Bitcoin is now negotiated at a critical level, now stable above support of $ 81,000, but still has trouble recovering the resistance of $ 88,000. After weeks of volatility and macro-piloted movements, BTC seems to consolidate above the key support levels, the bulls starting to resume momentum. While the financial markets are adapting to a new wave of global uncertainty, the cryptography market has short -term clarity, aroused a renewal of optimism among investors.

Tensions between the United States and China remain a dominant theme, continuing to weigh a wider financial feeling. Price policies and diplomatic friction have led to prudent positioning in the world markets. Despite this, the stability of Bitcoin above the $ 81,000 area fuels speculation according to which a break can be close, especially since the metrics in chain and ultimately show the strengthening of force.

According to cryptocurrency data, the market for future Bitcoin shows signs of bullish momentum. Open interest increases in tandem with a sharp increase in the financing rate, indicating an increased demand for long positions. In addition, the volume of purchase of lessee is also increasing, indicating that aggressive buyers are beginning to intervene. If this trend continues, Bitcoin could be ready for an important movement in the coming days.

Bitcoin is consolidated as term data show the increase in the momentum

Bitcoin continues to consolidate in a narrowing range, taken between global economic uncertainty and renewed speculative interest. With a price holding company above the support area from $ 82,000 to $ 81,000 but unable to recover the level of $ 86,000, the market remains undecided. The wider macroeconomic backdrop – in particular the climbing of trade tensions between the United States and China – is now a key engine of feeling. As prices increase and diplomatic friction threatens to push the global economy into a recession, risk assets like Bitcoin are under pressure.

Despite weeks of investor sales and prudence, Bitcoin has managed to avoid a breakdown, fueling speculation that the worst of the correction can be finished. While many analysts have gone down after a year which was to be optimistic, others look at emerging data which suggests a possible change of momentum.

Cryptoquant analyst Axel Adler has shared information according to which activity on the market for future Bitcoin is now raised. Open interest has increased significantly, reporting that traders take more directional bets. More specifically, there has been a high increase in the funding rate, pointing out a preference for long positions. In addition, the purchase orders for takers have increased, which suggests that aggressive buyers intervene. If this trend continues, Bitcoin could position for an escape from its current consolidation phase.

BTC hovers around the medium keys in the form of a bull rupture

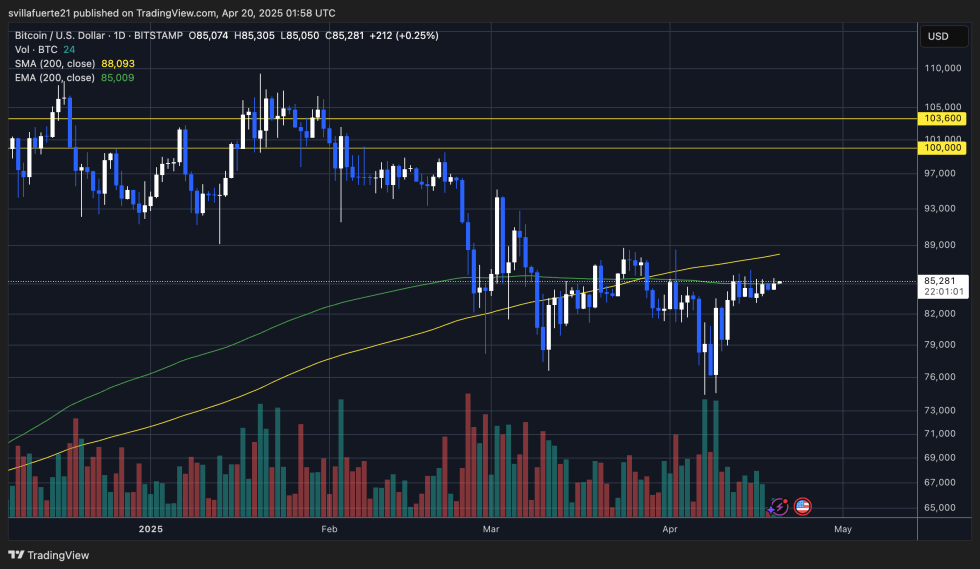

Bitcoin is currently negotiated at $ 85,200, sitting on the right on the exponential mobile average of 200 days (EMA) and just below the simple 200 -day mobile average (MA). This area has become a pivotal battlefield for bulls and bears while the market awaits a decisive decision. To confirm a recovery rally and return the wider upward trend, the BTC must recover the level of $ 90,000 with a strong dynamic and volume.

Until then, consolidation remains the dominant scenario. The price was higher in the support of $ 81,000 and below the resistance of $ 88,000 for several days, without a clear break in sight. This tight corridor reflects market indecision and cautious optimism in the middle of persistent macroeconomic uncertainty.

Merchants look closely at this area. A strong thrust above the resistance from $ 88,000 to $ 90,000 could open the door to fresh heights and renew the haus feeling. However, not holding the current levels, especially if BTC breaks down below $ 81,000 – could expose the market to a risk of additional decline. For the moment, Bitcoin seems to be in a maintenance scheme, strengthening the strength of its next major movement. Whether this decision is increasing or downwards will likely depend on future economic developments and the feeling of global risk.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.