- The activity of the BTC network reported a disturbing slowdown, reflecting the weakened feeling of investors.

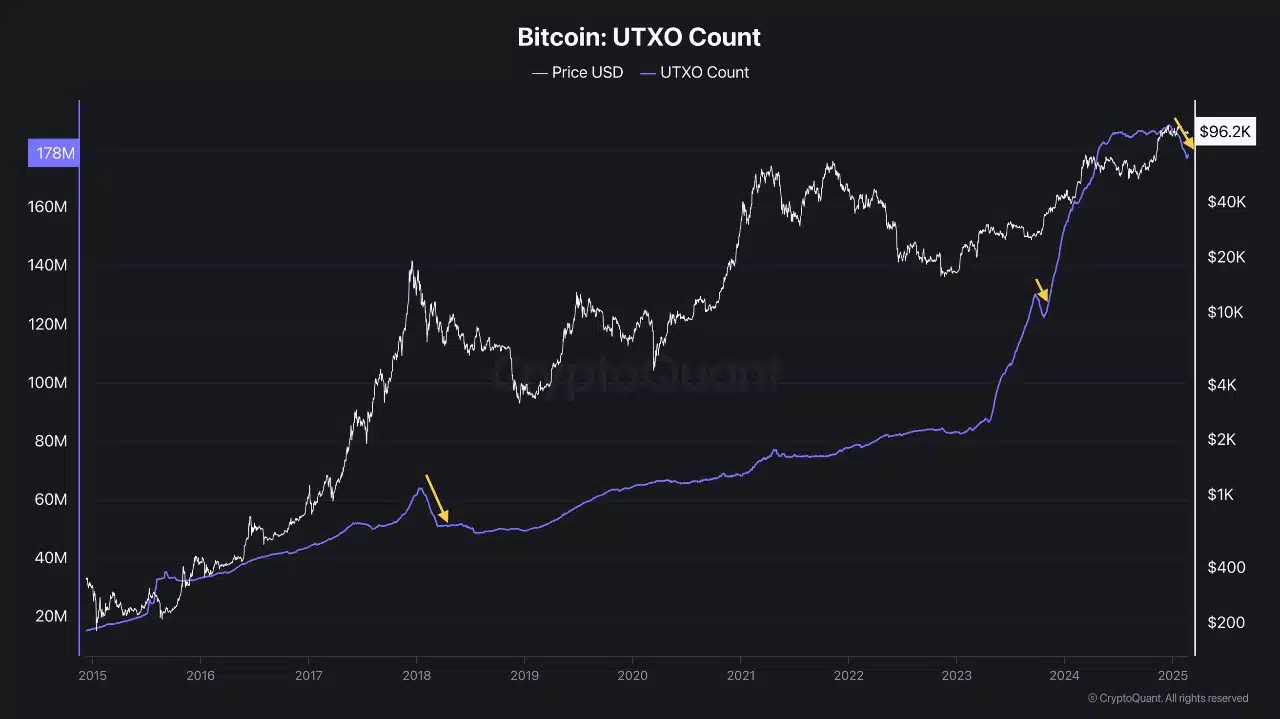

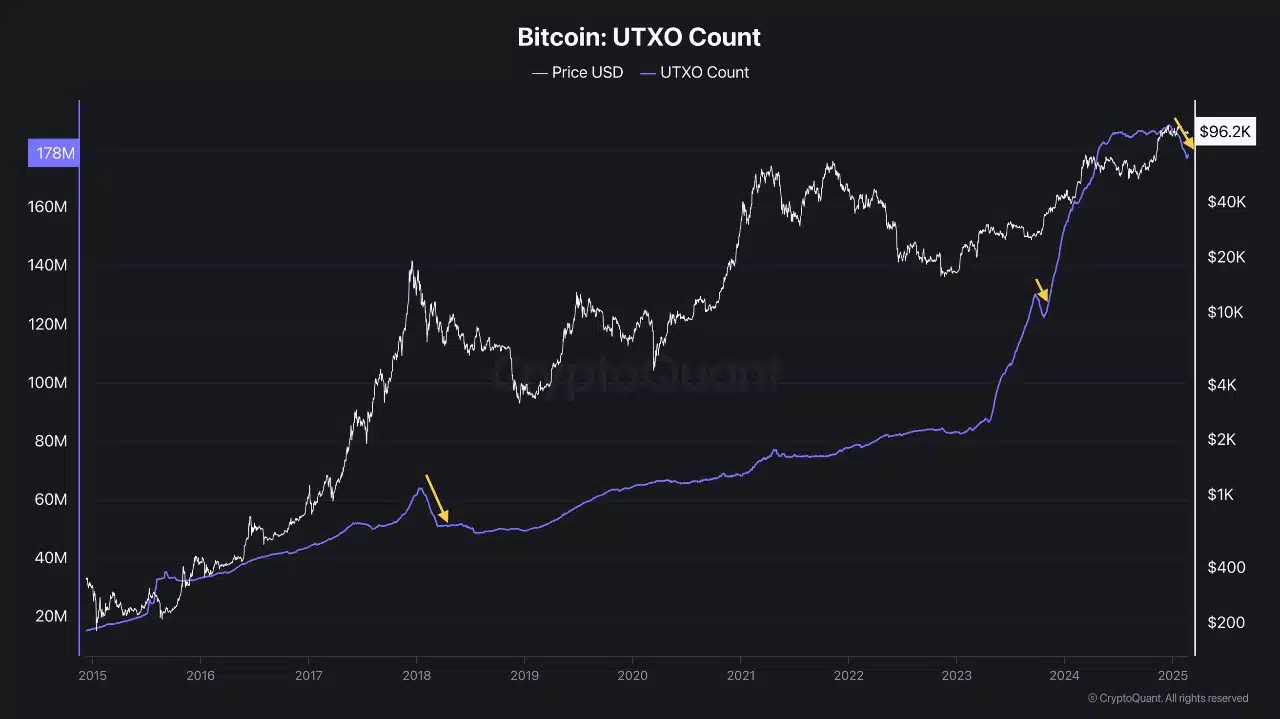

- The UTXO Bitcoin number, recorded from 2015 to 2025, notably decreased at the beginning of 2025, falling at levels comparable to the correction of September 2023.

The activity of the Bitcoin network (BTC) reported a disturbing slowdown, reflecting the weakened feeling of investors. Active portfolios, transactions and UTXO number are tied downwards, reflecting past correction periods.

The accumulation rate of Bitcoin Spot ETF has also slowed down, with recent capital outputs noted.

Less hands on the market

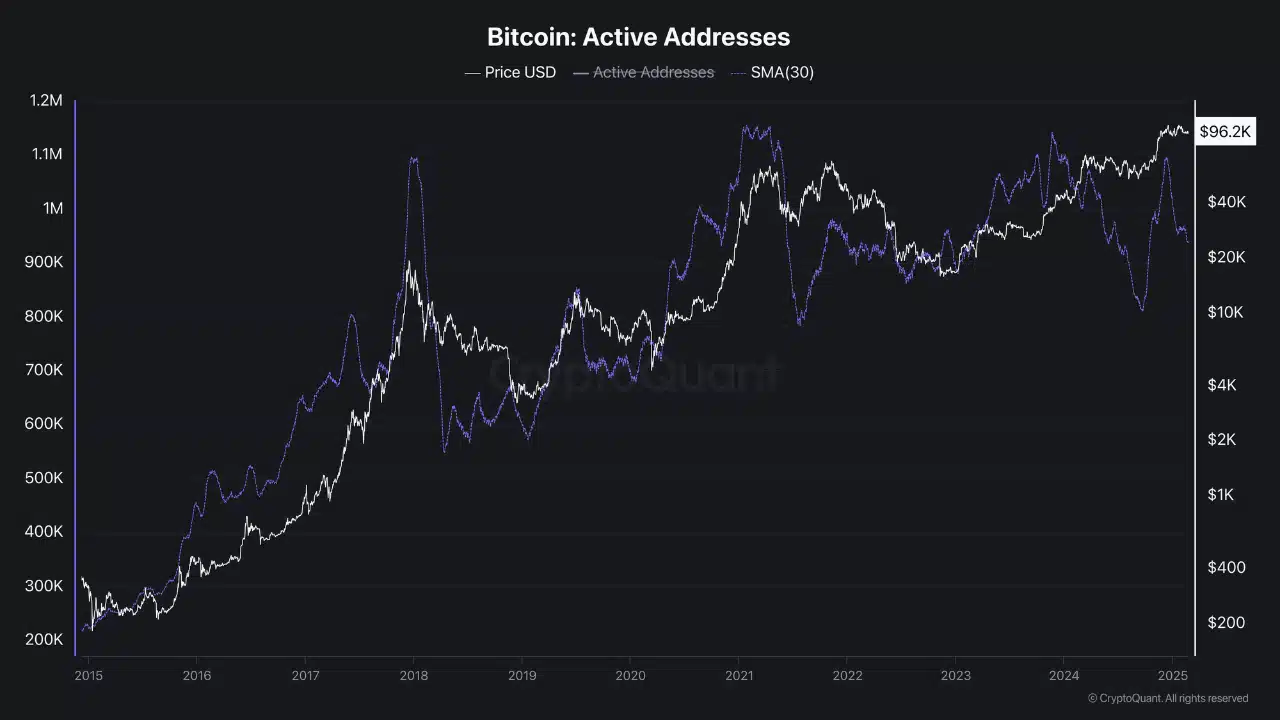

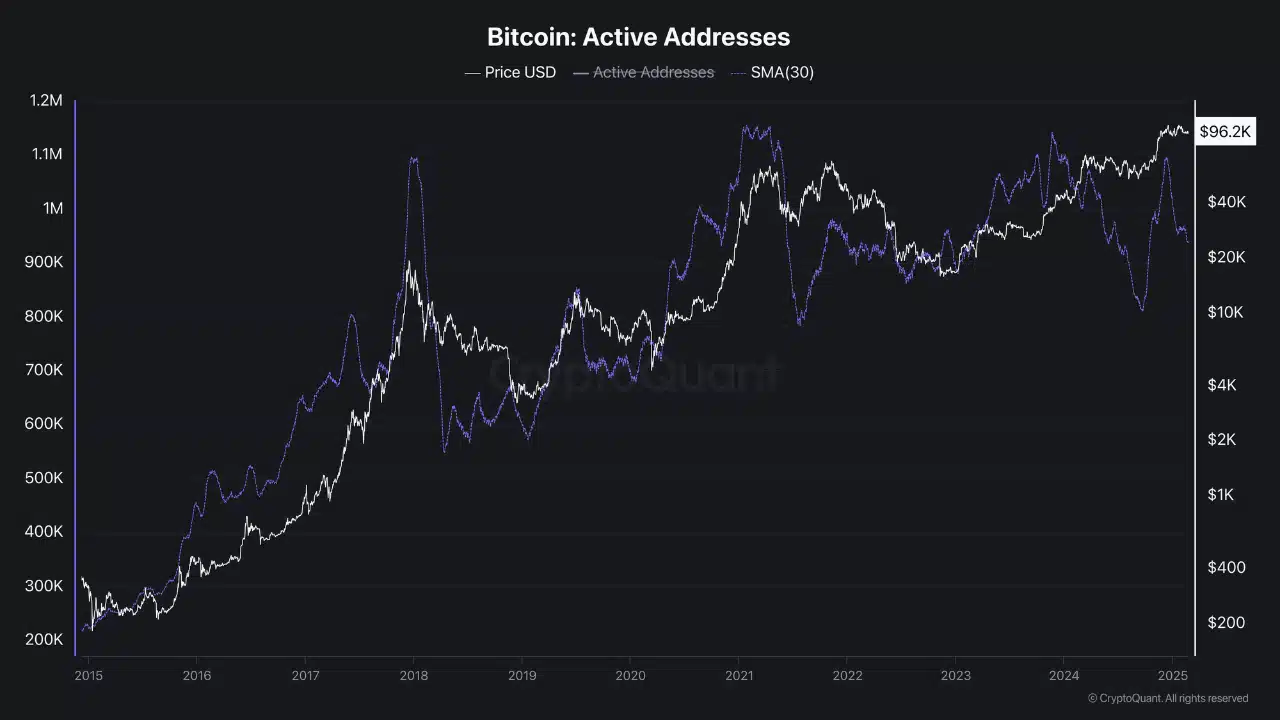

Consequently, the active addresses of Bitcoin decreased sharply at the beginning of 2025, the metric culminating nearly 1.2 million in 2021 and falling to 900,000 by 2025.

Source: cryptocurrency

This drop in bargaining volumes indicated a reduction in network participation, which argues concerns about a potential investor exodus, similar to the peak of the market cycle in 2017.

In addition, the decline suggested declining confidence, motivated by geopolitical tensions and the lack of legislative action adapted to Bitcoin.

If this trend continues, the Bitcoin price, currently at $ 96,200, could face prolonged consolidation similar to March 2024, unless new catalysts emerge.

Bitcoin: a temporary drop or a change of market?

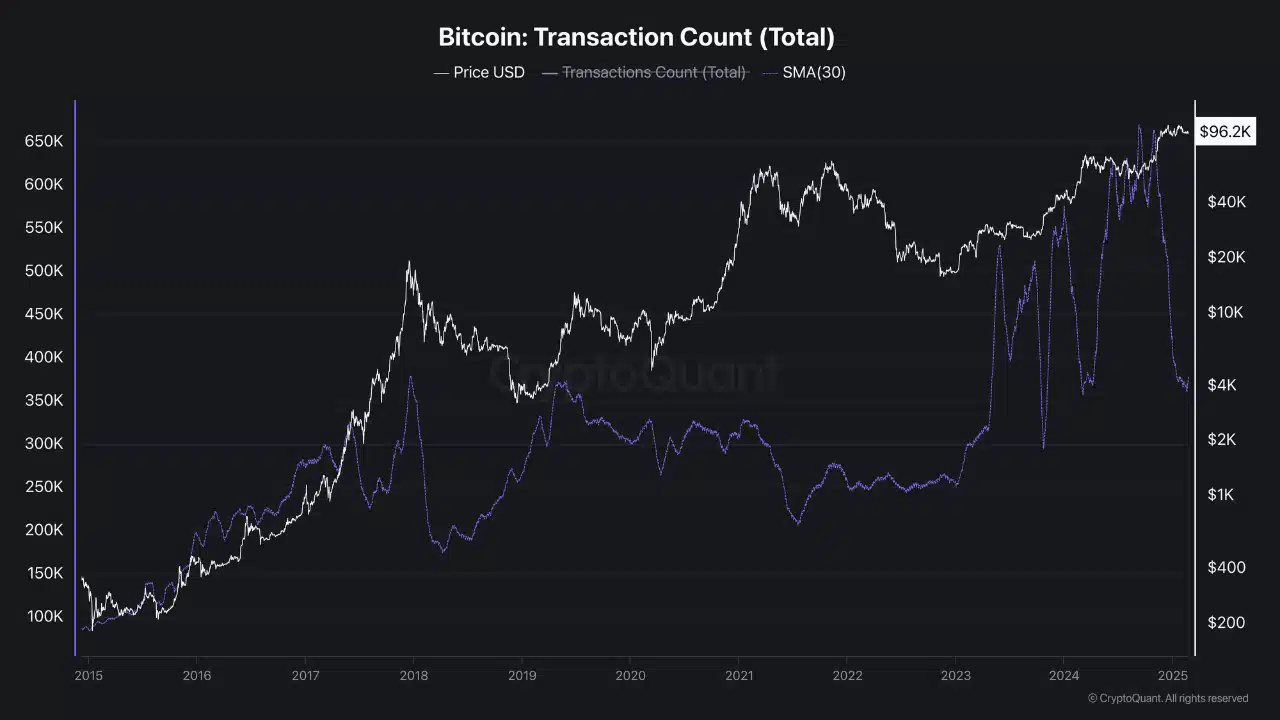

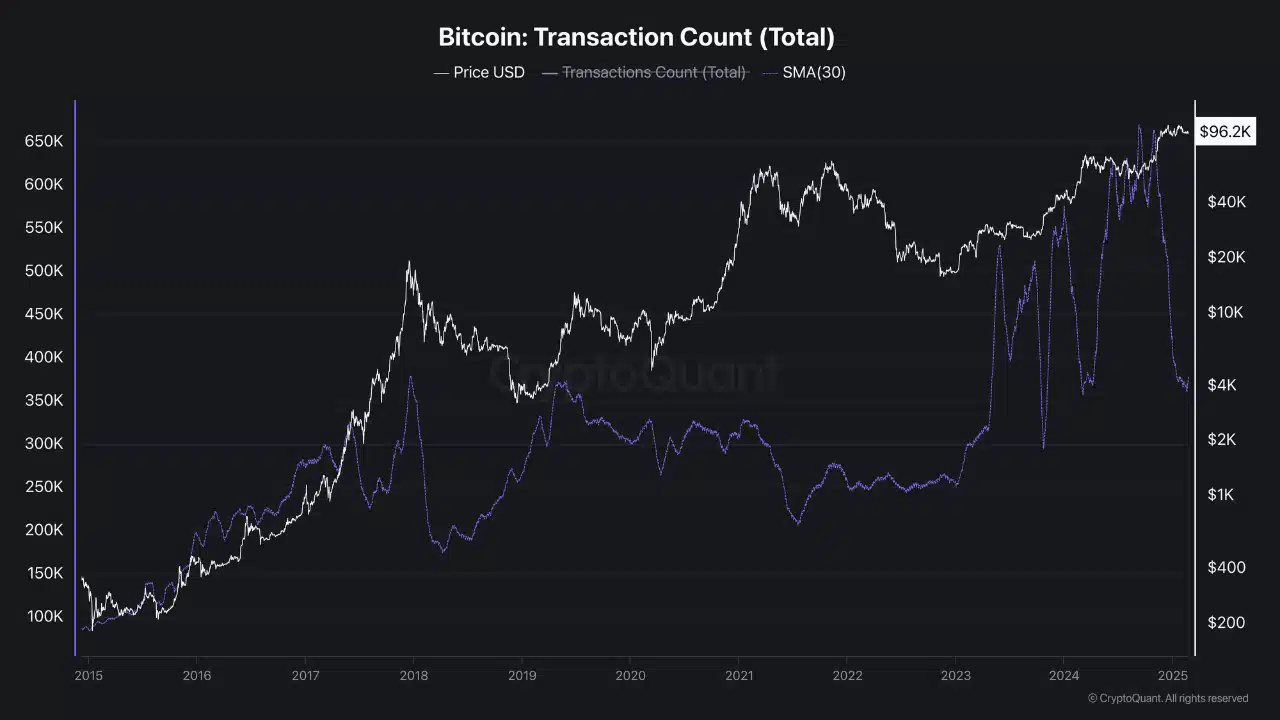

In addition, the number of Bitcoin transactions has also displayed a significant drop. Transactions, which have already culminated at 650,000 per day, in 2021, fell below 400,000 at the beginning of 2025.

Source: cryptocurrency

This reduction in commercial activity has indicated a feeling of investor weakening, resembling the correction of September 2023 when the number of transactions dropped during market slowdowns.

Persistent reductions could exert additional pressure on the price of Bitcoin, in particular in the midst of the feeling of risk linked to uncertainties in commercial policy. A reversal would require a renewal of optimism or market stability in macroeconomic factors.

Does the unused BTC shrink?

The UTXO Bitcoin number, recorded from 2015 to 2025, notably decreased at the beginning of 2025, falling at levels comparable to the correction of September 2023.

The metric, which regularly increased to 178 million at the beginning of 2025, experienced a clear drop, reflecting fewer transaction results not spent.

Source: cryptocurrency

This trend has raised concerns that the market could approach the end of a cycle, although this conclusion is not yet final. The model indicated a reduced network activity and an accumulation of investor decreases, resulting in concern about the potential price stagnation.

However, some bruise indicators have suggested a possible recovery, depending on new market catalysts.

Buyers or sellers: Who really has control?

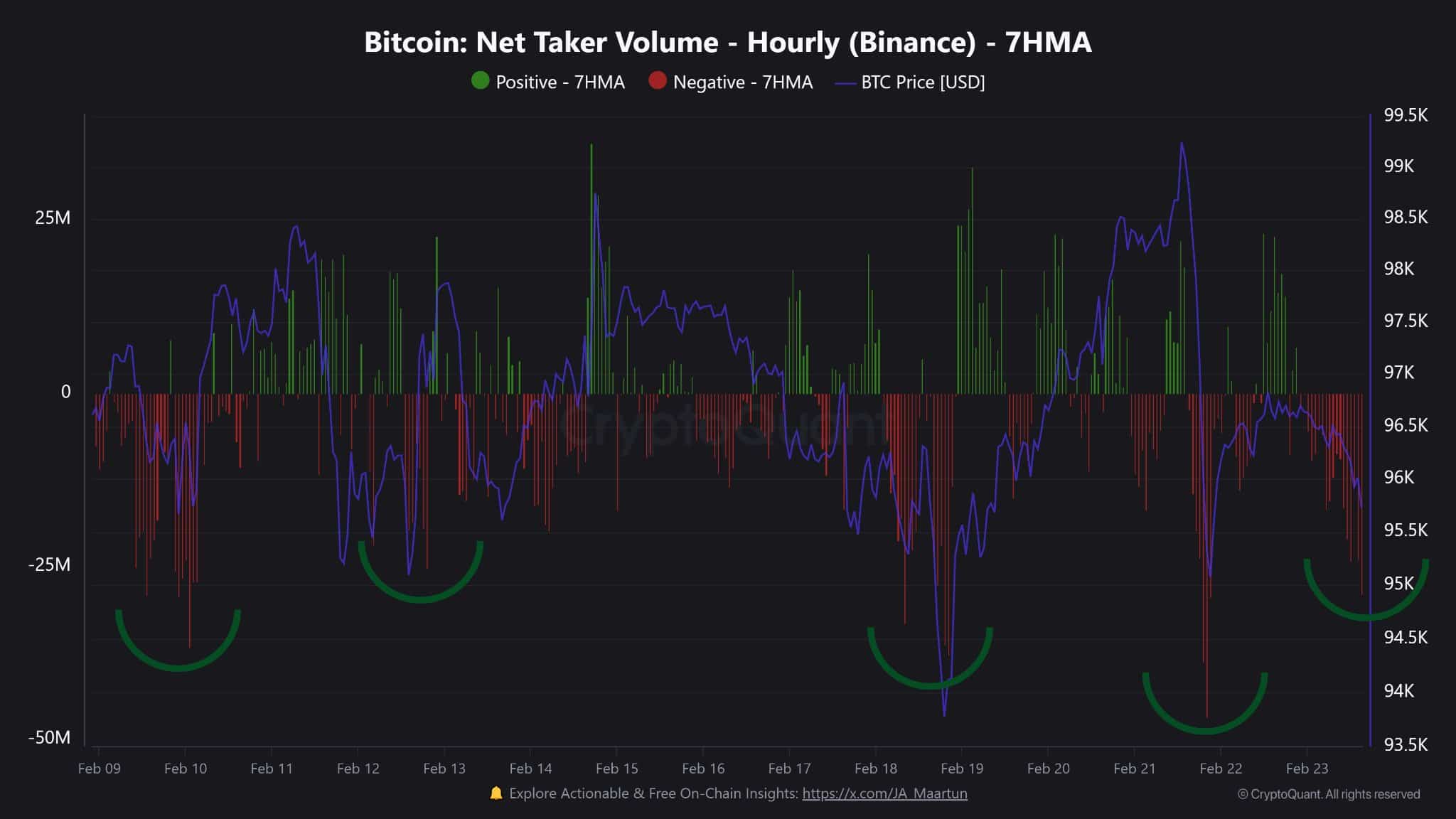

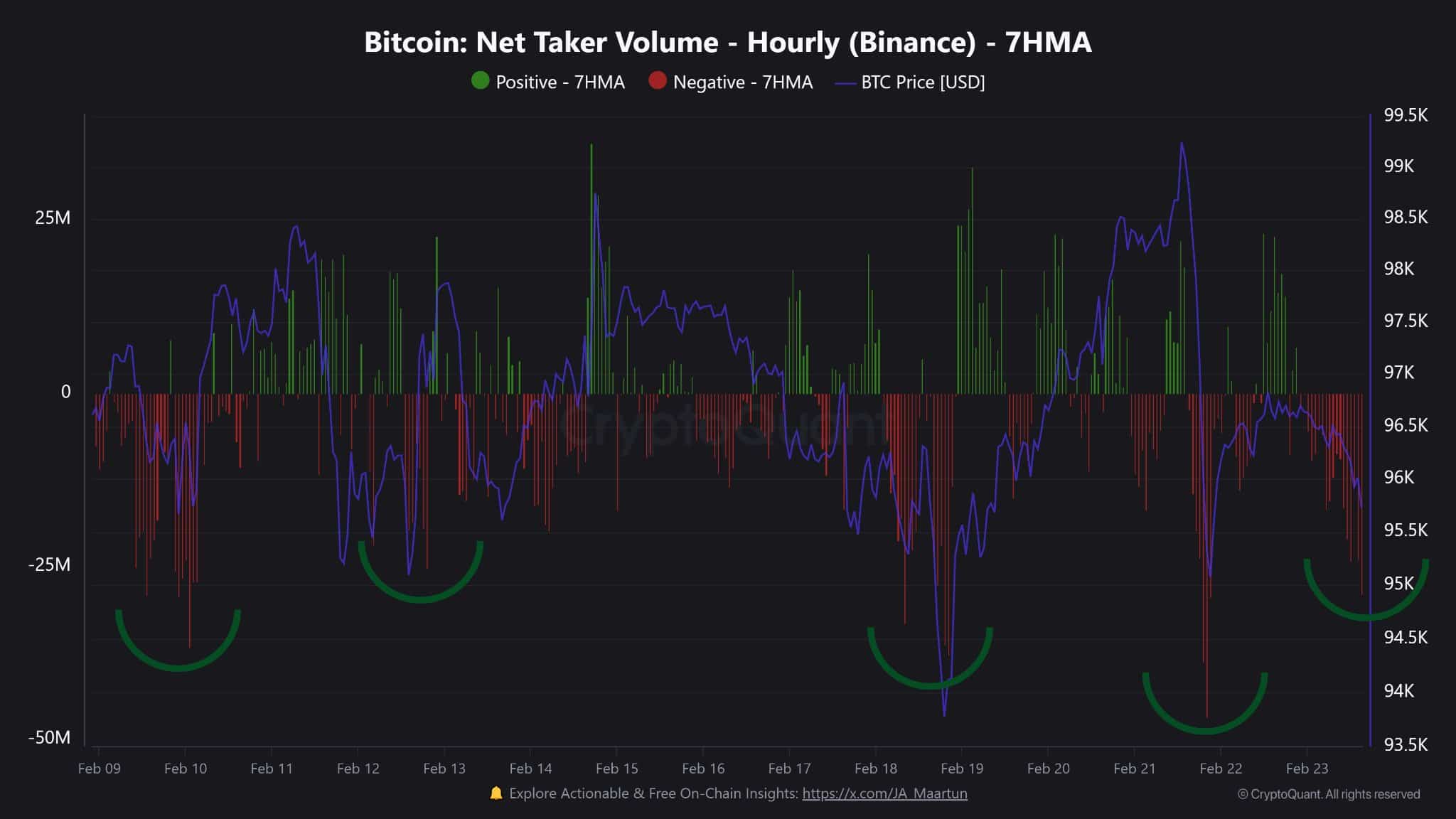

The volume of Bitcoin net taker on Binance, followed from February 9 to 23, 2025, revealed low values of 7HMA, with dominant negative points.

Source: cryptocurrency

This indicated the down pressure, while the sellers of takers exceeded buyers, strengthening the weak feeling of the market. The model was similar to March 2024 when low volumes of net takers preceded a consolidation phase.

An resurgence in long positions depended on the retirement of buyers of takers. This was based on geopolitical stabilization or the new bullish catalysts. If the feeling improved, the Bitcoin price could recover from $ 96,200. Otherwise, a longer consolidation period seemed likely.

In conclusion, the drop in activity of the BTC network, the reduction of transactions volumes and the reduction in the number of UTXOs have reported a weakening of investors’ confidence and a potentially prolonged consolidation phase.

The slowdown in the accumulation of ETF spots and volumes of net takers highlighted the current uncertainty of the market. While historical models suggest that the BTC could recover, any sustained upward movement would require a change in macroeconomic feeling.

He would also need the resolution of geopolitical tensions or renewed institutional demand.