The data on the chain show that the Ethereum network has experienced a sharp increase in the weekly volume of whales, a sign that the interest in large money is back in the active.

The volume of Ethereum in large transactions has reached the highest since 2021

In a new post on X, the supplier of Sentora Institutional DEFI solutions (formerly intotheblock) spoke of the latest trend in the volume of Ethereum transactions.

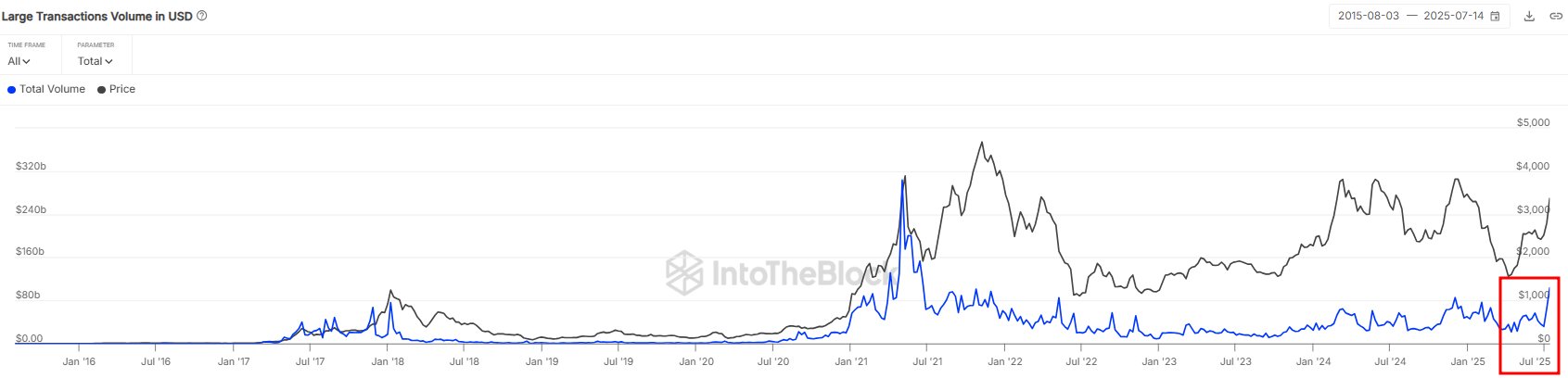

The “volume of large transactions” here refers to an indicator which maintains a trace of the total amount of volume which is moved to the ETH network by transactions valued at more than $ 100,000.

Generally, only investors the size of a whale are able to move quantities of this scale with a single transfer, so that the volume associated with these movements can be supposed to be a representation of the activity carried out by large money investors.

When the value of the metric increases, this means that whales increase their transaction activity. Such a trend can be a sign that their interest in assets increases. On the other hand, the lowering indicator implies that large holders can lose the interest of the cryptocurrency.

Now here is a graphic that shows the trend of the volume of large Ethereum transactions on the history of the medal:

The value of the metric appears to have been rising in recent days | Source: Sentora on X

As displayed in the above graph, the volume of Ethereum large transactions recently observed rapid growth, suggesting that whales have considerably increased their transaction activity.

Last week, the value of metric totaled more than $ 100 billion, which is the highest weekly level since 2021 Bull Run. This last wave of activity activity came in parallel to the escape of ETH which has now brought its price in the high levels of $ 3,000.

Although this is certainly a sign of high interest on the part of enormous entities, it is difficult to say if it is a positive. The volume of large transactions does not contain any information on the distribution between the movements of the purchase and the sale, so that its peak says nothing about what behavior is more dominant, just that these holders make a kind of movements.

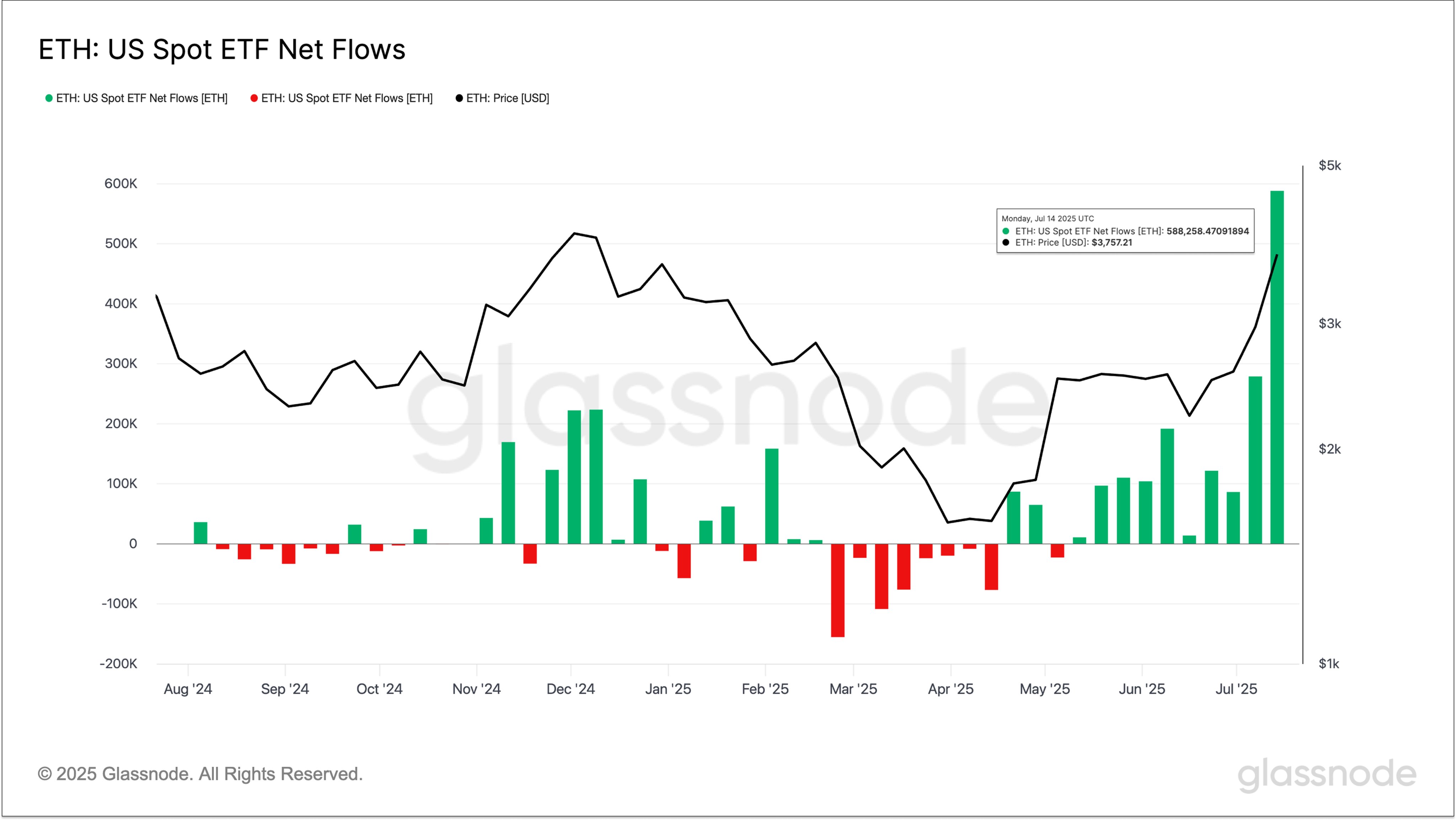

In some other news, the American funds for the exchange of Ethereum (ETF) spots have just seen a record week, as the Glassnode analysis company stressed it in a post X.

The trend in the netflow associated with the US ETH spot ETFs | Source: Glassnode on X

From the graph, it is visible that the ETF ETHEREUM ETF have come for green weeks for some time now, but the last one stands for the scale of control entries during.

“Last week, ETFS, ETHEREUM ETHERES, saw entries of more than 588,000 ETH – almost 17 times the historic average and more than double the previous record,” notes Glassnode.

Ethn price

At the time of writing this document, Ethereum is negotiated about $ 3,730, up 2% compared to last week.

Looks like the price of the coin has been climbing up recently | Source: ETHUSDT on TradingView

Dall-E star image, Glassnode.com, intotheblock.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.