Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

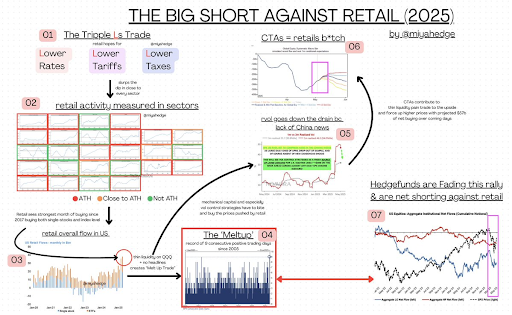

The Miya market commentator has described an interesting theory on why Bitcoin price is ready to reach $ 110,000 by the end of the year. The expert referred to the current macro-conditions and the way it is required to promote the flagship crypto at the end of the day.

Why the price of Bitcoin will reach $ 110,000

In an analysis Entitled “The Big Short against Retail”, Miya predicted that the Bitcoin Prize reaching $ 110,000 by the end of the year. At the same time, the expert expects the S&P 500 to fall to 4,700. She estimated that The stock market Going around a bad summer, which is why she expects a lower low on the SPX but a “virgin” bitcoin.

Related reading

Basically, Miya expects the price of Bitcoin to benefit from any potential drop -down trend on the stock market, investors considering it as a flight to security. She pointed out that the market is heading for a terrible macro situation, which could cause crushing actions. These predictions came when the expert commented on the nine consecutive green days whose actions have appreciated and why she believes that she will not last long.

The market commentator noted that Donald Trump made three main promises to the market: lower rates, prices and taxes. These promises should be held, and it claims that the market assesses them as a safe thing. Merchants are currently betting on a drop in rate in June, while the United States and China should meet to agree with a lower price. Weaker taxes could occur as a result of a successful pricing policy.

Thanks to this, the stock market has experienced an upward trend of nine days, while retail merchants have made profits by buying the decline. However, Miya warned that the market is not as strong as it seems and could soon explode, the price of Bitcoin benefiting when this projected accident occurs.

Why the stock market is required to crash

The expert noted that this false idea of the only time retail investors The illusion of complacency, as they currently do with their $ 57 billion offer in addition to the actions accumulated. However, she pointed out that ultimately, this will take place with the “container recession trade” hitting the United States in five days. BTC should be a coverage against this macro situation, which would result in an increase in bitcoin prices.

Related reading

Miya explained that all ‘MAGNIFICENT 7“The income of the last season was massively biased and was” unnecessary information “, which means that it cannot be invoked to show a solid market. She added that TMT companies that manufacture physical equipment generally manufactured waves, so that real impacts will appear in their H2 Capex on the results of the first trimester, which means that the impact of prices has not exactly started to launch.

When writing these data from CoinMarketCap.

Pixabay star image, tradingView.com graphic