The price of Dogecoin could be on the verge of a strong escape as forms of bull flag, the accumulation of whales accumulates and the funding rate remains positive.

DOGECOIN (DOGE), the largest crypto piece of memes, was negotiated at $ 0.2280 Tuesday, up 75% compared to its lowest level in April.

Technical analysis points to the overvoltage of the Dogecoin price

The daily graphic suggests that DOGE can approach an increased break. It forms a bull’s lifelong flag motif, characterized by a vertical rally followed by a consolidating rectangle. This configuration is generally associated with upward continuation.

Dogecoin is also about to form a mini golden cross motif, because the spread between the exponential movable mediums of 50 days and 100 days is turning.

Together, these models indicate the potential of an aggressive break once the flag formation is resolved. If this happens, the next resistance to the key to watch is $ 0.4815, the summit of November 2023. This level represents an increase of 110% compared to current prices. However, a drop below psychological support at $ 0.20 would invalidate upward perspectives.

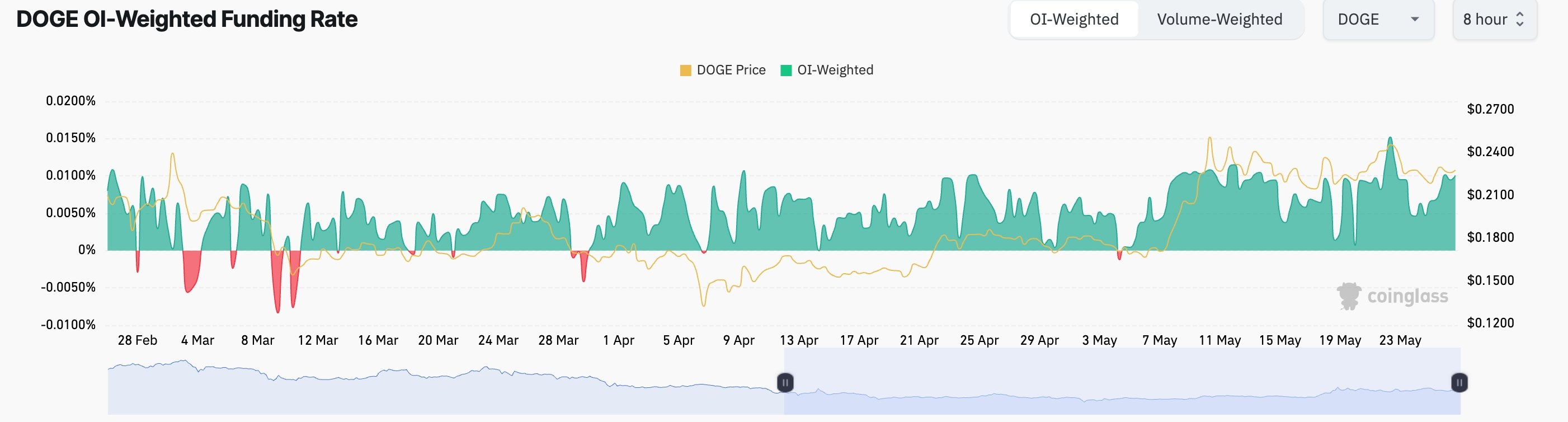

Dogecoin has a positive financing rate

Another bullish catalyst is the still positive financing rate of DOGE. According to CorciLass, the eight -hour financing rate has remained positive since March 31 and continues to climb.

In perpetual term markets, a positive financing rate occurs when long -term position holders pay costs to uncovered sellers, generally a sign that the feeling of the market expects prices to increase.

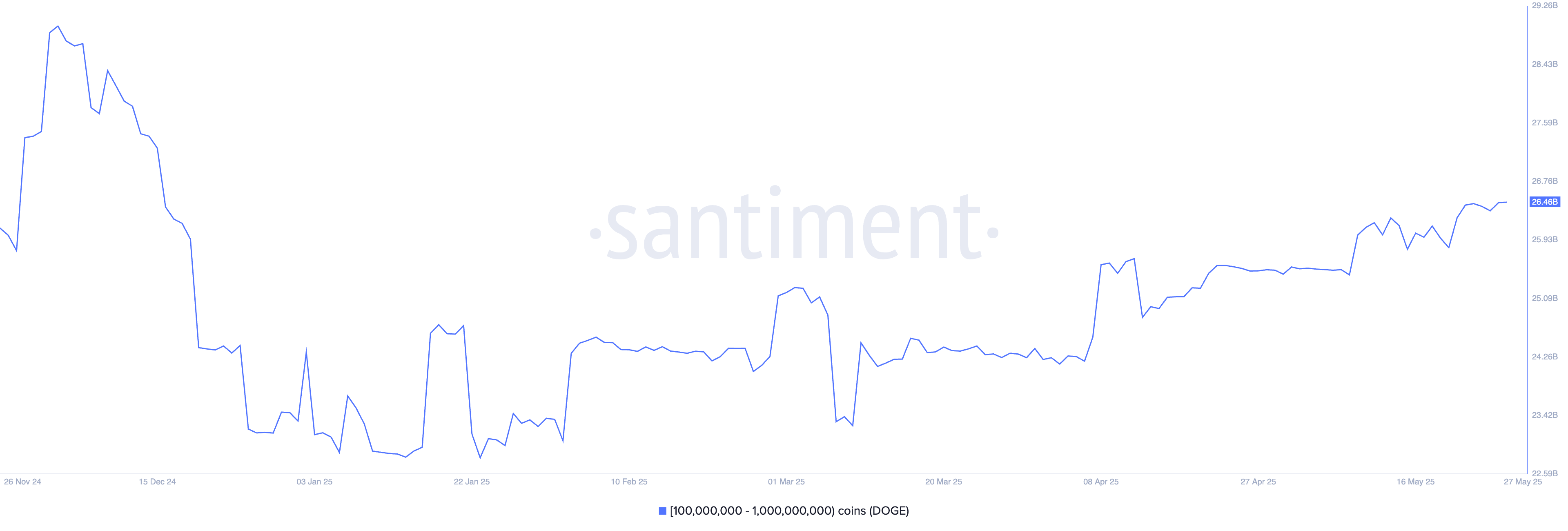

Doges whales accumulate

Additional data shows that large holders accumulate Doge, a sign of growing confidence in a continuous rally.

According to Santiment, the addresses holding between 100 and 1 billion DOGE now control more than 26.46 billion tokens, the highest level since December 2023. Their assets went from 23 billion tokens in January.

In support of this trend, the data show prolonged exchange since November 2023. Dogecoin has recorded more than $ 695 million in outings since April 1, which indicates that investors are moving coins for self -sufficiency, generally considered to be a long -term optimistic signal.