The Ethereum price is undoubtedly in a better place in recent weeks than in the first quarter of the year. However, the “King of Altcoins” seems to be stuck in a loop – an imply repeated prospects at a specific price level.

After taking the bullish momentum of the week, the Ethereum price was faced with a significant drop greater than $ 2,700 and has since crushed to the place where it started the week. Below is the underlying factor in ETH difficulties above $ 2,700.

What happens at ETH price above $ 2,700?

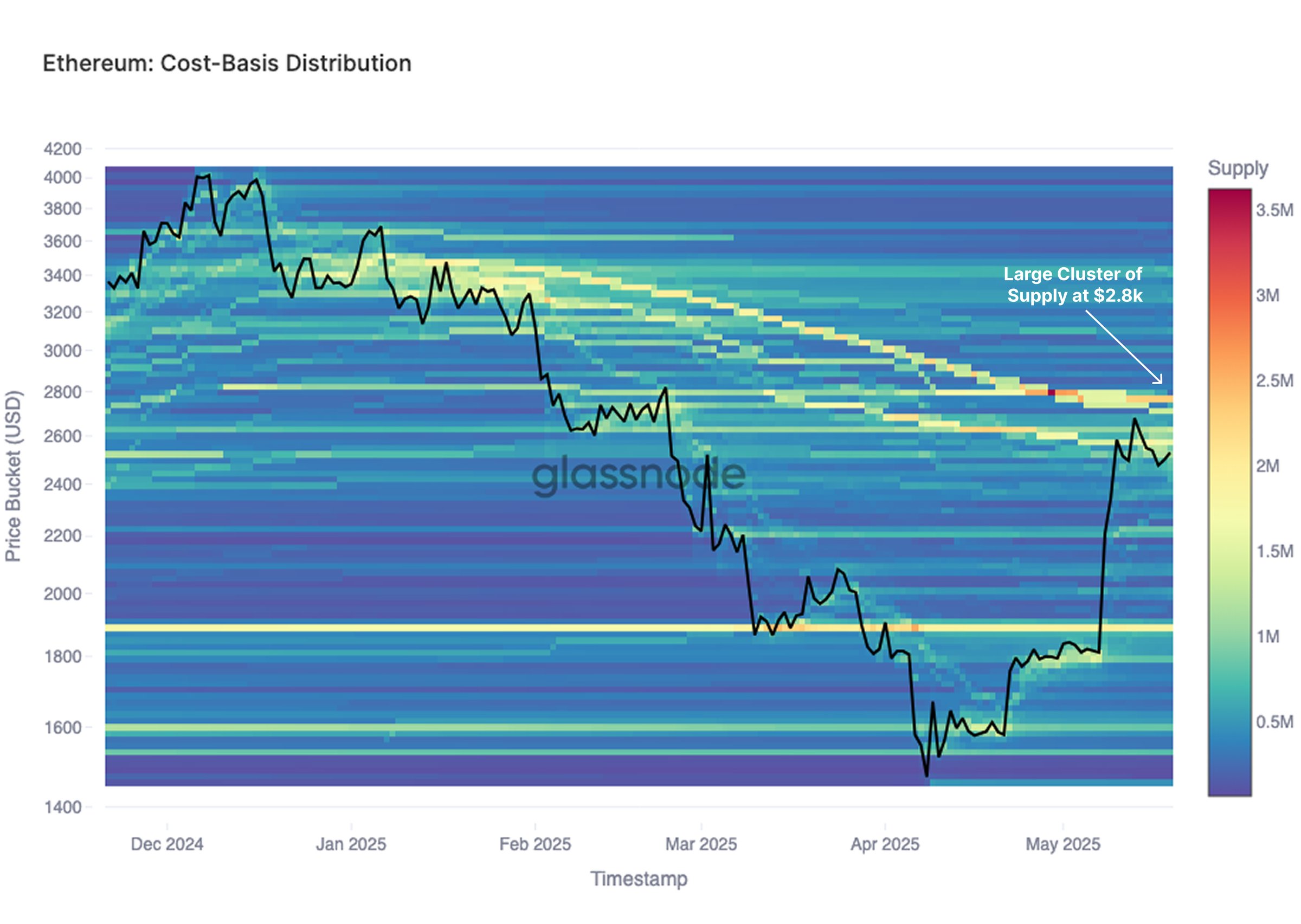

In an article on May 24 on X, the Blockchain Glassnode analysis company shared new information on the chain on the Ethereum Prize movement in recent days. According to the Crypto platform, the most significant level following for the price of the ETH is at around $ 2,800.

The justification of this observation on the chain is the distribution of the costs of the ETH offer. The relevant metric here is the basic distribution of costs (CBD), which reflects the supply of Total Ethereum held by addresses with an average cost base in specific price supports.

Source: @glassnode on X

As shown in the above graph, the CBD metric uses a thermal card with fixed price support levels (on the vertical axis) for a given period (on the horizontal axis). This indicator offers an overview of trend changes in the basis of investor costs over a specific period.

Glassnode noted that there is a large group for distributing investor cost areas around the $ 2,800 price level. Basically, this implies that several investors have acquired their parts in this price region.

Going further, Glassnode explained that the Ethereum price can attend a large sales pressure as the CBD cluster approaches around $ 2,800. This phenomenon is based on the propensity of several previously submarine investors to try to unload their assets near the profitability threshold.

This chain revelation explains why the Ethereum price has been faced with the higher rejection with the $ 2,700 mark in recent weeks. In order for the second largest cryptocurrency to divide above this supply barrier, ETH’s request around the CBD cluster must prevail over the sales pressure.

Ethereum Prize at a glance

To date, the Ethereum token is estimated at around $ 2.0, reflecting a drop of less than 1% in the last 24 hours.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Istock star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.