mobile averages of 50 days and 100 days.

Consequently, there are signs that he is gaining momentum, which will push him above $ 100,000 first, then at its top of all time.