- XRP relied on the support of the whales twice after the election, making it a crucial metric to look at.

- Is the $ 2 support level suspended by a wire?

Ripple (XRP) plunged $ 2.10 in the middle of the recent slowdown in the market, recording a single day drop by 8.06% – one of the steepest among high capitalization assets.

After the election, XRP closed twice below $ 2, in the range of $ 1.95 to $ 1.98, which sparked significant rallies of 71% and 53%, respectively.

These rebounds were not coincident – they were driven by whale wallets injecting billions into the large XRP book. Each dive coincided with an increase in institutional entries.

Now, while Ripple revisits this critical support area, is the question: another escape is imminent?

Key threat to support at $ 2

In a recent analysis, a market strategist warned that an XRP’s $ 2 support violation could trigger his “final game”, signaling a deeper break.

This prompted Ambcryptto to dive deeper into the possible factors at stake.

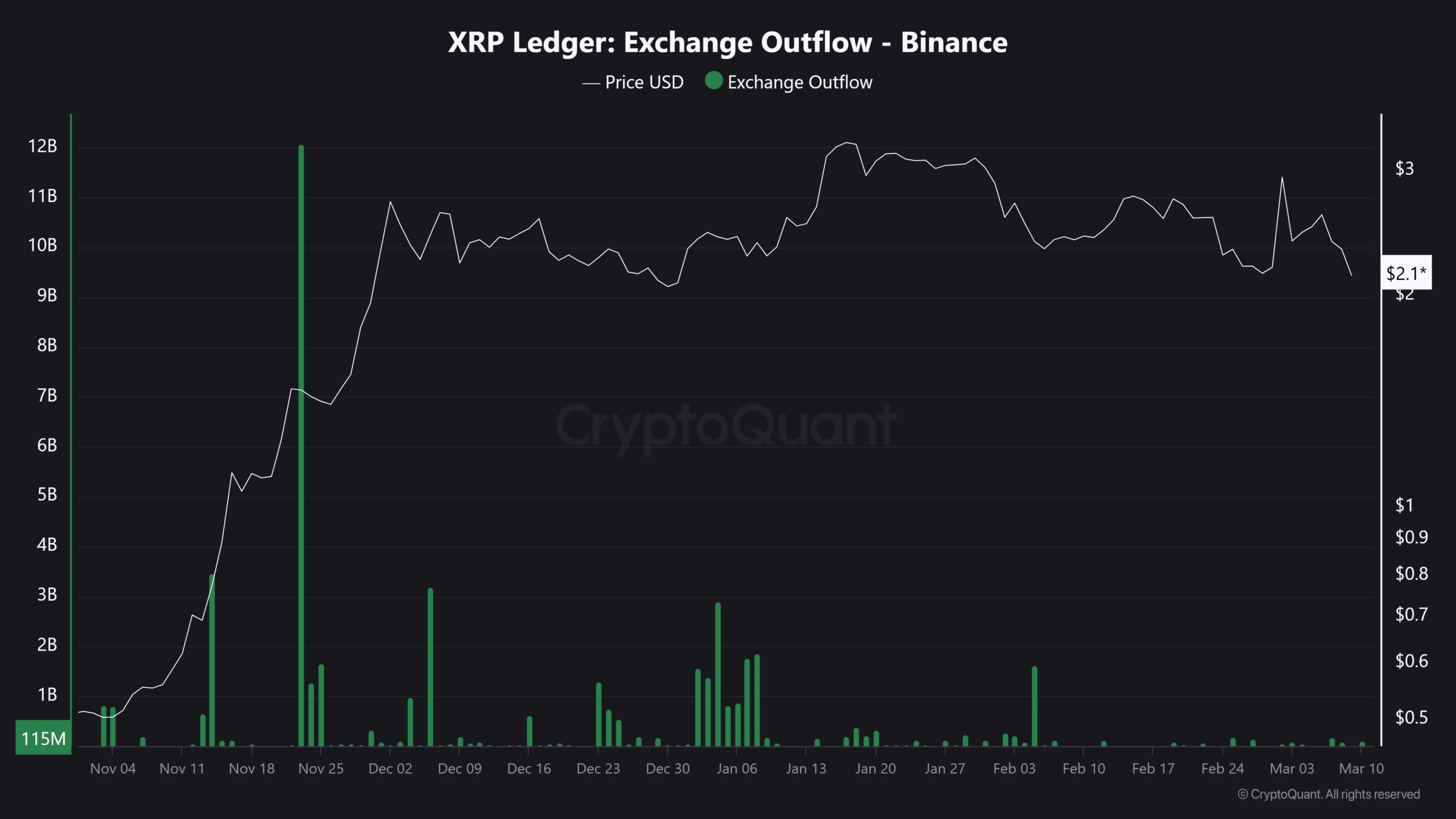

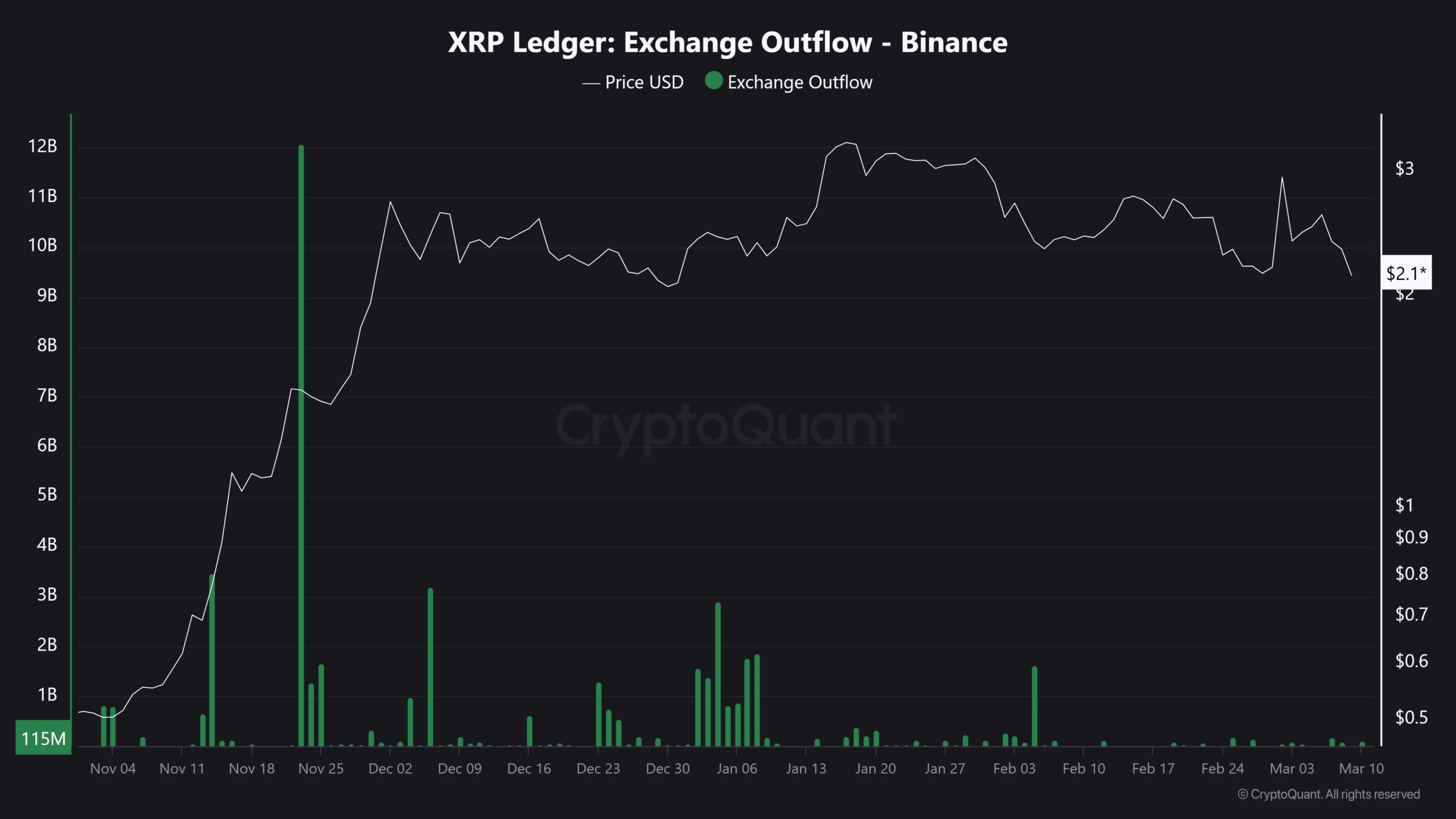

FOMO, a key liquidity driver in detail, has been absent since the electoral rally. Binance’s outings, which previously increased to 12 billion XRP, have now fallen to 115 million.

Source: cryptocurrency

Adding to the concern, during the two previous declines of XRP below $ 2, the outings fell to only 10 million XRP, which indicates that small retail investors were reluctant to buy the decline.

At the same time, long -term merchants are also withdrawing. The open interest of XRP (OI) dropped from 6.38% to 3.17 billion dollars, a sharp drop compared to the peak of $ 7.80 billion on its gathering in mid-January.

With the narrowing of liquidity and the decline of the FOMO, the possibility of recovering $ 3 seems more and more thin, increasing fears that the $ 2 support level of RIPPLE remains unstable.

Does XRP lose its grip on the market?

Less than two weeks after talking about the “potential” inclusion of XRP in the strategic reserve sparked a counterpoup, the market response was decisive.

In one day, Ripple dived by 18.79%, undergoing a much greater drop than the drop of 8.10% of Bitcoin.

Although it is the most efficient high -end asset of 2024 by YTD growth, a repeated rally in 2025 remains uncertain.

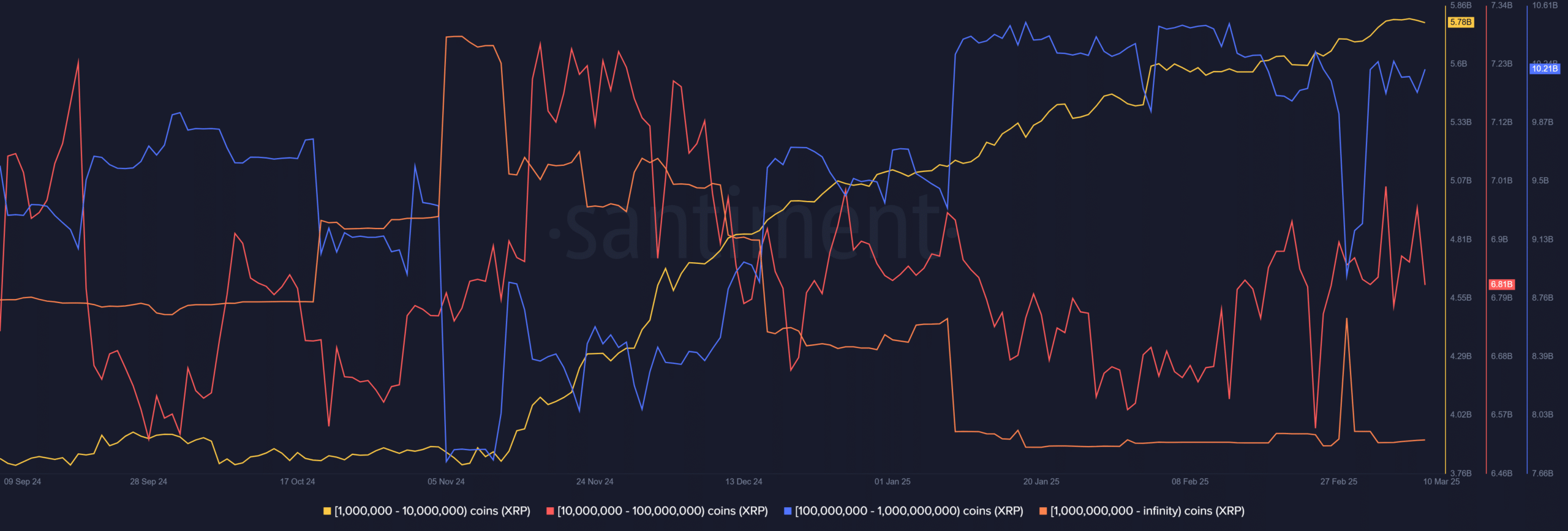

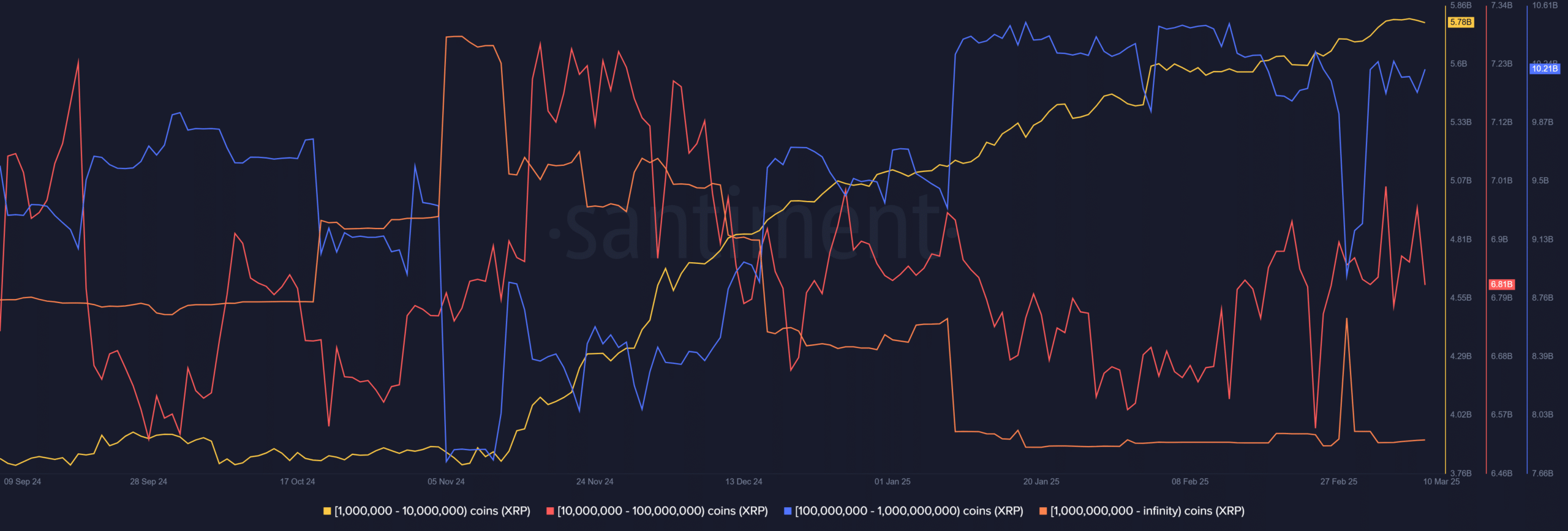

The key now lies with the main holders, whose accumulation has defended the level of $ 2 so far.

Source: Santiment

With the increase in volatility, the demand for detail decreases and the long -term liquidity dries up. There is no institutional support for an XRP reserve.

The level of support for $ 2 is now faced with an increasing pressure. The main holders remain the last line of defense to maintain this critical support area.