The first market analyst, Ali Martinez, shared data on the chain that lean in Bitcoin to reach an evaluation of $ 130,000, although one condition. This upward prediction of prices comes from a slight price rebound of 2.6% in the last two days, pushing Bitcoin in the price range of $ 118,000.

$ 110,000 appears as a crucial bitcoin support area – here is why

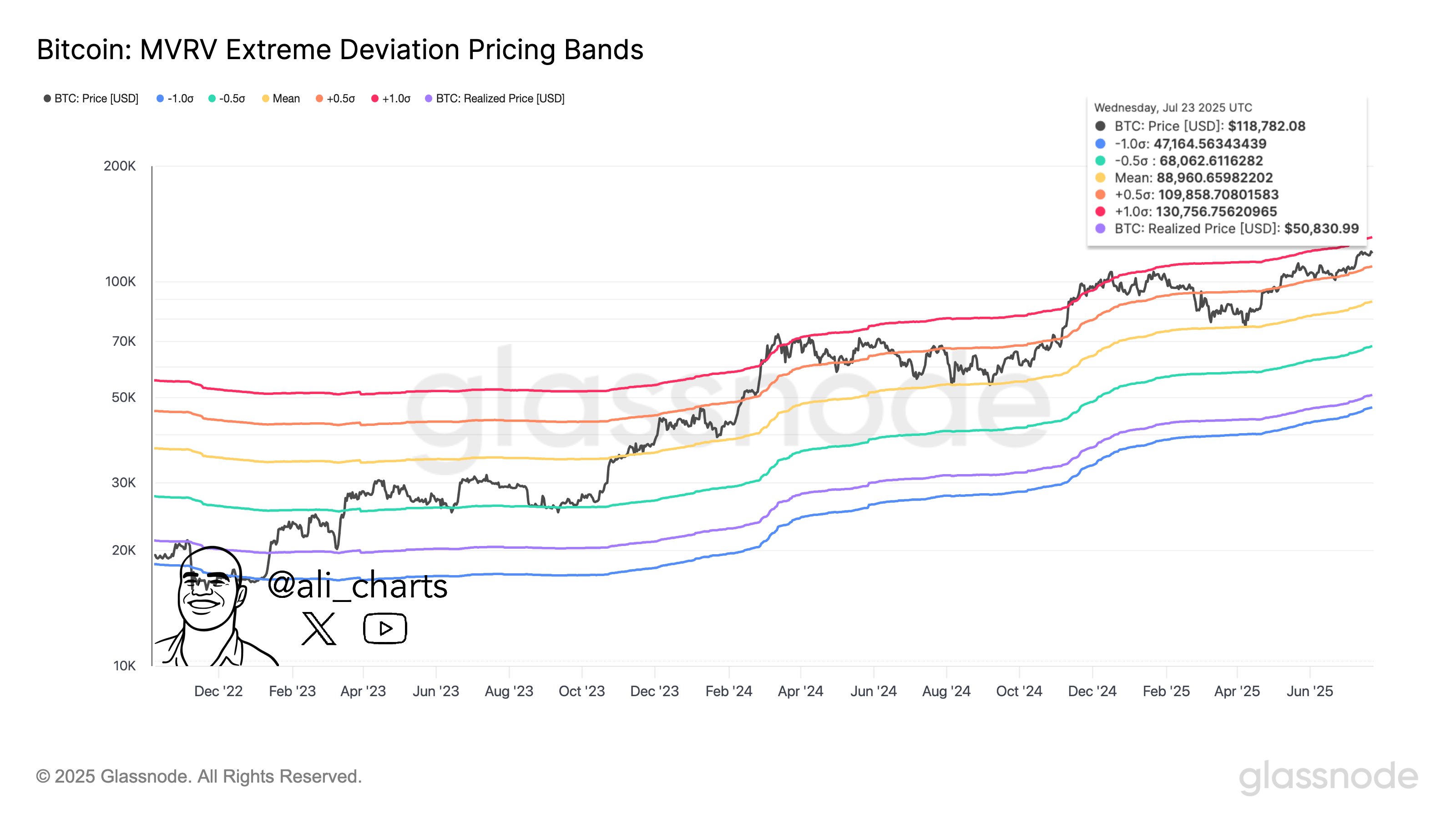

In a post X on July 26, Ali Martinez postulates that Bitcoin could be on the right track for a significant leg more based on recent data of MVRV pricing bands by Glassnode. However, the first cryptocurrency must avoid losing a certain support area to avoid an invalidation of this upward thesis.

MVRV bands, derived from market value reports to the value achieved (MVRV), help visualize when bitcoin is either overvalued or undervalued compared to its historical price. These bands work like Bollinger strips but are based on the fundamental principles of the chain, depending on the statistical differences around the average MVRV value.

As of July 23, 2025, Bitcoin was negotiated at around $ 118,782, following a regular rise in recent weeks. According to the MVRV pricing model, the cryptocurrency oscillated just under the deviation band + 1.0σ, marked at $ 130,756, representing the next resistance and main target. In particular, the band + 1.0σ is also interpreted as a key area of extreme market optimism, often preceding local summits ( + 2.0σ)

On the other hand, the band + 0.5σ of the model was $ 109,858 below current market prices, serving as a vital support threshold. Ali Mariner explains that Bitcoin must maintain its price level above this band to maintain a high probability of continuation to the level + 1.0σ target based on historical models. However, a breakdown of less than $ 110,000 could indicate a deeper correction, potentially up to the average band at around $ 88,960, or less to $ 68,062 (-0.5σ).

Bitcoin investors make profits with growing market confidence

According to more data from the MVRV model, the growing distance between the price made of the BTC, around $ 50,831, and its current market price reflects an increasing conviction of investors. For the context, the price made represents the basis of the average cost of all traffic parts, thus indicating how deep the average profit is the average Bitcoin holder is for the moment.

At the time of the press, the first cryptocurrency is negotiated at $ 118,178 after 0.73% in the last day. However, the daily trading volume is considerably decreasing by 53.39% and valued at $ 47.98 billion. According to the coinciocese price prediction site, the feeling of the Bitcoin market remains largely optimistic, the Fear & Greed index approaches extreme greed at 72 years.

Coincocex analysts project the main cryptocurrency to maintain its current rebound, going to $ 122,019 in five days and $ 141,075 in a month.