Bitcoin officially struck its previous summit of $ 112,000, going to $ 118,000 just hours ago and entering an Uncharted territory for the first time since the end of May. The escape confirms the bullish momentum after weeks of consolidation and unsuccessful attempts, the action of prices now showing a clear force. With the authorized $ 112,000 psychological and technical barrier, many analysts think that this decision could mark the start of the next Bitcoin expansive rally.

Related reading

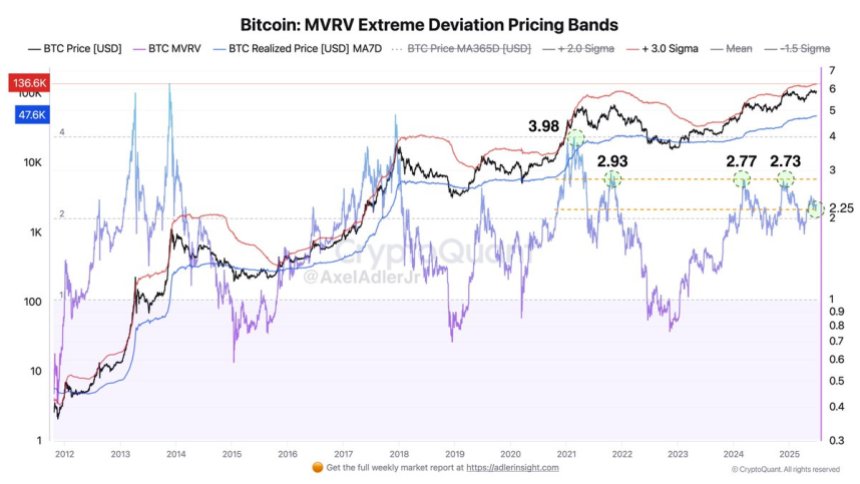

The bulls firmly have control and the metrics in chain support this story in small groups. According to the new cryptocurrency data, the MVRV price bands (market value with the value achieved) are currently at 2.25. Historically, Bitcoin enters the overheated area around 3.0 or more, which suggests that there is still room for growth before reaching an excessive evaluation territory.

This metric, which measures the gap between the market price and the value achieved, helps to identify when the BTC is exaggerated or undervalued in relation to past performance. At current levels, data indicate a potential of continuous increase without concerns of major overheating, fueling the confidence that this escape could extend more.

Bitcoin enters the expansion phase as a market for $ 130,000

After weeks of tight consolidation below the $ 110,000 mark, Bitcoin finally broke out, signaling the start of a new market phase. The escape above the previous summits has rekindled the optimism of investors, not only for the BTC but also for the larger Altcoin market, with many altcoins which are now growing above the levels of resistance of the keys for the first time in months.

This decision comes in the middle of an increasing anticipation of a weakened US dollar and inflationary pressures because Washington adopts more loose tax policies. The market is increasingly tariff in the effects of tax reductions, high government spending and dominant political rhetoric – all of which create a favorable environment for risk assets such as Bitcoin.

However, the macro backdrop is not without risk. US Treasury yields remain high, distressing the underlying systemic stressful warnings on the credit markets. This tension highlights the fragility of the current rally and the importance of monitoring fundamental changes.

Top analyst Axel Adler shared information using the MVRV oscillator, a model that compares Bitcoin’s market value to its value achieved. According to Adler, historical data in the past four years suggest that when MVRV reaches 2.75, Bitcoin tends to face its first wave of significant sales pressure. If the same scheme is true in this cycle, Bitcoin could reach around $ 130,900 before seeing a significant activity.

Although MVRV’s current reading remains this threshold below, the model offers a clear signal of how long-term holders can start unloading. Until then, the break opens the way to a higher potential leg, with bulls now in control, pushing towards the discovery of prices and a possible test of the $ 130,000 area.

Related reading

BTC is entering an unexplored territory with a strong momentum

Bitcoin officially broke into the discovery of prices after exploding by its high resistance of all time almost $ 112,000. The 3 -day graph shows a massive optimistic candle pushing the BTC at $ 118,683, representing a gain of 8.94% during the last session. This escape is the first clear sign of a strong continuation increased after weeks of lateral consolidation below the resistance of the keys.

The graph highlights a structure to break manuals. BTC respected the support zones of $ 103,600 and $ 109,300 several times in May and June before finally taking enough momentum to pierce the upper resistance. The recent increase came with a notable peak in volume, adding confidence to the sustainability of the rupture.

The displaced averages also confirm the upward trend. The SMA 50, 100 and 200 lines remain aligned upwards with an increasing separation, which suggests that the market structure remains strong and that the trendy continuation is likely. Bitcoin is now negotiated well above all the mobile averages, strengthening the strength of the rally.

Related reading

Without the historical resistance levels above, BTC enters a phase of price discovery. The next psychological target for bulls will probably be $ 120,000, followed by the level of resistance based on MVRV around $ 130,900. As long as BTC is more than $ 112,000, the momentum remains decisively in favor of Bulls.

Dall-e star image, tradingview graphic